Investing for Retirement Part 2 The Importance of Asset Allocation

Post on: 18 Май, 2015 No Comment

There have been several major academic studies on asset allocation, including Brinson, Hood & Beebower (BHB) in 1986, which compared pension fund returns with broad market index returns and concluded that 93.6% of the volatility of returns can be attributed to asset allocation. Their research provoked a lot of discussion and debate. In a subsequent study in 1991, Brinson, Hood & Beebower examined pension fund returns through 1987 and found a similar 91.5% allocation-determined link to return volatility.

Yale professor Roger Ibbotson and Morningstar researcher Paul Kaplan went a step further, analyzing both pension fund and balanced mutual fund data and came to a similar conclusion, finding that approximately 90% of the variability of returns over time is explained by a fund’s asset allocation decision . In other words, asset allocation can be a largely accurate predictor of returns over time.

So, asset allocation is perhaps the single most important investment decision you’re going to make, which is why advisors spend a lot of time with clients finding the appropriate allocation at the start. But that doesn’t mean that you can put asset allocation decisions on autopilot. You’ll need to revisit your asset allocation on a regular basis to make sure you’re not taking too much or too little risk in order to meet your goal.

In general, the longer your time horizon, the more risk you can take. That’s why in the retirement calculator example in my last post. I used that 9% return assumption from a 70% stock/30% bond allocation. With 30 years to go until retirement and then another 20-30 years in retirement, I have a relatively long time horizon in which to absorb the volatility of the equity markets.

As you get closer to retirement, however, you should generally be reducing equity risk in favor of bonds or other lower volatility asset classes because you don’t have as much time to make up for a large surprise on the downside. The table below shows how even a balanced portfolio can experience negative returns during a bear market.

Source: Bloomberg*

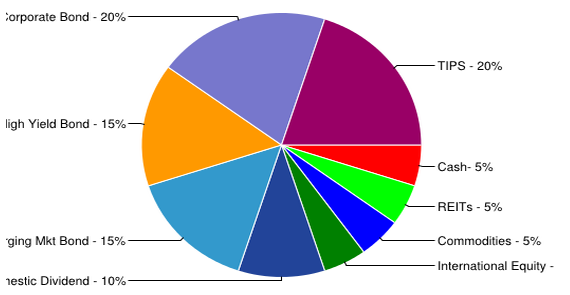

So what asset allocation is right for you? The conventional approach on this question has been to select an allocation (assuming a well diversified portfolio) that seeks to balance the return potential needed to meet your goal with the risk level. There’s also a newer school of thought on this question that factors in your “job sector risk” in a qualitative way to make your asset allocation more or less risky based on the risks inherent in your employment. We’ll discuss job sector risk further in my next post.

*Methodology

- Stock return data: Wilshire 5000 Index (which is, by definition, only price return, not total)

- Bond return data: Ba rclays Cap ital Aggregate Bond Index

- Inflation data: non-seasonally adjusted CPI-U (data used by UST when adjus t ing TIPS pri n cipal)

- Cumulative return = Stock return + Bond return Cumulative inflation