Investing in Precious Metals Fool’s Gold or Hidden Gem

Post on: 25 Сентябрь, 2015 No Comment

by John Kiernan. Personal Finance Editor on November 15, 2013

All investors hope to strike gold at some point. But while the cliché applies figuratively to most people’s investment strategies – hitting it big on a speculative play or IPO, for example – others are literally seeking to make money off of gold and other precious metals.

Perhaps their interest in commodities investing stems from some sort of innate patriotism, harkening back to the California Gold Rush of the mid-1800s, or maybe we’ve simply gotten too engrossed in popular reality television programs like Discovery’s “Gold Rush” and A&E’s “Storage Wars.” But regardless of the underlying rationale, it’s fair to wonder if the shimmering appeal of the commodities markets belies reliable profit potential for the average investor or is merely a fool’s errand?

We sought advice from a number of leading investing experts, and it seems the value of commodities investing varies based on the exact nature and purpose of your investment as well as your market expertise and what else is in your portfolio.

Understanding the Role of Gold & Silver

Adjusting Your Perspective:

The first thing investors must understand about gold and other precious metals is that they’re more akin to insurance than a traditional return-seeking investment. More specifically, such commodities are used as a hedge, or protection, for other assets (like cash) and investments (like stocks and bonds) whose real value would decline during periods of runaway inflation. When the dollar carries less purchasing power, cash reserves don’t go as far and equity positions aren’t worth as much, but commodities will likely retain or increase in value as demand for non-paper wealth rises, offsetting losses in other areas of one’s portfolio.

“Gold and silver are not investments per se for the average person. They’re insurance, chaos insurance,” says Mark Waldman, executive in residence for the Department of Finance & Real Estate at American University and co-owner of Waldman Financial Advisors. “So, to the extent that you think it’s possible that there will be some major, major financial crisis way beyond 2008, owning gold is insurance against the inflation of traditional currencies.”

Vijay Singal, J. Gray Ferguson Professor of Finance in Virginia Tech’s Pamplin College of Business, offers a similar assessment. “Precious metals make sense only when an inflationary environment is expected, which would result in degradation of dollar’s value,” he told CardHub. “When the Fed embarked on pumping money into the economy four years ago, I started buying silver and gold. My thinking was that inflation will skyrocket in the near future (2-3 years). I was wrong and the Fed was right in maintaining that inflation will not increase.”

If inflation had skyrocketed, the price of gold would likely have done the same, reflecting increased demand for the precious metal as more and more people sought to safeguard their nest eggs.

Nevertheless, there is some disagreement among industry experts as to whether the gains attainable through commodities investments make them a natural hedge against inflation or a highly-speculative way to time the market and profit off of others’ fears. That’s largely because the correlation between inflation and the price of gold hasn’t always remained constant – gold averaged $619/oz. in 1980, $279/oz. in 2000, and $1,224/oz. in 2010, for example.

In other words, it seems that the price of gold doesn’t necessarily increase because of inflation, but perhaps because people think it should increase during periods of high inflation, which creates more of a market for the metal and ultimately drives its price up.

Deciding How to Invest:

Most experts recommend allocating no more than 5% or so of your net worth in precious metals. But regardless of how much you plan to invest in these commodities, it’s important to understand the various ways in which you can play the silver and gold markets.

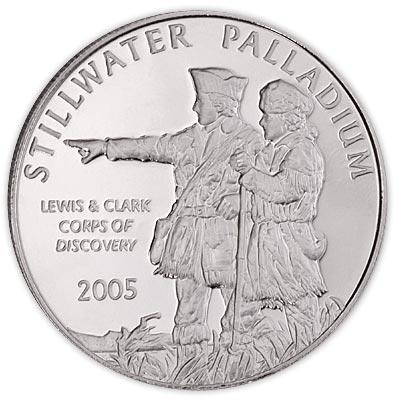

Your basic options are to purchase the physical commodities themselves (i.e. buy gold/silver bars, bullion, or coins), to invest in either an Exchange Traded Fund (ETF) that tracks the prices of commodities or one of the companies involved in the procurement and sale of precious metals, or to play the futures and options markets (i.e. try to predict future price changes). Each, as you might expect, has its own share of relative advantages and disadvantages.

“If you’re buying precious metals as an investment, the ability to resell without losing value (a characteristic known as liquidity) is an important consideration,” says Dr. Stephen Henry, assistant professor in the Department of Economics & Finance at the State University of New York (SUNY) College at Plattsburgh. “The most liquid precious metal investments are probably the various ETFs that are designed to track commodity prices. If you’re committed to owning the physical material, look for forms that can be bought for a price as close as possible to the melt value – bullion coins or bars. The problem here is that fees and shipping costs can really eat into your profits, especially for smaller investors. Be careful with futures or option contracts; they are very liquid, but almost always involve tremendous amounts of leverage, which magnifies the risk of losing your initial investment (and potentially more).”

