Investment Risk Tolerance Build a Portfolio You Can Live With

Post on: 11 Июнь, 2015 No Comment

Whether you are investing for retirement or just to build wealth, investing is a high stakes game of risk and reward. The less risk you take, the less reward you expect. Of course taking on too much investment risk can be devastating to your investing goals, too. Getting unexpected negative results in your portfolio is never good, but the money lost may not even be the worst part.

What could be worse than poor investment results? The psychological impact that can change your investing behavior.

In other words, it is one thing to lose 25% of your portfolio in one bad year due to poor investing choices. It is an entirely different and worse thing to stop or dramatically change your investing after such an event. (Going to a 100% cash portfolio wont bring that lost 25% back!)

The best way to avoid letting your emotions dictate your investment choices is to better understand your risk tolerance. At the end of the day you want peak performance out of your portfolio, but that performance has to fall within guidelines that you are comfortable with.

What is Investment Risk Tolerance?

Understanding your risk tolerance is essential

Risk tolerance is how comfortable you are with risk. Someone who is a risk taker can emotionally survive putting 100% of their funds into a handful of stocks as long as they know it might cost them everything. A risk-averse individual wouldnt be able to sleep in that scenario. Where you fall on the risk tolerance spectrum should dictate when, where, and how you invest .

There are different titles for where you might fall on a risk tolerance spectrum, but the easiest is to put extremely conservative on one end and extremely open to risk on the other end. Risk takers are capable of handling the dramatic swings of their investments, and should be rewarded over a long period of time for taking that additional risk. Conservative investors are comfortable not getting as much long term gain as long as the swings up and down are not as dramatic.

Accepting Returns That Match Your Risk Tolerance Profile

Heres the kicker: you have to become comfortable with the returns you can achieve at the risk tolerance level you are comfortable at, and build your investment portfolio accordingly. A conservative investor might see eye popping results from a mutual fund one year, and decide to finally take on more investment risk only to discover the next year the fund tanks in value. If this risk makes the investor uncomfortable, he or she would be well served to go back to their original style of investing. Unfortunately, they may run the risk of pulling back too far by either going into an all cash investment, or stop investing altogether.

That result would have a much more significant impact on their retirement than any investing loss they might have faced. Going outside of your comfort zone in investing can be dangerous for this reason alone. It is far better to stick to a consistent investing plan and asset allocation that you are comfortable with than to take some uninspired risks that end up damaging your ability to invest at all.

How to Assess Your Investing Risk Tolerance

The easiest way would be to talk to a Certified Financial Planner. Almost every good planner out there will spend time talking to you not only about your goals, but how comfortable you are with various types of risks. They then take all of the information youve given them and compile it into an investing plan that matches up with your comfort level.

Alternatively there are several tools online to help you gauge risk:

These online tools are best used as a starting point, and remember, you can always adjust your investing style as your needs and risk tolerance change.

Guidelines for Investing Based on Risk Tolerance

There are two major categories of investing for the risk taker and risk-averse investor alike:

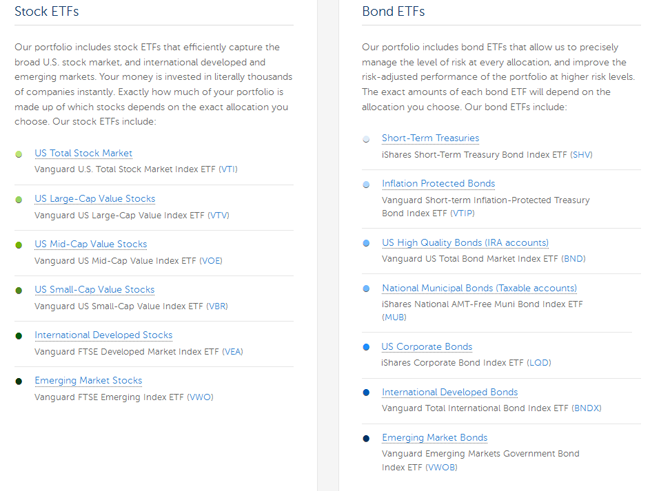

- Conservative investors: Primarily bond or income based investments

- Risk taking investors: Primarily stock based investments

You dont have to be 100% in one category; again, there is a spectrum of risk, and most people fall somewhere in the middle. A risk taker in his twenties who has 30 to 40 years before retirement may have a 100% stock based portfolio (preferably in stock based mutual funds). On the other hand the 55 year old investor with less than 10 years to retirement needs a much larger piece of their portfolio to be in income producing assets like bonds.

Most people, however, fall somewhere in the middle. The 20-something investor would likely be better off with some bonds or other income based assets in his or her portfolio, and would likely want to adjust the basis of the portfolio as he or she ages. Likewise, the 55 year old investor still needs stocks to fuel the growth of the portfolio. It shouldnt be all or nothing in one category for either investor.

If you find yourself uncomfortable making investment choices based on risk, then consider using a simple target date retirement fund. which automatically adjusts your investment based on a target portfolio based on your proposed retirement date. These investments arent perfect. but they are a great place to start. And since they are more or less hands off, you wont have to worry about making any major changes.