Investing in Treasury Inflation Protected Securities (TIPS)

Post on: 16 Июль, 2015 No Comment

Point of View With BlackRocks Brian Weinstein and Martin Hegarty

(May 2012) While the current rate of core inflation is muted, the Federal Reserves incredibly accommodative monetary policy means that higher rates of inflation may be on the horizon, and investors should be prepared. With the potential impact inflation can have on a portfolio, investors of all types are asking: So what do I do with my money? ™ To provide some answers, we spoke with BlackRocks senior inflation-linked fixed income experts. In this interview, they offer perspectives on how Treasury Inflation Protected Securities (TIPS) can offer some protection against longer-term inflation and provide some diversification in any fixed income portfolio:

- With interest rates sitting at historically low levels, investors need to consider how well they are being compensated for future inflation.

- We believe that TIPS serve an important role in an investors fixed income portfolio by benefiting from future inflationary pressures without taking on more credit risk.

- Managing inflation risks is particularly important for investors moving into retirement, since they likely hold a significant allocation of lower-yielding, high-quality fixed income assets.

What are TIPS and how do they work?

Treasury Inflation Protected Securities (TIPS) are Treasury bonds that carry inflation protection. Like nominal Treasuries (those that are not adjusted for inflation), TIPS are issued by the US government with a stated real interest rate, and the government pays interest every six months based on this rate. Unlike nominal Treasuries, however, the principal amount of TIPS is linked to the Consumer Price Index (CPI), which is a measure of a fixed basket of goods and services purchased by the average consumer. This basket includes, among other things, essentials such as food, energy, apparel, as well as medical and education costs.

When inflation, as measured by the CPI, rises, the principal of TIPS will increase (as will the amount of the semi-annual interest payment), making these bonds an effective hedge against rising inflation for fixed income investors. Investors should note that when inflation falls, interest payments will decline, however, TIPS securities are redeemed at par upon maturity.

Why should an investor consider TIPS now?

While we would argue that it makes sense to hold TIPS in any environment, we believe that it is even more important now given the historically low level of nominal yields. Furthermore, large government budget deficits, the Federal Reserves zero interest rate policy and expanded balance sheet increase the risks of future inflation. Fixed income investors should view an allocation to TIPS as a means to help protect their fixed income portfolio against potentially higher rates of inflation in the future. Over time, inflation has been volatile, and since the inflation lows in 2009 the recent trend has been up (see Figure 1). A skilled investment manager can take advantage of tactical investing opportunities through differences in the relative value of individual TIPS securities and TIPS versus nominal Treasury securities based upon their view of future inflation rates. TIPS also can provide some diversification to a portfolio, as the price movements are determined by changes in real rates which are not perfectly correlated to changes in nominal rates. Investors should note that diversification does not ensure profits or protect against losses.

TIPS have returned strong performance since 2008. Have investors missed out?

Various factors came together over the last three years that resulted in strong returns for TIPS. While that performance will be difficult to repeat, we believe that TIPS remain an attractive investment for fixed-income investors (see Figure 2). Even though TIPS performance over the past three years was strong, the Federal Reserves highly accommodative monetary policy could create higher levels of inflation and inflation expectations that would result in the continued outperformance of the asset class.

What has driven the strong performance in TIPS since 2008?

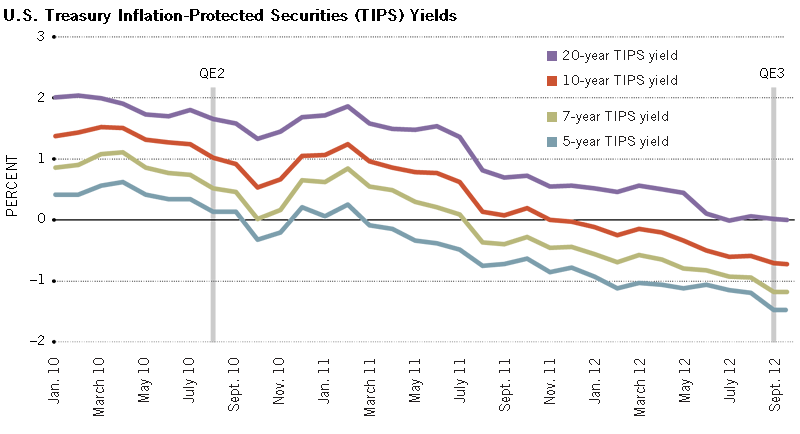

Since 2008 there have been two drivers of strong performance for the TIPS market. First, the economic recovery following the credit crisis has been extremely sluggish. This resulted in a dramatic rally in real rates, where yields were pushed drastically lower, as exhibited by the 10-year TIPS moving from 2.14% at the end of 2008 to -0.40% in the first quarter of 2012. The other component supporting the TIPS market has been the sharp rise of commodity prices, driven by emerging market growth and a weaker U.S. dollar as the Federal Reserve expanded its balance sheet via two rounds of quantitative easing (QE). Correspondingly, headline inflation surged from -2.0% (year over year) in the middle of 2009 to nearly 4% (year over year) at the end of 2011. TIPS significantly benefited from this dynamic of rising headline inflation and falling real growth expectations.

Is there still opportunity for investors in the TIPS market?

