Investing Commission v Based Advisors Which Cost More

Post on: 16 Март, 2015 No Comment

Investing Commission vs. Fee Based Advisors Which Cost More?

There is a debate in the financial services industry over commission versus fee-based compensation. As an investor, it’s important that you understand the differences. Otherwise, it can end up costing you tens of thousands of dollars and great frustration.

If you’ve read any of my weekly articles, you know that I am opposed to investors working with a commission -based advisor. I often receive angry emails from brokers and agents berating me for ‘misleading’ investors. They say that over time an investor will end up paying less in a commission -based product versus paying an ongoing management fee of 1% per year.

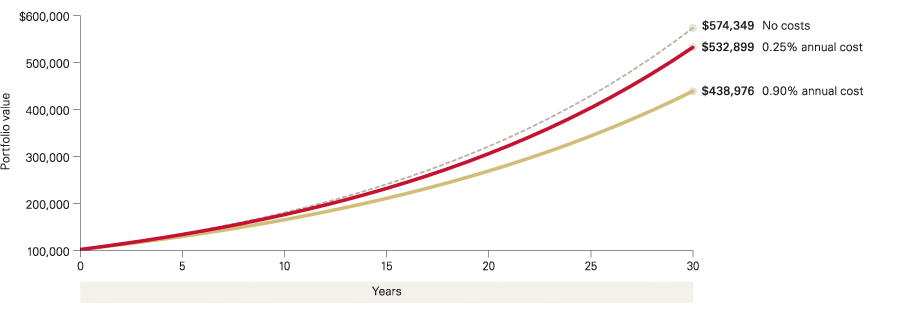

On the surface, this appears to be true. If you invest $100,000 into a mutual fund with a 5.75% front-end commission. you will have $5,750 deducted from your account on the first day. If instead, you paid 1% of the value of the account each year for seven years then you would end up paying $7,000 in fees—not counting the fees from the account increasing in value. As the value of the account goes up, so does the amount paid in management fees. On the other hand, the up-front commission was only based on the initial investment.

Why on earth, then, do I say that it is more expensive to pay a commission ?

First, this simple example above does not take into account the true costs associated with investing over that seven-year period. It’s true that if you owned the same investment for seven years and didn’t make any changes along the way, that you would benefit from paying a commission versus fees.

The problem is that there will only be a handful of every 100 people who will hang on to the investment that long. Studies have shown that the average length of mutual fund ownership is less than 2 years! It’s not unusual for an investor to go back to the broker that received the initial commission (or to a different one) to complain about the performance of the investment. Many times the broker then recommends the investor make a change that involves another commission .

Or maybe you initially purchased a variable or an equity-indexed annuity. If you need to take out your money because your situation changes or you’re unhappy with the annuity’s performance, you will end up paying a steep surrender penalty. The amount of that penalty should be considered part of its cost.

Secondly, the service you receive suffers when you pay a commission versus an ongoing fee. Commission -based advisors justify earning their commission by saying that the client is paying for 7-10 years worth of service up-front. But the advisor gets the commission regardless of how the investment performs, how little they service the account or how unhappy you are.

The commission -based advisor improves their standard of living regardless of whether they improve yours.

If you pay a dentist for seven years worth of service up-front, what incentive will the dentist have to bring you in every six months? None. In fact, by doing so, the dentist is wasting time that could be spent selling someone else a 7-year package!

Paying a management fee gives the investor CONTROL over the relationship. You can change investments or move your account, at any time, without additional costs.

As a fee-based advisor, the only way I can improve my standard of living is to first improve yours.

In fact, when you consider all the time I initially spend with a client, it takes retaining that account several years in order for me to profit from it. As a result, I continue to be motivated to meet your needs and to keep you satisfied.

Wouldn’t you rather have your advisor’s compensation tied to their performance?

The worst investment you can make is having an advisor who doesn’t do a good job. You won’t know if you have the right advisor until after you’ve worked with him/her for about a year. If you’ve purchased commission -based products it will be costly to change. It’s not so with a fee-based advisor.

Don’t be fooled by the argument that it is cheaper to pay a commission than to work with a fee-based advisor. It’s just not true. It’s your money and you deserve better.

www.guardingyourwealth.com

Have a financial question? I’ll personally answer it. Go to www.guardingyourwealth.com and click on ‘Ask Jeff’.

In addition to being a nationally syndicated columnist and Certified Financial Planning Practitioner, Mr. Voudrie provides personal, private money management services to clients nationwide.

www.refundcommission.com/?p=34