International Investing mutual funds or direct investments in foreign markets

Post on: 10 Май, 2015 No Comment

The stocks of most foreign companies that trade in the U.S. markets are traded as American Depositary Receipts (ADRs). U.S. depositary banks issue these stocks. Each ADR represents one or more shares of foreign stock or a fraction of a share. If you own an ADR, you have the right to obtain the foreign stock it represents, but U.S. investors usually find it more convenient to own the ADR. The price of an ADR corresponds to the price of the foreign stock in its home market, adjusted to the ratio of the ADRs to foreign company shares.

International Investing

There are different ways you can invest internationally: through mutual funds, American Depositary Receipts, exchange-traded funds, U.S.-traded foreign stocks, or direct investments in foreign markets. This online brochure explains the basic facts about international investing and how you can learn more about foreign companies and markets. Although this brochure covers foreign stocks, much of it also applies to foreign bonds.

Why should investors read this brochure?

As investors have learned recently, the market value of investments can change suddenly. This is true in the U. S. securities markets, but the changes may be even more dramatic in markets outside the United States. The world’s economies are becoming more interrelated, and dramatic changes in stock value in one market can spread quickly to other markets.

Keep in mind that even if you only invest in stocks of U.S. companies you already may have some international exposure in your investment portfolio. Many of the factors that affect foreign companies also affect the foreign business operations of U.S. companies. The fear that economic problems around the globe will hurt the operations of U.S. companies can cause dramatic changes in U.S. stock prices.

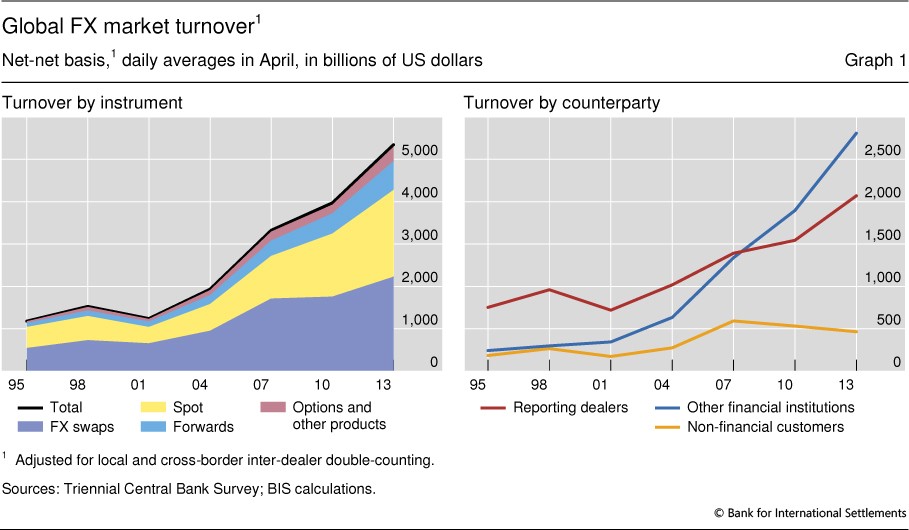

Sudden changes in market value are only one important consideration in international investing. Changes in foreign currency exchange rates will affect all international investments, and there are other special risks you should consider before deciding whether to invest. The degree of risk may vary, depending on the type of investment and the market. For example, international mutual funds may be less risky than direct investments in foreign markets, and investing in developed economies may avoid some of the risks of investing in emerging markets.

Why do many Americans invest in foreign markets?

Two of the chief reasons why people invest internationally are: