Investment Management The Private Bank Wells Fargo

Post on: 16 Июль, 2015 No Comment

You are invested — in your family, your business, and your health. Your financial investments can help you live the lifestyle you desire, secure your legacy, and help support your goals.

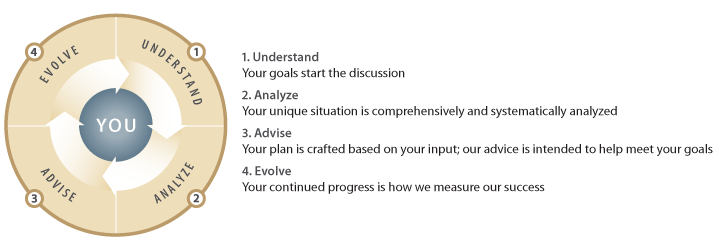

Meeting tomorrow’s goals while managing today’s risks requires a long-term view of investing. Our investment management approach has helped generations of clients effectively achieve their goals.

A dedicated team of specialists

Our approach involves engaging a dedicated team of specialists to provide you with the highest level of personalized service. To tailor your portfolio, we use our consistent process for research, structure, strategy, and risk management.

To help you meet your investing goals, you have access to a wide range of investments and investing strategies through our in-house specialists in a variety of fields. You also have access to leading investment managers around the world.

By choosing to work with Wells Fargo Private Bank as your discretionary portfolio manager, you are selecting a team that works for your best interest. We put your needs and expectations first and strive to do so with skill and care.

A personalized approach to investment management

We customize your investment plan to align with your specific situation and complement your existing financial portfolio.

- We identify an appropriate asset allocation strategy based on your needs for liquidity, income, and the time horizon of your other financial goals.

- Our asset allocation approach combines equities, fixed income, real assets, and complementary strategies with intent to optimize the relationship between risk and return.

- We offer research-driven, short-term, portfolio recommendations based on market conditions.

- If you have investments such as real estate, business partnerships, or mineral land rights, we are experienced in integrating specialty assets into your overall investment plan.

Balance investment growth and preservation

To help your portfolio weather changing markets, we apply our rigorous and disciplined methods for due diligence and structured portfolio rebalancing.

With attention to balancing growth and preserving your investments, we regularly monitor your asset allocation (the mix of different types of investment instruments you own). This is an important tool in seeking to enhance returns and manage risk in your portfolio.

Evaluate and manage risk

We review your portfolio annually to help you identify, manage, and address a broad range of concerns. Using our Risk Optics ® philosophy, we evaluate multiple sources of risk beyond historical volatility to customize our advice to your unique circumstances.

When proposing risk management solutions, we consider:

- Tax efficiency based on your specific situation and goals

- Your needs to increase assets, preserve capital, and generate income

- Timing necessary to achieve specific financial goals or for the needs of any dependent family members

Interested in learning more about our investment services? Connect With Us

Wells Fargo & Company and its affiliates do not provide legal advice. Please consult your legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of your situation at the time your taxes are prepared.

Asset allocation does not assure or guarantee better performance and cannot eliminate the risk of investment losses.

Real estate investments carry a certain degree of risk and may not be suitable for all investors.

Fixed income securities are subject to availability and market fluctuation. These securities may be worth less than the original cost upon redemption. Certain high-yield/high-risk bonds carry particular market risks and may experience greater volatility in market value than investment-grade corporate bonds. Government bonds and Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and fixed principal value. Interest from certain municipal bonds may be subject to state and/or local taxes and in some instances, the alternative minimum tax.

Some complementary strategies and real assets may be available to pre-qualified investors only.

The overall RiskOptics ® score is calculated based upon analyst created risk scores for certain Investment Strategies and proxy scores for others. Investment Strategies that are not scored by an analyst will be mapped to a proxy based on the asset class or subclass of the Investment Strategy. Depending on an individual’s unique portfolio composition, their overall portfolio RiskOptics ® score may reflect scores for Investment Strategies that have been analyst evaluated using the RiskOptics ® methodology as well as approximated by their proxies. The use of proxy scores may overstate an Investment Strategy’s risk score in some instances. The proxy score will be created by averaging top decile of the Investment Strategies’ scores for each asset class or subclass daily.