Investment Themes Redefining the World in 2015

Post on: 6 Июль, 2015 No Comment

Even in a world in which change is a constant, certain trends stand out.

Some of the most exciting developments today are happening around some of the most challenging problems. All across the world, individuals, companies and governments are working to address issues such as water scarcity, cybercrime and energy demand. Meanwhile, rapid shifts in technology and demographics are fueling unprecedented changes in the way we work, interact and live our lives. Looking at these developments and identifying the ones that will become global priorities can be an important way to find long-term growth opportunities.

A Transforming World describes and connects these global trends. Here, in this special report, we focus on seven investing themes that could create opportunities in 2015, and beyond.

A framework that links multiple investment themes is required in a Transforming World, in our view, to identify the major trends that will likely influence asset markets in coming years and identify the biggest winners and losers. BofA Merrill Lynch Global Research’s framework connects the world using five clusters as follows: People. the allocation of scarce human resources, Innovation. the disruptive role of technology, Markets. the allocation of scarce financial capital, Government. the role of public policy, and Earth. the allocation of scarce natural resources.

The last seven years have been characterized by a series of unprecedented financial crises, an unprecedented financial policy response and abnormally large asset price returns. We believe the liquidity-addled asset returns of recent years are coming to an end as the macro drivers of the macro market, zero rates and record profits max out. In our view, the normalization of economic growth and policy rates in coming years is likely to coincide with more normal bond and equity returns, and higher volatility. Lower expected returns in bond and equity market returns mean that theme picking will become more important in adding alpha, in our view.

Indeed, as is supported by returns from certain widely followed third-party indices in the table to the right, we note that certain themes which resonate with our Transforming World framework, such as biotech, water and cybersecurity, have outperformed the returns from equities.

We note that the annualized price return from these three external indices over the past three years is 32%, versus a 15% return from global equities over the same period. While other similar thematic indices may not reflect the same level of performance, we do think they support our view that thematic investing is likely to outperform in the brave, new, post-Quantitative Easing world. We believe investors should position for lower expected returns from financial markets by concentrating portfolios in assets related to our long-term themes.

Below we highlight actionable research on seven investment themes for 2015: financial repression, robotics, cybersecurity, Internet of Things, solar, water and the longevity revolution.

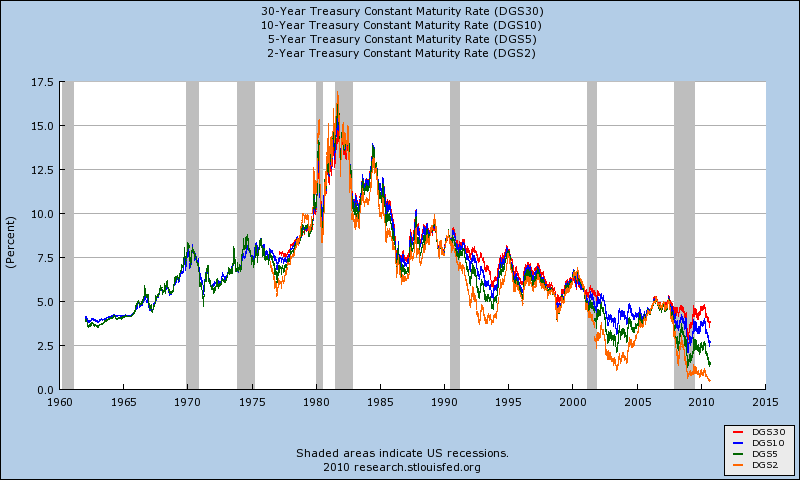

Financial Repression

Global central bank assets, including FX reserves, now total $22.6 trillion, a sum larger than the combined GDP of the U.S. and Japan. Eighty-three percent of the world’s equity market cap is currently supported by zero interest rate policies; and 50% of all government bonds in the world currently yield 1% or less. In 2014, government bond yields fell to all-time lows in Japan, Germany, France, Spain, Italy, Ireland, Portugal, Sweden, Switzerland, Korea, Czech Republic, Hungary and Poland.

The current level of global interest rates, both real and nominal, is depressionlike, with only the 1930s a comparable period. Currently, 1.4 billion people are experiencing negative real interest rates. Low rates mean low returns and, as stated above, enhance the appeal of theme investing.

Robotics

Nike employed 106,000 fewer contract workers in 2013 due to greater automation. In 2014 and 2015, robot installations are estimated to increase by 12% per year (source: IFR), with the trend to automation continuing to be driven by corporate focus on cost competitiveness, outsourcing of engineering functions, increasing quality requirements and rising wage inflation across emerging markets. In our view, companies that should benefit from robotics include industrial automation and robots, robotic surgery, control systems and equipment, and industrial PCs/smart planet.

The Rise of Robotics: Michael Hartnett, chief investment strategist for BofA Merrill Lynch Global Research, discusses the increased use of robots in various industries, and the potential opportunities for investors.

Cybersecurity

Cybersecurity: Sarbjit Nahal, head of thematic investing for BofA Merrill Lynch Global Research, discusses the increasing danger of cyber attacks, and the potential for greater spending on cybersecurity by both governments and corporations.