Investing in International Bonds

Post on: 8 Июль, 2015 No Comment

Getty Images

International Bonds 101

Is your bond portfolio dominated by U.S.-based investments? If you’re like most U.S. investors, it probably is – but this may mean you’re underinvested in the largest asset class in the world: international bonds .

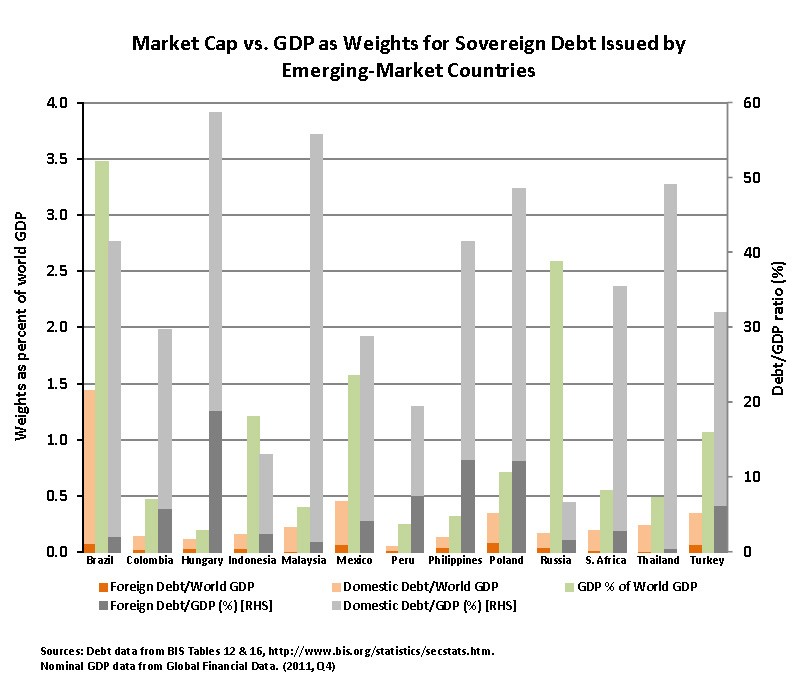

According to a Vanguard study conducted in 2012, non-U.S. bonds are the largest asset class in the world, making up more than 35% of the total value of all stocks and bonds outstanding. While in the past individuals investors had relatively few options to access this area of the market, the growth of the mutual fund and ETF industries has provided an expanding number of alternatives.

Investors may therefore wish to consider foreign bonds as a way to add diversification to their portfolios. After all, foreign countries may offer seperate market drivers than the U.S. market, including different economic and inflation trends, or divergent central bank policy. But before you take the plunge, there are some key issues to understand.

Types of Investments

The first step is selecting what area of the market in which you should invest. Among the large, and growing, range of options for individual investors are:

- Developed-market international government bond funds

- Developed-market international corporate and high yield bonds

- Funds that invest in both government and corporate debt overseas

- Emerging market government bonds

- Emerging market corporate and high yield bonds

- Funds that invest in both government- and corporate- issued emerging market bonds

- “Go anywhere” funds that can invest in any market segment overseas

As always, the key task is to balance the issues of each market segment’s risk and return characteristics with your own risk tolerance and goals. Developed market bonds tend to have lower risk – but also lower long-term return potential – than emerging market debt. Developed market bonds also tend to provide less diversification. since the economies of Japan, Europe, and the United Kingdom are more closely tied to those of the United States than those of the smaller emerging markets. Investors with a lower risk tolerance, a shorter time horizon, and less need for income may tilt their international allocation toward the developed markets, while those with higher risk tolerance and longer-time horizons may be willing to take on the added risk of the emerging markets in exchange for higher yields.

Along that same line, funds that invest in corporate and/or high yield bonds in either asset class will tend to have more risk than funds that concentrate on government debt. This is because in addition to being sensitive to interest-rate movements, corporate and high yield bonds also carry credit risk. At the same time, international corporate bonds are one of the highest-yielding segments of all global bond markets and are also the area that can provide the greatest degree of diversification relative to U.S. bonds. Keep in mind, however, that this market segment could experience significant principal losses if the world economy enters another crisis period.

The most important consideration? Don’t invest solely on the basis of yield. This is a common mistake by bond investors. and one that can lead people to take on much more risk than is appropriate.

The Impact of Currencies

Another important consideration for those investing overseas is the impact of currencies. Funds generally come in two forms – those that are invested in bonds denominated in local currencies, and those that are hedged back into the U.S. dollar.

Local currency funds. Many international bond funds buy securities using the local currencies. As a result, the value of the funds’ holdings are affected by fluctuations in foreign currencies. For example, a portfolio manager buys $1 million dollars of bonds denominated in Japanese yen. During the subsequent year, the value of the bond is unchanged, and the manager sells at the price at which he or she paid. However, during that same time period the value of the yen falls 2% versus the dollar. In other words, that $1 million worth of yen is now worth $980,000. In this way, local currency bonds are affected by both bond price movements and currency movements.

Learn more about the impact of currencies here.

Dollar-based funds. Some funds may employ “currency hedging” to offset the value of currency fluctuations. Such funds own foreign bonds, but they take offsetting positions in the underlying currencies to eliminated the impact of currency movements.

Learn more about currency hedging here .

While local currency-based funds tend to be more volatile, they also provide a greater degree of diversification than funds that are hedged back into U.S. dollars. For those whose priority is diversification or reducing their exposure to the U.S. dollar – or perhaps taking advantage of the long-term appreciation potential of emerging market currencies – local-currency funds may be appropriate. Investors who are more sophisticated, who have a higher risk tolerance, and who can invest for a longer-term time frame may also consider funds that are exposed to local currencies. On the other hand, more conservative investors or those with a shorter-term time horizon may take a closer look at funds that are hedge away the currency exposure.

The Risks of Investing Overseas

Vanguard explains this issue succinctly in its research paper Global Fixed Income: Considerations for U.S. Investors. “As with international stocks, international bonds expose investors to interest rate fluctuations, inflation and economic cycles, and issues associated with changing or unstable political regimes. While these risk factors may seem worrisome to U.S. investors, it is important to view them in the appropriate context. For example, while the bonds of any one country may be more volatile than comparable bonds in the United States, an investment that includes the bonds of all countries and issuers would benefit from imperfect correlations across those issuers. Perhaps even more important, exposure to international risk factors may be worthwhile if the outlook for the U.S. fixed income market is poor.”

Still, it’s important to keep in mind that international bonds in general – and emerging markets in particular – tend to be more volatile than bonds of corresponding credit quality in the United States. As a result, investors need to make sure that they’re comfortable with volatility and have a long enough time horizon (three to five years) to be able to overlook short-term losses.

The Bottom Line

The foreign bond markets offer a choice that’s similar to what investors must contend with when selecting investments within the United States: accept the low yields on lower-risk investments or take on added risk to pick up a more attractive yield. Still, the world of bond funds and ETFs is offering investors a growing number of opportunities for investors who are looking for ways to diversify their portfolios.

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Be sure to consult investment and tax professionals before you invest.