Introduction to Total Return Swaps

Post on: 4 Апрель, 2015 No Comment

Credit derivatives include total return swaps. Although this is a less common type of credit derivative. it is an important off-balance sheet tool, particularly for hedge funds and for banks seeking additional fee income.

TRS: A Form of Financing

Total Return Swaps, TRS, (also called Total Rate of Return Swaps, or TRORS) are simply another form of financing. An example of a modified form of a car lease illustrates the concept. The investor (a hedge fund, insurance company or other), is the receiver of the total rate of return and is the lessee, who leases the car. In this particular lease, the investor gets all of the benefits of the car without any of the hassle. The investor gets a chauffeur. The investor does not have to worry about parking the car, putting gas in the car, maintaining the car, or servicing the car. The investor does not pay luxury tax since the investor does not own the car. At the end of the lease, the investor must pay the lessor any depreciation in the value of the car. If the car has not depreciated in value, the investor pays nothing.

If the car appreciates in value, the investor gets a payment from the lessor for the value of the appreciation of the car. For all of this, the investor pays a lease fee. There is one catch, however. If the car is damaged as defined in the lease agreement, the investor must pay the difference between the original value and the damaged value, and the lease terminates. Alternatively, the investor can take ownership of the car and pay the original value of the car to the lessor. The definition of “damage” and the determination of the value of the “damaged” car are conditions the investor and the lessor negotiate at the beginning of the lease. In some cases, the lease agreement may allow the investor to purchase the car at the market value of the car at the end of the lease agreement. The method of determination of market value of the car is negotiated by the investor and the lessor before they sign the lease agreement. A TRS, a total rate of return swap, allows an investor to enjoy all of the cash flow benefits of a security without actually owning the security. The investor receives the total rate of return. At the end of the TRS (or at prearranged interim periods), the investor, the receiver of the TRS, must pay any decline in price to the TRS Payer. If there is no decline in price, the investor does not make a payment. If the security appreciates in price, the investor gets the difference between the original price and the new, higher price. For all of this, the investor makes ongoing payments to the TRS Payer. The payments are analogous to the lease payments we discussed earlier. In the credit derivatives market, this payment is referred to as the floating rate payment, the financing cost, or the funding cost of the investor.

Off-Balance Sheet Synthetic Assets

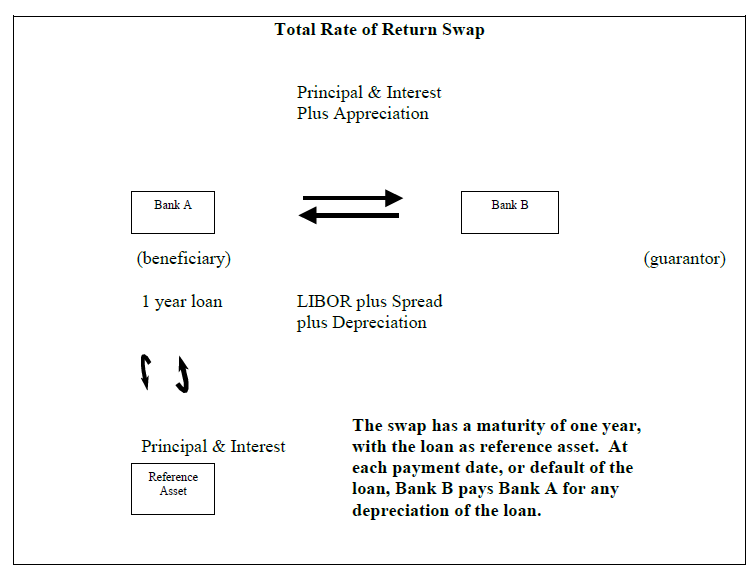

TRS are off-balance sheet transactions. Low cost borrowers with large global balance sheets are naturally advantaged as payers in TRS. Synthetic assets are created in the process. Higher cost borrowers, such as hedge funds, enjoy the financing and leverage of the total return transaction. A TRS is a bilateral financial contract between a total return payer, and a total return receiver. The total return payer pays the total return of a reference security and receives a form of payment from the receiver of the total rate of return. Often payment is a floating rate payment, a spread to LIBOR. The reference assets can be indices, bonds (emerging market, sovereign, bank debt, mortgage-backed securities, corporate), loans (term or revolver), equities, real estate receivables, lease receivables, or commodities. Total return swaps have been around at least since 1987 when Salomon Brothers offered the first mortgage swap agreement (“MSA”). Most of the total return swaps offered in the market are simpler than the MSA. The basic total return swap transaction is shown in the diagram below: The total rate of return payer is the legal owner of the reference asset, just as the lessor was the legal owner of the car in our initial example. The total rate of return payer holds the reference asset on its balance sheet. For the period of the transaction, the total rate of return payer has created a short position in the market risk (depreciation of the car) and a short position in the credit risk (potential “damage”) of the reference asset.

