Invest In Emerging Market Bonds With These ETFs (EMB PCY EBND ELD)

Post on: 8 Июнь, 2015 No Comment

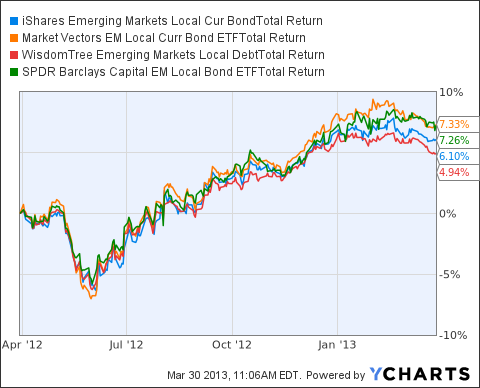

With the advent of exchange traded funds. it has become possible for retail investors to hold baskets of securities — specifically bonds — which in the past would have required the aid of a trained fixed income specialist. As many investors are aware, the current interest rate environment in the U.S. has been forcing fixed income investors to broaden their horizons when searching for yield. One area that has been gaining traction is emerging market bonds. Currently, there are several interesting candidates to choose from, but unfortunately the lack of coverage makes finding them a difficult task. In the article below, you’ll find several popular emerging market bond ETFs that could be worth a closer look. (For more, see: An Introduction To Emerging Market Bonds .)

PowerShares Emerging Markets Sovereign Debt Portfolio

The PowerShares Emerging Markets Sovereign Debt Portfolio (PCY ) ETF aims to invest 90% of its total assets in securities that track the government bonds issued by approximately 22 emerging market countries. The index is constructed using a proprietary index methodology and is re-balanced and reconstituted on a quarterly basis. It carries a total expense ratio of 0.50% and has a market value of $2.25 billion. The yield to maturity of the fund is 5.10%. In terms of distributions, the fund pays a monthly distribution of approximately $0.10721, which equates to an approximate annual yield of 4.38%. (For further reading, see: The Risks of Investing in Emerging Markets .)

Taking a look at the chart of PCY below, you can see that it is trading within a defined uptrend. The recent move back toward its swing high of $29.50 suggests that increased demand could cause a rise in upward momentum. Currently, there are few technical signals that suggest this trend will reverse any time soon. (For more, see: Investing In Bonds and Fixed Income .)

Vanguard Emerging Markets Government Bond ETF

The Vanguard Emerging Markets Government Bond ETF (VWOB ) is constructed of 676 bonds that span the spectrum of emerging markets. Countries with the highest weightings include Russia, Brazil, Mexico, China, Turkey, Indonesia, Venezuela and the United Arab Emirates. This ETF carries a relatively low expense ratio of 0.35%, which is 71% lower than the average expense ratio of funds with similar holdings. As was the case of PCY, this ETF is also quite liquid with total net assets of $295.7 million. Monthly distributions typically range between $0.27 and $0.30. For yield-seeking investors, the SEC yield of VWOB was 4.43% as of Sept. 5, 2014. (For more, see: Understanding Bond Prices and Yields .)

Taking a look at the chart, you can see that it is currently trading near its 50-day moving average. This level has propped the price up over the past several weeks and many emerging market bond investors will likely be looking to enter positions at current levels.

WisdomTree Emerging Markets Local Debt Fund

The WisdomTree Emerging Markets Local Debt Fund (ELD ) invests in local debt denominated in the currencies of emerging market countries. Countries of specific interest found within the fund’s portfolio include Brazil, Chile, Colombia, Mexico, Peru, Poland, Romania and Russia. This ETF carries an expense ratio of 0.55%, which is comparable to PCY. This ETF has total net assets of $832 million and has a 3-month return of 2.42%. Looking at monthly distributions, investors can expect to see $0.13, which translates to a distribution yield of approximately 3.32%.

Taking a look at the chart, you’ll see that the price has recently bounced off the long-term support of its 200-day moving average. The sideways price action suggests that the fund is trading within a period of consolidation and that most active traders will be looking to take a position as close to $45.62 as possible. (For more, see: Investing in Emerging Market Debt .)

SPDR Barclays Capital Emerging Markets Local Bond ETF

The SPDR Barclays Capital Emerging Markets Local Bond ETF (EBND ) seeks to provide results, before fees and expenses, that correspond with the Barclays Emerging Markets Local Currency Government Diversified Index. This ETF consists of 427 holdings and has total net assets of $117.92 million. Comparable to other funds shown above, EBND trades with an expense ratio of 0.50% and pays distributions monthly. The current 30-day SEC yield comes in at 5.03% Taking a look at the chart, you’ll find that the price has slowly been drifting downward since notching its high of $31.64 back in July. Active traders will want to wait on the sidelines for a few more weeks in hopes of entering a position near the 200-day moving average, which is currently sitting at $30.08. ( For more, see: Emerging Market ETFs For Your Retirement Account .)

iShares JPMorgan USD Emerging Markets Bond Fund

The iShares JPMorgan USD Emerging Markets Bond Fund (EMB ) gives investors exposure to U.S. dollar-denominated government bonds issued by emerging market countries. This ETF is comprised of sovereign debt from over thirty emerging market countries and carries with it an expense ratio 0.60%. This ETF has total net assets of nearly $4.7 billion and has 266 holdings. Countries of specific interest in the fund are Turkey, Philippines, Colombia, Russia, Hungary and Brazil. The current 30-day SEC yield is 4.28%. Taking a look at the chart, you can see that the fund is trading within an established uptrend and the move toward current highs suggests that traders will continue to keep this fund on their watch lists and will continue to add to positions as it moves beyond previous highs. From a risk management perspective, traders will likely set their stop-loss orders below the nearby 50-day moving average, which is currently trading at $114.49. ( For more, see: The Better Bet: Emerging Market Debt or Equity .)

The Bottom Line

Bond investors are looking toward emerging market economies for yield. Fortunately, there are ETFs that make accessing such investments far easier. A good place to start is analyzing the previously mentioned ETFs. (For further reading, see: An Evaluation of Emerging Markets . )