Investing In (And With) Lending Club How It Works (LC)

Post on: 28 Июнь, 2015 No Comment

The initial public offering of peer-to-peer lender LendingClub Corp. (LC ) offered a mostly-overlooked opportunity for well-off individuals: The enticement of a fast-growing investment class that promises fairly-reliable 8% annual income returns.

The trick isn’t to buy the stock of the San Francisco-based LendingClub: It’s to become an investor in the loans the company wants to make to consumers and small businesses. The basic idea is that you step in to the role of credit card companies that have been charging average spreads of 2,500 basis points or more on credit card debt. There’s plenty of room to undercut the banks and still make as much as 8% annual returns.

Matching Borrowers and Lenders

LendingClub explains the basic math behind its 8% annual yields on its Web site for loan investors. The company finds lenders who have high-interest credit card debt to refinance (and, if they’re willing to use LendingClub, they either can’t or won’t solve the problem using even-cheaper home equity), mostly through heavy use of Web advertising and direct mail. They pay about 13% interest on average, LendingClub takes a point as its fee, and urges investors to allow about 4% for loan losses. The result is an 8% return. (For more, see: Peer-to-Peer Lending Breaks Down Financial Borders .)

The process is fairly simple. Consumers apply for loans at the Web site, where a LendingClub partner called WebBank (best known as a private-label credit card provider at Dell.com and other e-merchants) approves or rejects the loan. Then, usually within a few days, the loans are sold to investors recruited by LendingClub. According to the prospectus for the IPO, the average credit score of these lenders is 699 and the minimum FICO score is 660. To calm prospective investors, the company emphasizes that just 1 in 10 applicants is approved. The average loan is just over $14,000, and most are used to pay off other debt.

Reliable Returns?

The returns look reliable in any but an extreme financial meltdown, because LendingClub’s process allows for broad diversification for even small investors in the loans they buy into. The actual investment vehicle investors receive is notes reflecting small chunks of each loan, and those notes are available in increments of as little as $25, the company says. So for as little as $2,500, a new LendingClub investor can get a piece of 100 loans. (For more, see: Peer-to-Peer Lending: The Future of Banking .)

Investors with at least 100 different notes are virtually guaranteed to make money, the company argues. More than 99.9% of investors who own that many notes of roughly the same size – meaning they don’t buy bigger shares of a few, higher-risk loans – make positive returns.

Returns are actually higher on the higher-risk paper, in part because of the diversification. Returns have been around 4.69% on debt the company assigns an A rating, in part because those folks are charged an average interest rate of 7.64%. Loans rated E through G generally carry rates of 20% or higher, and have had returns of 8% to 9%, as higher rates offset more defaults. Of loans issued between 2007 and early 2013, almost 8% of loan balances have been charged off, according to LendingClub’s online statistics page.

Compared to Corporates

These returns stack up well next to corporate bond yields, which are their most obvious competition for mindshare among small investors and advisors.

Bloomberg’s U.S. Corporate Bond Index has returned about 7.3% in the last year, and carries an effective yield of just 3.1%. Returns on investment-grade European debt have been negative, and global investment-grade returns have been flat, Bloomberg says. Globally, high-yield bonds have returned -0.4% despite a 6.61% effective yield, a reflection of the falling principal value of the debt amid expectations that the U.S. will soon begin hiking interest rates.

Money to Spare

Well-off individuals appear to be responding to the pitch — in small numbers so far, but responding nonetheless.

For the year ended December 31, 2013, of the capital invested in … loans, $1.2 billion, or 59%, was invested by individuals through investment vehicles or managed accounts, $569 million, or 29%, was invested by self-managed, individual investors and $245 million, or 12%, was invested by institutional investors. During the year ended Dec. 31, 2013, all of the custom program loans were invested in through whole loan sales to institutional investors.

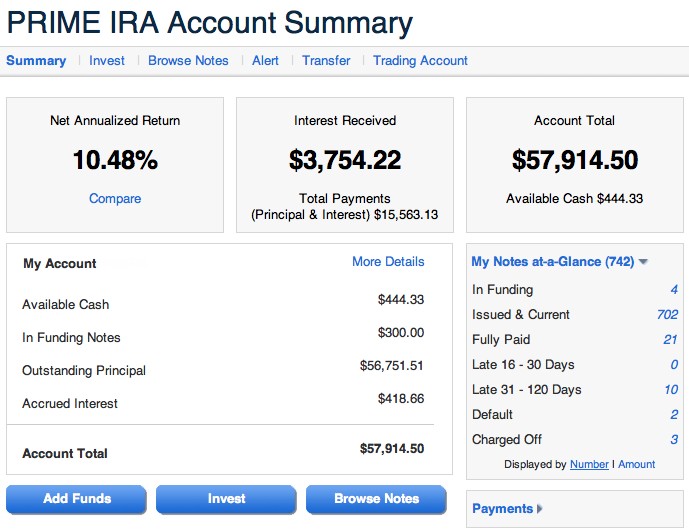

The company allows investors to manually pick and choose the loans they want to invest in using a Web site, or to set up instructions that allow conforming loans to automatically be assigned to their accounts, LendingClub says. Investors can also defer taxes by using an IRA or 401(k) rollover to manage their investments in the notes. (To learn more about lending, see: The Best Way to Borrow .)

The Bottom Line

With rates widely expected to begin rising by mid-2015, the steady returns and easy diversification of these notes look attractive — especially since they are designed to be held to their 36-month or 60-month maturities, and so are not as obviously prone as corporates or Treasurys are to short-term losses in principal value as rates rise. And the size of the multi-trillion-dollar consumer debt market assures that LendingClub and peer-to-peer lending platforms like Prosper Marketplace, Inc. will have plenty of room to grow. (For more, see: Microfinance Has Major Impact .)