Investment Strategies For Your Portfolio

Post on: 19 Апрель, 2015 No Comment

A Foundation For Life

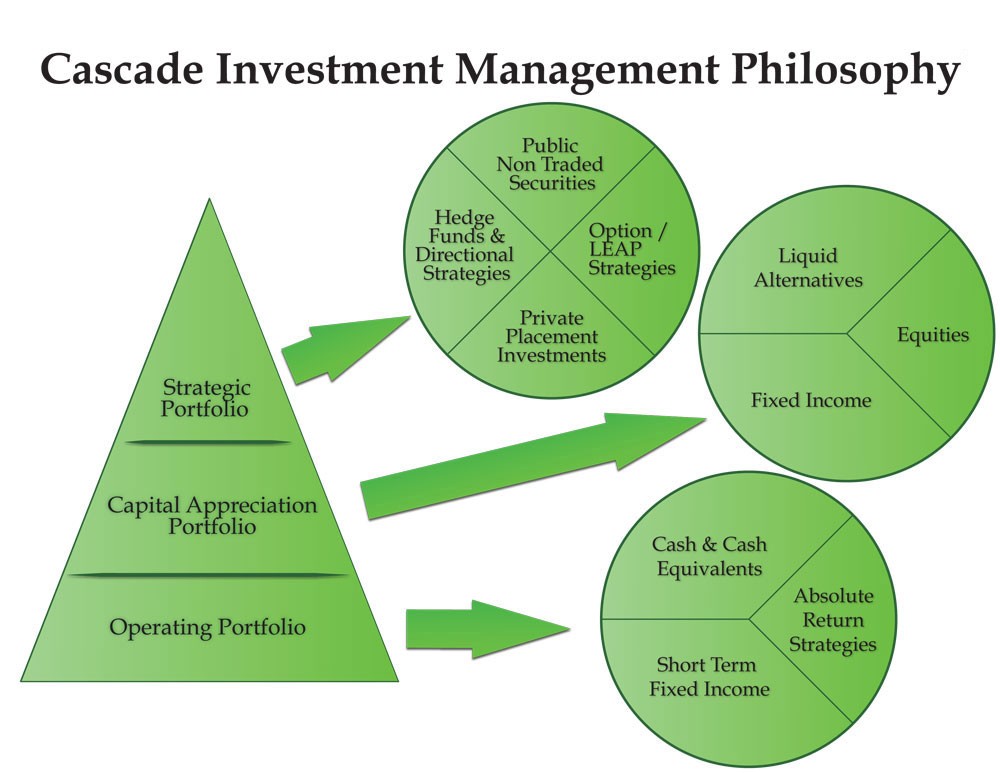

We build your portfolio to meet the time frame of your financial goals, using three categories that vary in degree of risk to your assets. Investments with low to moderate risk have less potential to grow, but are ideal to meet your income needs for the next 10 years. Investments with the most risk have more potential to grow and meet your long-term needs.

To keep you on track to fund your goals, the proportion of your portfolio in each category will change over time. For example, it may contain more growth investments if the time frame for your retirement goal is 25 years instead of next year.

Principles For Building Your Portfolio

From the global slowdown to the foreclosure crisis, economic events since 2008 have been unprecedented in scale. In response, we have adjusted our investing philosophy to provide more protection for your money and support your long-term goals.

Our asset allocation strategy is built on three facets:

- Risk Management. Regardless of how your money is invested, it is subject to the risk that it may decline in value. A serious risk is that your money will not keep up with inflation. We use strategies to help protect the value of your assets.

- Diversification. While diversification does not guarantee a profit or protect against a loss in a declining market, it can help reduce your exposure to risks. Diversification spreads your money among different types of investments that do not react the same to world and market events. Bonds, for instance, may rise in value when stocks are performing poorly.

- Long-Term Trends. Our investment philosophy is informed by the current economy, where previously unimagined circumstances have become long-term trends. Investors are still coming to terms with how global economic growth increasingly depends on emerging market countries. Another reality is that the U.S. economy is recovering at a slower rate than it has from previous recessions.

A Portfolio Designed For You

Your advisor will recommend a portfolio that will invest and distribute assets according to your specific time frame and lifestyle. This framework will help shape the types of investments built into your portfolio.

In designing your portfolio, we use traditional investments, including stocks, bonds and cash equivalents. Where appropriate, we may recommend a broader array of investments, including inflation-linked and international bonds, developed and emerging market international stocks, real estate and commodities funds.

For larger accounts, we may suggest using our proprietary individual equity strategies for the stock portion of the portfolio. These strategies offer additional tax management flexibility and effectively avoid fees associated with mutual fund management. Stocks are carefully selected for their profitability, competitive position, growth and cost of capital.