Investing in ETFs Active or Passive

Post on: 6 Апрель, 2015 No Comment

- What is a passive ETF?

In short, a passive ETF is a pooled investment that tracks an index. Like their mutual fund counterparts, this sort of ETF initially tracked widely published indexes (such as those from Standard & Poors, Russell and Barclays). Unlike their mutual fund counterparts though, the indexed ETF was structured differently. An index was chosen and the stock or bonds represented by that index was purchased. The shares of the ETF were sold on open stock exchange like a stock. When an investor purchased these shares, the number of shares in the ETF did not change.

Are passive ETFs better than index mutual funds?

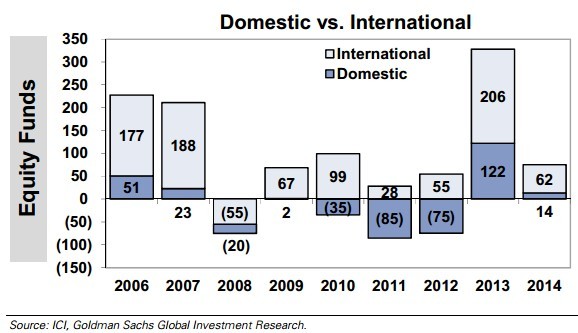

The answer varies from investor to investor. ETFs have drawn a wide following, indicative of their meteoric rise in popularity. Mutual funds however remain the single most important entry point that most investors have, most coming through their retirement plans in the workplace. For the investor who chooses an index mutual fund, the knowledge that they cannot beat that benchmark should be known. It may come amazingly close until the expenses from the fund are subtracted from the return. Passive ETF investors understand this simple concept but often make no long-term commitment to ownership of the fund.

The investor is cautioned however concerning two important factors when looking to ETFs for indexed investments. First is the cost of the trade, both into the security and out. Second is the index may be so narrow that the index may be higher risk than might otherwise be assumed.

What are actively managed ETFs?

The concept of an actively managed ETF seems at first glance to be relatively straightforward. If they are similar to traditional actively managed mutual funds, the manager would have the option to buy any security within the limits of the fund’s charter. The performance of these types of funds may not necessarily align with any benchmark but the comparison will still be made.

Actively managed ETFs, at least in their early development, use the index as a jumping off point and allow the ETF to venture into other investments and investment types somewhat within the chosen sector.

Why should you consider actively managed ETFs?

The emerging profile of an actively managed ETF investor is one who traditionally has not used a financial advisor. In numerous instances, financial advisors used passive ETFs to move client’s money into what they perceived were portfolio-appropriate positions. They may have little experience with actively managed ETFs and may not make recommendations to use them.

The actively managed ETF investor acknowledges that they no longer invest with a buy-and-hold strategy, often act independently of any single piece of financial advice and in many cases considers their experience an asset. Using this sort of investment broadens their already practiced trading abilities. Because they trade like stocks, ETFs can be purchased and sold using a number of different trading techniques.

Should the average investor consider actively managed ETFs?

There are three reasons the average investor should avoid this investment and one for why it might be worth considering. First among the downsides of ownership in this type of investment: If your mutual fund portfolio is mainly in index funds, this might suggest your focus is on a low-cost, benchmarked approach and actively managed ETFs stray from this objective.

Secondly, you have kept a close watch on your own risk tolerance. This sort of ETF increases the risk in your portfolio.

And last among the reasons you might avoid this investment: You are a buy-and-hold investor. Given the opportunity to trade these funds actively decreases your chances of holding this investment long enough to be suitable to your long-term goals.

The one reason why you might consider this investment: you are looking for a lower cost option for your current actively managed mutual fund holdings.