Investing Guide Rebalance Your Portfolio to Reduce Risk

Post on: 20 Июнь, 2015 No Comment

Rebalance Your Portfolio to Reduce Risk

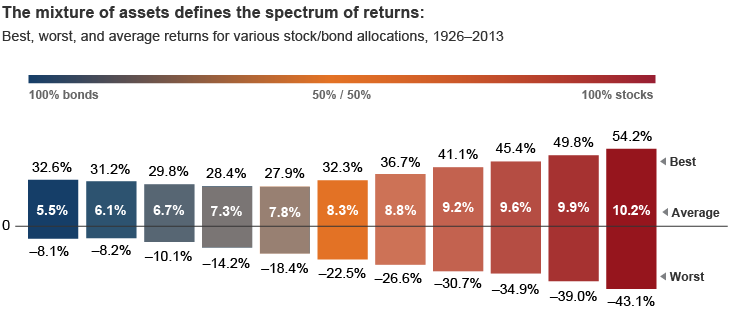

When investors first start to put money in the market, they usually allocate a certain percentage to stocks, bonds, cash, or other assets. Some aggressive investors allocate 70 percent or more to stocks, 20 percent to bonds and 10 percent to cash. Conservative investors tend to allocate more to bonds and cash.

But as the years go by, investors often lose sight of their original asset allocation and by doing so, they could be increasing the riskiness of their portfolio.

How? Stocks usually outperform other assets over time, so the investor who allocates 70 percent of their portfolio to stocks in year one may find that stocks represent 80 percent of their portfolio 10 years later. Stock prices are more volatile than bond prices or cash equivalents, such as certificates of deposit or money market accounts.

Long-term investors need not worry so much about the volatility of stock prices because they don’t plan to cash out for 10 or more years. But rebalancing doesn’t hurt returns all that much, according to several recent studies, and certainly lowers the risk to your portfolio, so it may worth doing.

How to rebalance? Come up with your target allocation by considering how risk averse you are and when you plan to spend your investments. The more aggressive and longer you can wait to spend your assets, the more stocks should make up a greater percentage of your portfolio.

After a few years when your stocks are up, sell part of them to return to the original asset allocation. If stock prices fall, buy more stock to take you back up to the original allocation. In effect, you will be selling stocks at their highs and buying them at their lows, a great way to ensure a pretty good, long-term return.

You can also rebalance within asset categories. For example, your bond portfolio may be allocated into U.S. government bonds, foreign bonds and corporate bonds. Assuming that you earn more on your corporate bonds (which has been the case in recent years), you can sell some of them and buy U.S. government bonds to return to the original bond allocation.

Try to rebalance your portfolio by investing dividends from your stocks in bonds or cash equivalents. If stocks are down, of course, you could use interest from your bonds to buy stock. That way, you don’t incur capital gains and so, avoid taxes. Also don’t rebalance your portfolio much more than once a year as you will reduce your returns by paying too much in commissions.

Bottom line: aggressive investors willing to stomach dips in the value of their portfolios should stick with putting as much away in stocks as possible. For those less risk tolerant, rebalancing is the way to go.