Investment Tips for Teens

Post on: 1 Июль, 2015 No Comment

As teenagers, we dont often think about how were going to pay for retirement or even how were going to pay for college. Investing and financial planning are things that tend to intimidate young people, but, in reality, they shouldnt. Keeping track of a portfolio is about as easy as checking Sherron Collins stats from the last KU game.

If you can follow Big 12 Basketball, you can follow the stock market, local Morgan Stanley financial adviser Barry Wheeles said.

In fact, teenagers are the ones that should be investing. Getting such an early start can do wonders in the end. Investing just a little now can set you up for life later that is, if you play your cards right.

How Much Money Should I Invest?

A good rule for teens to follow is to not invest an amount that you know youll need in the near future. If you know youre going to need the money to pay for something such as college or a car within the next few years, DONT INVEST IT. No investment service can promise they wont lose your money and if you make a gamble, it might not pay off. Dont invest what you dont have. This may sound obvious, but some investors get caught with large debts because they overestimated how much they could actually invest.

Teens with a steady income, no matter what size, should consider setting goals for saving their money or investing it. Even if you feel like its an insignificant amount, you could be surprised. Putting your summer job money in a Roth IRA and letting it sit until retirement can set you up quite well. Two-thousand dollars put in a Roth IRA every summer of a teens high school career can yield over $1.1 million.

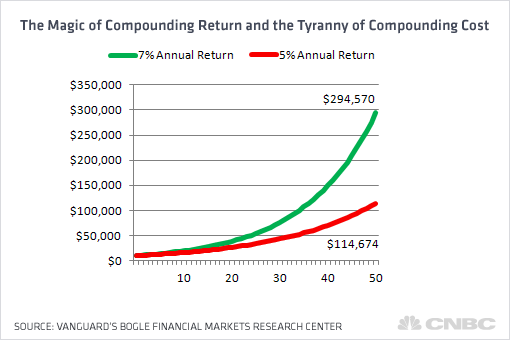

Wheeles loves the Rule of Seven example for long-term investors. The Rule of Seven says that your investment will double after 10 years if you have a seven percent interest rate (you can find government bonds with a seven percent interest rate at www.treasurydirect.gov). Though the amount you initially invest as a teen might not be much, the interest over time in addition to the amount you add to the fund later in life can make a once insignificant amount turn into retirement goldmine.

How Do I Get Started?

The best place to begin your investment search is by educating yourself on the various funds and stocks available for purchase. Wheeles suggests using services like Morningstar.com to familiarize yourself with funds or company stocks you might be looking to invest in. If youre looking to invest in a certain company, Wheeles recommends researching that company before you do so. Check to see if they match with you philosophically. If there are issues you support, check to see if they support those too. Also, check to see how their company is being viewed. Are they receiving government bailouts? Do they have executives accused of questionable ethics? Setting up a simple Google Alert for that companys name can keep a potential investor updated on the status of a given company or fund.

The next step is to find the service you want to use to invest your money. Your bank or credit union will usually have a person dedicated to just financial advice and investments. Also, there are many investment companies in the area, such as Wheeles Morgan Stanley, that will match you with a financial advisor who will help manage your investments for you. Online investment services are another option. Services like E-Trade and Sharebuilder.com are examples of online stock trading sites.

Online services are generally the easiest to deal with, but you are on your own when it comes to advice. That is why many choose to set up a portfolio with a financial adviser. Make sure to examine the costs of the service before you invest. If you decide to go with a financial adviser, it would benefit you to meet with the adviser before you sign any agreements and discuss their investment philosophies to make sure youre both on the same page.

What Should I Invest In?

Wheeles suggests that teens involve themselves in mutual funds, instead of individual stocks, to begin their portfolio. Mutual funds consist of a diverse number of publicly traded companies and generally produce a fairly stable return. Individual stocks fluctuate much more than mutual funds and thus are less reliable and more of a risk. Generally, a fund is managed by an established financial manager. The manager of the fund then decides which companies to purchase and in what amounts. The fee for the manager will be a part of the price you pay for your shares.

There are three different share classes for mutual funds: A, B and C. In most cases, the A class should only be purchased if the investor is looking for a long-term investment.

A class shares are front-load shares. This means that the investor pays an upfront fee to purchase the fund and then little or nothing to retain it each year. Investors looking to invest for less than five years should look to B and C class shares instead of A shares.

The B and C classes typically are purchased by investors looking to invest on a short-term basis. B shares have back-end loads which mean that while the investor wont have to pay an initial fee, but they will most likely be required to pay a fee when they sell the fund. Investment service providers have begun discouraging or even eliminating B shares from their sales pitch largely because of their lack of pay off in the long run.

For investors looking to sell their funds before the five year mark, C shares are probably their best bet. C shares are level-load shares. They dont charge an initial fee and the fee paid upon selling the fund is small or their may not be one at all depending on how large your account was.

Teens looking to make money to pay for college should look at C shares, while students who are willing to let their investment sit should check out A share options.

How Do I Keep Up With My Stocks?

Depending on what type of service you use to invest, the way you keep track of your investments will change. Online services will allow you to check your portfolio by simply logging on. If you use a financial adviser either from your bank, credit union or a private company then youll need to contact them personally to check on your investments. However, your financial adviser will not honor any investment instructions given in a voicemail because of security and communication concerns.