Over the last two years TIPS have outperformed nominal (non- inflation adjusted Treasuries) due to the dynamic of low nominal yields and relatively high inflation. For example, 10-year yields averaged about 2.75% in 2011 compared to 3% CPI inflation. This trend appears likely to continue as the Fed attempts to generate nominal growth in the economy while real growth remains constrained by various factors including a weak labor and housing market. Therefore, inflation likely will be a significant driver of nominal GDP growth, suggesting investors should consider adding TIPS to their fixed income portfolio.

Like other fixed income assets, TIPS will be negatively affected if real rates rise. However, if inflation expectations increase, then TIPS investors will be compensated while holders of nominal bonds will not. As such we see value for investors in reallocating a portion of their nominal fixed income portfolio into the real return that the TIPS market offers.

What is your outlook for inflation?

Over very long time horizons there is a close correlation between increases in the monetary base and changes in the CPI (see Figure 4). With the extraordinary recent increase in the monetary base (see Figure 3) the potential for higher rates of inflation in the future are clearly present. While the sluggish recovery and muted wage pressures due to high levels of unemployment have kept inflation contained, that could change if economic growth were to accelerate. Moreover, the disinflationary impact of emerging market growth has come to an end as wage growth in those countries has accelerated. With real yields pushed lower because of highly accommodative monetary policy and breakevens sitting just below their historic averages, the TIPS market is currently pricing in a low growth and moderate inflation environment. Given the potential for higher rates of inflation in the future, we believe that fixed-income investors will be better served by owning real rather than nominal assets.

What is the breakeven inflation rate?

Investors should look at the breakeven inflation rate as being one of the key determinants of value in the TIPS market. The breakeven inflation rate is defined as the difference between the yield on the nominal bond and the real yield provided by TIPS and can be considered the cost of purchasing inflation insurance. Therefore, the breakeven rate is reflective of the anticipated level of inflation over the life of the bond. As such, if you think inflation will be above the breakeven level, then TIPS are a better investment than nominal Treasuries. For example, if the breakeven rate for the 5-year Treasury is 2.00% that means that the market is pricing in an anticipated average rate of inflation of 2.00% over the next five years.

What are the key risks facing TIPS today?

Several risks can adversely affect TIPS. The one that immediately comes to mind is if the Federal Reserve embarks on an aggressive monetary policy tightening campaign in response to rising real growth expectations. If the central bank were to quickly hike rates, then this would negatively impact TIPS because as real rates rise, the price of TIPS falls. Another risk would be a sharp decline in inflation expectations. This would likely be accompanied by fears of a double-dip recession or falling commodity prices.

Who should consider TIPS for their portfolio?

We believe that every investor should consider an allocation to TIPS for their fixed income portfolio based on their expectations for inflation. Currently, with the potential for higher inflation in the future, we believe many investors should consider reallocating a portion of their nominal fixed income assets into the real, inflation-adjusted return that the TIPS sector offers.

Investors heading into retirement should consider holding a larger allocation to TIPS as a portion of their fixed income portfolio. When an investor is of working age, inflation will eat away at their assets, but they have the flexibility to negotiate wages and take greater risks in investments in order to keep up with inflation. When entering into retirement, however, investors are typically dependent upon a fixed stream of payments that will not adjust with inflation. Investors are encouraged to own more high quality fixed income assets as they near retirement, however, locking in low long-term yields in no way compensates for future inflation.

For conservative investors, like those heading into retirement, there are not many fixed income sectors other than the TIPS market that provide a real rate of return without moving further out on the risk spectrum. An allocation to TIPS as a portion of an investors fixed income portfolio will ultimately help to preserve their purchasing power over time.

How should investors incorporate TIPS into fixed income portfolios?

It is important to have a clear sense of inflation expectations and where the best opportunities may exist along the yield curve. For this reason, we believe a professionally managed portfolio of TIPS can be a real advantage for investors. Mutual funds are highly liquid and offer instant diversification (versus the chore of having to build your own portfolio of securities). Diversification among securities is very important in terms of managing risk, perhaps never more so than today. BlackRocks teams of investment professionals are dedicated to tracking trends and analyzing opportunities across fixed income markets. This can be a real advantage for investors in the current environment.

__________________________________________

Investment involves risks. Bond values fluctuate in price so the value of your investment can go down depending on market conditions. The two main risks related to fixed income investing are interest-rate risk and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the issuer of the bond will not be able to make principal and interest payments. Investments in non-investment-grade debt securities (high yield or junk bonds) may be subject to greater market fluctuations and risk of default or loss of income and principal than securities in higher rating categories.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are those of the portfolio manager profiled as of March 6, 2012, and may change as subsequent conditions vary. Individual portfolio managers for BlackRock may have opinions and/or make investment decisions that may, in certain respects, not be consistent with the information contained in this report. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Past performance is no guarantee of future results. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

You should consider the investment objectives, risks, charges and expenses of any fund carefully before investing. The funds prospectuses and, if available, the summary prospectuses contain this and other information about the funds, and are available, along with information on other BlackRock funds by calling 800-882-0052. The prospectus and, if available, the summary prospectuses should be read carefully before investing.

The information on this web site is intended for U.S. residents only. The information provided does not constitute a solicitation of an offer to buy, or an offer to sell securities in any jurisdiction to any person to whom it is not lawful to make such an offer.

Prepared by BlackRock Investments, LLC, member FINRA.

BlackRock is a registered trademark of BlackRock, Inc. All other trademarks are the property of their respective owners.