Don’t Rationalize Jewelry as an Investment:

People often talk themselves into making big-ticket purchases by calling them investments. This is perhaps most common with jewelry. However, in most cases, it’s simply too hard to both find a piece will retain or even gain value over time AND ultimately get someone to buy it at a price that will provide a decent return.

“I’m sure it’s possible to find jewelry bargains occasionally at yard sales and storage auctions, but jewelry sold in a retail setting is almost never going to make a worthwhile investment,” Henry says. “While a piece of jewelry may have a certain intrinsic value due to its precious metal content, the retail price of that jewelry will far exceed both its resale value and its melt value. Buy jewelry that you like and enjoy wearing, and appreciate it for that… as an investment, it will probably disappoint.”

Different Rules for Different Commodities

Gold and silver aren’t the only commodities in which consumers can invest in some way, shape, or form. In fact, most people tend to divide commodities into five main categories: 1) Grains; 2) Energy; 3) Livestock; 4) Softs – a miscellaneous category that typically includes foods and fibers; and 5) Metals – gold, silver, copper, steel, and perhaps even jewelry and rare coins. For the uber-wealthy, physical assets like vintage cars can even make a potentially rewarding investment.

While each different type of commodity serves its own unique purpose – from providing a hedge against economic or political unrest to enabling one to make bets about the future of agriculture or clean energy – there is one important commonality that consumers must understand: A certain underlying subject matter expertise is needed to navigate the market profitably. You have to realize that there are people who devote their whole lives to commodities investing, and even they don’t always make the right calls. You’re also effectively competing with them, so it pays to know what you’re talking about.

At the end of the day, the more specific you get with your investment – buying a particular metal rather than investing in a precious metals ETF, for example – the more important it is to be an expert in the area.

Constructing a Diversified Portfolio

We’ve all heard about the importance of diversification to successful investing, and for good reason. As Jim Cramer, the host of the popular investing show Mad Money and a former hedge fund manager, likes to say, there’s always a bull market somewhere. In other words, there will always be certain sectors of the economy that are performing well and others that are doing badly. And since it’s too hard to predict which ones will be strong or weak with any degree of certainty, it’s best to spread your investments across asset classes in order to protect yourself from wild swings in any one sector. Sure, your potential gains won’t be as big in certain situations, but your losses won’t wipe you out either.

“What’s the best way to diversify? Diversify across multiple asset classes — bonds, stock, real estate, commodities (including energy, metals, and agricultural commodities), and cash and cash equivalents,” says Rich Curtis, senior lecturer of finance at the Charles H. Dyson School of Applied Economics and Management at Cornell University. “Within each class one might also diversify — for example, within stocks one might hold small and midcaps in addition to large caps, value stocks in addition to growth stocks, U.S. stocks in addition to foreign stocks (including emerging market stocks), etc.”

How, exactly, can the average person gain exposure to each of these asset classes without sacrificing boatloads of time? The easiest way, according to Curtis, is to “utilize mutual funds and exchange-traded funds for most of these assets classes, and REITS for real estate investments. Mutual funds, ETFs, and REITs afford diversification, and if one chooses carefully, low expenses,” Curtis says. “Note that while investors don’t have to invest in every asset class, investing in only a single asset class leaves the investor overly concentrated and vulnerable to big drops in value in that one class. Since none of us can predict the future, it’s prudent not to put all one’s eggs in a single basket. As Don Fehrs, former chief investment officer of the Cornell Endowment once said, ‘If you knew which asset classes were going up, you would not need the diversification. You would not need the risk reduction. But since an investor cannot see the future, diversify, diversify, diversify.’”

Bottom Line

At the end of the day, whether you decide to invest in commodities like precious metals or not, the role they theoretically play in one’s investment portfolio should open your eyes to the importance of hedging your bets and setting yourself up for steady long-term gains, irrespective of the political or economic climate.

“Alternatives investments, such as commodities, real estate and collectibles, can offer decent returns,” says Dr. David S. Krause, director of the Applied Investment Management Program at Marquette University. “However, their advantage is that they tend to track across the business cycle differently than financial assets. These tend to do well during inflationary periods when financial assets tend to do poorly.”

Having a position in areas that do well while the rest of your portfolio flounders is extremely important given that the name of the investing game is diversification and risk management. With those safeguards at the heart of your investing philosophy, you’ll be much more likely to strike proverbial gold. Without them, you may very well end up looking like a fool.

“Without a doubt, the best way to accumulate wealth and to control risk is through the use of a well-diversified portfolio,” Krause says. “I also advise against the tendency to try to time the market.”

Image: Chursina Viktoriia/Shutterstock