Investment Suitability

Post on: 16 Март, 2015 No Comment

Investment Suitability

2C200 /%Ensuring suitability of your investments is one of the main pillars of creating a sound financial plan. What does suitability really mean though and how is it measured?

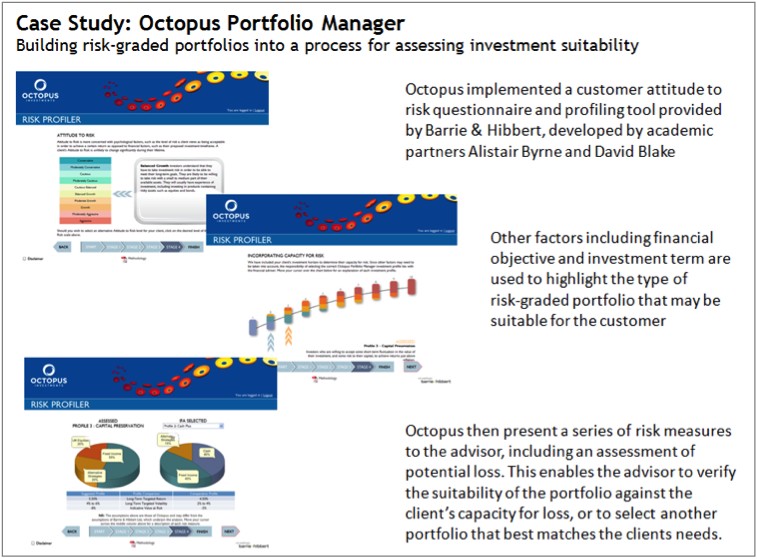

The concept is quite simple – advisors & investment companies must ensure that each investment recommendation they make is suitable for the investors in relation to their objectives, risk tolerance and other personal circumstances. There are regulators who set these rules by putting standards in place to try to protect investors; but the actual practice of determining suitability is not perfect. It’s important for clients to understand what suitability really means and they need to start asking more questions.

The most common practice for measuring the appropriateness of investment choices is done by utilizing the Know Your Client (KYC) rules. All investment firms and advisors must complete KYC forms before setting up or changing any investments for a client. These KYC forms should also be updated on a regular basis to keep track of any changes in a client’s situation.

KYC documents help to determine the following:

Risk Tolerance – In simple terms, risk tolerance is a question of how much risk a client is willing to take with their investments. A “conservative” investor should not be participating in any high risk investments. The risk tolerance is a gauge of how comfortable the client is with accepting risk in their portfolios.

Investment Knowledge – How well does the client understand the investment world and the various strategies and ideas that are being presented? A client with a low level of investment knowledge should not be investing in exempt market products or hedge funds.

Investment Objective –You need to determine if the primary objective is for safety and capital preservation, to provide regular income or to see long term growth. Each type of objective requires a very different asset mix.

Financial Situation – It’s important to take into account your overall financial situation when making investment choices. Your overall net worth and annual income level will help to determine what amount of risk you are able to withstand in your investments.

Time Horizon Saving for retirement 30 years down the road is quite different from saving for a house down payment in 4 years. The length of time that you plan to invest the money for is important to discuss.

Intended Use – Retirement savings, income generation, corporate retained earnings, estate planning & children’s education are some examples of potential plans for investment assets. Each intended use will require a custom tailored investment plan.

One challenge that we face in implementing these standards is defining what the various terms mean. The terms “Low” or “Moderate” risk tolerance can mean very different things to different people. Discussions need to take place to clarify what people really mean when they use these terms.

Suitability standards are put in place to help protect investors and help ensure that the investments they select are appropriate for their needs. Although the system isn’t perfect, it’s a good step in the investment process and one that should not be taken lightly. Take the time to properly review the suitability documents with your advisor and make sure you fully understand them.