Investor Is Not the Legal Owner of the Asset

The total rate of return receiver, the investor, is not the legal owner of the reference asset, any more than the lessee was the legal owner of the car. The TRS is an off-balance sheet transaction and the reference asset does not appear on the balance sheet of the receiver. For the period of the transaction only, the total rate of return receiver has a synthetic long position in the market risk and a synthetic long position in the credit risk (“damage) of the reference asset. At the maturity of the transaction, the total rate of return receiver may choose, but is not obligated, to purchase the reference asset at the then prevailing market price. In the event of default of the reference asset prior to the maturity date of the TRS, the TRS usually terminates, but it need not necessarily terminate. We’ll look at the case in which it does not terminate later, since in most cases of default, the TRS does terminate. The total rate of return receiver bears the risk in the event of default in either case. If the TRS terminates due to a default, the total rate of return receiver, the investor, makes the total rate of return payer “whole” for the market risk and credit risk of the reference asset. The investor may make a net payment of the difference between the price of the reference security at the beginning of the transaction and the price of the reference security at the time of default. Alternatively, the investor may agree to take delivery of the defaulted reference asset and pay the initial price of the reference asset to the total rate of return payer. Once this has occurred, neither the payer nor the receiver has any additional obligation to the other party, and the TRS terminates.

Motivation of Receiver of the Total Return

In a very important sense, TRS are not credit derivatives. TRS, considered in their most basic form, are funding cost arbitrages. TRS are applied in a variety of ways: balance sheet management, portfolio management, hedge fund leverage, and asset swap maturity manipulation. While the overall effect of a TRS may have very important credit implications for both the payer and receiver of the total rate of return swap, the use is primarily that of a financing. There are many reasons for both a payer and receiver (“investor”) to enter into a total rate of return swap. There is one overwhelming compelling reason for the receiver of the total rate of return swap, however. Many credit derivatives specialists who either miss the point or pander to the sensitivities of credit managers and regulators will cite reasons such as the following:

- Investors can create new assets with a specific maturity not currently available in the market.

- Investors gain efficient off-balance sheet exposure to a desired asset class such as syndicated loans, or high yield bonds to which they otherwise would not have access.

- Investors may achieve a higher return on capital (see also below). TRS are often treated as derivatives, off-balance sheet instruments. Direct asset ownership is an on balance sheet funded investment. Investors can fill in the credit gaps in their portfolio.

- Investors can reduce administrative costs via an off balance sheet purchase (as opposed to buying loans on balance sheet).

- Investors can access entire asset classes by receiving the total return on an index.

I’ve been to presentations where these are the only reasons cited for the motivation of the receiver of the total rate of return. The above reasons are often true. But that’s like saying the reason you are driving a Porsche Targa around a race track is that it gets you around faster than walking. While it’s true, it is not the point of what you are doing. The key reason receivers of the total rate of return enter into this transaction is to take advantage of leverage . Investors make no initial cash payment. Cash flows are usually paid on a net basis. The investor’s “payments” are subtracted in advance from the securities cash flows. The investor does nothing but receives a positive net payment. (This assumes that the funding cost of the investor remains less than the cash flows from the security. If the investor is receiving a fixed coupon and makes a floating payment, it could happen that in an inverted yield curve environment the investor would be in the position of having to make a net payment.) Leverage is the reason that hedge funds are a primary target as counterparties in TRS. The hedge funds are the receiver of the total rate of return. The primary motive of the hedge funds is to exploit leverage. The participation of hedge funds and other shaky, albeit partially collateralized credits, is a critical, and not necessarily welcome, development in the credit derivatives market. While the motive of the hedge fund counterparty is leverage, the motive of the payer of the total rate return in the TRS is to report high earnings. We’ll examine this transaction and the quality of these earnings in more detail in the section on hedge funds. For a creditworthy bank or other creditworthy receiver, no upfront collateral is generally required at all. The receiver puts up no cash. The spread earned is pure spread income; the interest income on the TRS less the receiver’s funding cost.

Motivation of the Payer

The payer in a TRS creates a hedge for both price risk and default risk of the reference asset, although the payer in the TRS is a legal owner of the reference asset. Investors who cannot short securities may be able to hedge a long position by paying the total rate of return in a TRS. Like any credit derivatives transaction, the TRS is an off balance sheet transaction for the payer or the total rate of return. A long-term investor who feels that a reference asset in portfolio may widen in spread in the short term, but then will recover, may enter into a TRS which is shorter than the maturity of the asset. The structure is flexible and does not require a sale of the asset. In this way the investor can lock in a return, yet take a temporary short-term negative view on an asset. An investor, who has an unrecognized loss in a bond position, can defer the loss without risking even further losses on the asset. The investor can pay the total rate of return on the asset for the period of time required to defer the loss. At the maturity of the total rate of return swap – if it is not the same as the maturity of the asset the investor can sell the asset and recognize the loss. An investor with a gain in a security can employ the same method to defer a gain while simultaneously protecting the value of the reference asset.

Hedge Funds and Leverage

While the TRS opens up distribution in the loan market, the total return receiver continues to be an important element in the structure. When a bank lays off the credit risk of a loan by paying the total rate of return to a hedge fund, how much risk does the bank reduce? Credit managers face a dilemma. Banks are in the business of providing finance and generally want to lay off risk in a cost effective manner. Credit derivatives traders, eager to book income, want to lend money to hedge funds since they will pay high financing costs, much greater than the banks can get from other counterparties such as banks, insurance companies, or investment banks. There is a reason for the high funding cost demanded of the hedge funds, however. Hedge funds do not disclose other assets on their balance sheets. The credit manager evaluating the credit of a hedge fund has nothing to go on. There is no way of knowing how many of these transactions have been done by the hedge fund. On the one hand, more transactions imply greater diversification. On the other hand, the credit manager has no way to determine how much leverage the hedge fund employs. Some hedge funds are only required to put up 5% upfront collateral. Banks demanding 20% upfront collateral often find that hedge funds will do the TRS with another bank who will give more favorable collateral terms. Banks will often require a daily mark-to-market on the underlying asset, and often there is a “cure” period allowing the hedge fund time to come up with additional collateral. Not every bank requires a daily mark-to-market, however. If a bank enters into a credit derivatives transaction with a hedge fund, what benefit, if any, does the bank get from a reduced joint probability of default? Is there a reduced probability? Does the upfront collateral suffice to enhance the credit quality of the hedge fund counterparty to compensate the bank in the event of default? If the underlying asset defaults, is the price volatility low enough so that the upfront collateral will cover the decline in value? A hedge fund counterparty seems to be a perversion of the concept of credit derivatives. Do I view the hedge fund as a single A? Most banks would emphatically say not. Do I view the hedge fund as BB+? The problem is no one really knows. Hedge funds do not disclose enough information to make this evaluation. The fact that banks are willing to do this business with hedge funds illustrates how hard it is for banks to generate income from their traditional investment grade loan business. Investment grade loans show a dismally low return on capital. The banks’ primary goal isn’t increased distribution. The primary goal is to book higher spread income. The question remains whether the enhanced spread income which hedge funds are willing to pay as a funding cost is enough to compensate banks for the credit risk. I believe that there is no benefit from a jointly supported rating when a hedge fund is the “guarantor”. The protection provided by the hedge fund is phantom protection. The only benefit is from the upfront collateral, which may reduce my exposure in the event of a default on the underlying asset. If a hedge fund puts up only 5% collateral that is not much of a reduction in my overall exposure. The unfortunate truth is that in the event of default of the reference asset, I do not know whether the hedge fund will be in a position to come up with the additional money. Sources: Tavakoli, J. Credit Derivatives & Synthetic Structures: A Guide to Instruments and Applications 2nd Edition, John Wiley & Sons, 1998, 2001. For advanced applications, see Structured Finance & Collateralized Debt Obligations. 2nd Edition, by Janet Tavakoli, John Wiley & Sons, 2001, 2008.