Introduction To InflationProtected Securities Yahoo Finance New Zealand

Post on: 19 Май, 2015 No Comment

Investors usually focus on the nominal rate of return on their investments, but the real rate of return is what really matters. So, if someone told you about a security that guarantees a real rate of return over inflation with no credit risk, you would of course be interested.

When constructing a portfolio, investors should aim to increase the portfolio’s risk-adjusted return; to do this, they need to look for asset classes that are uncorrelated. While fixed-income securities and equities tend to be most commonly combined in a portfolio for this purpose, there is another asset class that can offer further diversification potential with minimal effort and cost. Since the early 1980s, inflation-protected securities (IPS) have grown gradually within many of the world’s developed markets. No other security packs as much punch on a risk-adjusted basis. What Are Inflation-Protected Securities?

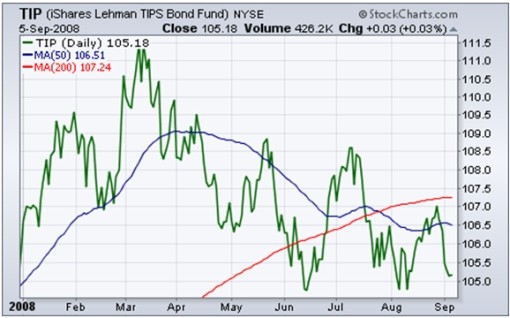

While IPSs are structured similarly to normal bonds, the main difference is that the IPS structure of the interest payments is in two parts rather than one. First, the principal accrues with inflation throughout the life of the IPS, and the entire accrued principal is paid out at maturity. Second, the regular coupon payment is based on a real rate of return. While the coupon on an IPS tends to be materially lower than the coupon on a normal bond, the IPS coupon pays interest on the inflation-accrued principal rather than on the nominal principal. Therefore, both principal and interest are inflation-protected. Here is a chart showing the coupon payments of an IPS.

3a%2f%2fi.investopedia.com%2finv%2farticles%2fsite%2f091504.gif&t=1426401586&sig=THBItrtDx3UZ7fF3jyF.Hw—

B /%

When Are They Better Than Bonds?

The time to purchase IPSs over normal bonds really depends on the market’s expectations on inflation and whether those expectations are realized. An increasing rate of inflation, however, does not necessarily mean that IPSs will outperform normal bonds. The attractiveness of IPSs depends on their price relative to normal bonds. For example, the yield on a normal bond may be high enough to beat the yield on an IPS even if there is a future increase in inflation. For example, if an IPS is priced with a 3% real yield and a normal bond is priced with a 7% nominal yield, inflation would have to average more than 4% over the life of the bond for the IPS to be a better investment. This inflation rate at which neither security is more attractive is known as the break-even inflation rate. (Learn more about the link between inflation and bonds in Hedge Your Bets With Inflation-Linked Bonds .)How Are IPS Purchased?

Most IPSs have a similar structure. Many sovereign governments of developed markets issue an IPS (for example, TIPS in the U.S.; Index-Linked Gilts in the U.K.; and Real Rate Bonds in Canada). IPSs can be purchased individually, through mutual funds, or through ETFs. While federal governments are the main issuers of IPSs, issuers can also be found within the private sector and other levels of government. Should IPS Be Part of Every Balanced Portfolio?

While many investment circles classify IPSs as fixed income, these securities are really a separate asset class. This is because their returns correlate poorly with regular fixed income and equities. This fact alone makes IPSs good candidates for helping to create a balanced portfolio; furthermore, they are the closest thing to a free lunch that you will see in the investment world. Actually, you need to hold only one IPS in your portfolio to realize the majority of the benefits of this asset class. Since IPSs are issued by sovereign governments, there is no (or minimal) credit risk and therefore limited benefit in diversifying any further. Inflation can be fixed income’s worst enemy, but an IPS can make inflation a friend. This is a comfort especially to those who recall how inflation ravaged fixed income during the high inflationary period of the 1970s and early 1980s. Sounds Too Good to Be True?

While the benefits are clear, IPSs do come with some risk. First, to realize fully the guaranteed real rate of return, you have to hold the IPS to maturity. Otherwise, the short-term swings in the real yield could negatively affect the short-term return of the IPS. For example, some sovereign governments issue a 30-year IPS, and, although an IPS of this length can be quite volatile in the short term, it is still not as volatile as a regular 30-year bond from the same issuer. A second risk associated with IPSs is that, since the accrued interest on the principal tends to be taxed immediately, IPSs tend to be better held within tax sheltered portfolios. Thirdly, they are not well understood and the pricing can be both difficult to understand and calculate.

Summary

Ironically, IPS is one of the easiest asset classes to invest in, but it is also one of the most overlooked. IPSs’ poor correlation with other asset classes and unique tax treatment make them a perfect fit for any tax sheltered, balanced portfolio. Default risk is of little concern as sovereign government issuers dominate the IPS market. Investors should be aware that this newer asset class does come with its own sets of risks. Longer-term issues can bring high, short-term volatility that jeopardizes the guaranteed rate of return. As well, their complex structure can make them difficult to understand. However, for those who are willing to do their homework, there truly is a free lunch out there in the investment world. Dig in!

More From Provider