Internal rate of return (Business) Definition Online Encyclopedia

Post on: 21 Июнь, 2015 No Comment

INTERNAL RATE OF RETURN — IRR

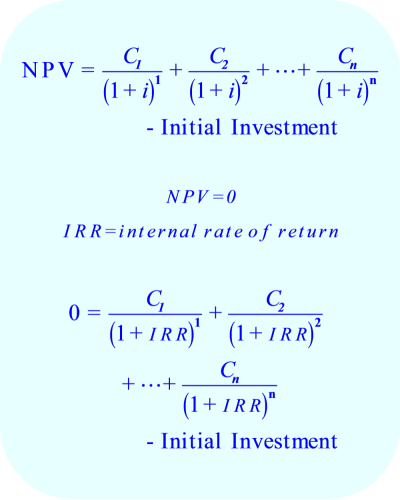

The internal rate of return (IRR) is the interest rate such that the discounted sum of net cash flows is zero. If the interest rate were equal to the IRR, the net present value would be exactly zero.

internal rate of return

method used to determine the policyholder ‘s return on premiums paid into a life insurance policy. This method is illustrated in two ways.

Internal Rate of Return

The rate of return that would make the present value of future cash flows plus the final market value of an investment or business opportunity equal the current market value of the investment or opportunity.

Also called dollar-weighted rate of return.

Internal rate of return

Definition: The rate used to discount future income into present value.

Related glossary term.

INTERNAL RATE OF RETURN — A method of determining investment yield over time assuming a set of income.

INTERNAL RATE OF RETURN (IRR) — A multi-year analysis of rate of return similar to Financial Management.

Internal Rate of Return (IRR)

The internal rate of Return (IRR) is the discount rate that equals the present value of a future steam of cash flows to the initial investment.

Like the internal rate of return. the modified internal rate of return cannot be validly used to rank-order projects of different sizes, because a larger project with a smaller modified internal rate of return may have a higher present value.

Incremental internal rate of return

IRR on the incremental investment from choosing a large project

instead of a smaller project.

Related Terms.

Dictionary Finance P Portfolio Internal Rate Of Return

Finance Dictionary — P Terms

Share.

Internal Rate of Return (IRR). The growth rate of your money over a time period relative to the amount invested. IRR, which compares the profit to the amount invested, is expressed as a percent gain or loss for easy comparison with other percent changes for the same time period.

Internal Rate of Return

Method that determines the discount rate at which the present value of the future CASH FLOWS will exactly equal investment outlay.

Internal Rate Of Return (IRR): Any IRR calculation must be based on continuous compounding. Thus the Internal rate of return of an investment, is the growth rate of the money over a time period relative to the amount invested.

Internal rate of return (IRR): A capital budgeting performance measure that represents the discount rate required to achieve a net present value of zero for the project.

Internal rate of return.

A measure used in project evaluation. It is the annual percentage of profitability on the initial investment.

Franзais: Taux de rendement interne

Espaсol: Tasa de rentabilidad interna (TRI).

internal rate of return (IRR)

A measure of yield that relates the cash flow from each interest payment and the cash flow from the investment’s redemption value at maturity to the purchase price of the investment.

Internal Rate of Return. (IRR): A measure of return on an investment that takes both the size and timing of cash flows into account.

Internal rate of return (IRR)

A measure of the rate of return on an investment and therefore an indicator of the efficiency with which the company uses its capital.

Investment.

INTERNAL RATE OF RETURN (IRR) The interest rate at which the present value of expected cash flows equals the value of the initial outlay.

INTRINSIC VALUE The estimated value of a security.

Internal Rate of Return (IRR): The theorem of internal rate of return is, in effect, compounding interest in reverse, or discounting. In contemplating a current investment with a proposed investment, IRR is a most efficient evaluation.

Internal Rate of Return (IRR) The discount rate at which present value of the current cash flows of an investment equal the cost of the investment. When the IRR is greater than the required return. called the hurdle rate in capital budgeting. the investment is acceptable.

Internal rate of return (IRR)

Dollar-weighted rate of return. Discount rate at which net present value (NPV) investment is zero. The rate at which a bond’s future cash flows, discounted back to today, equal its price.

International fund.

Internal Rate of Return (IRR)

The rate of discount which needs to be applied to make the net present value of an investment equal to the price paid.

Internal rate of return

Main article: Internal rate of return

The internal rate of return (IRR), also known as the dollar-weighted rate of return, is defined as the value(s) of that satisfies the following equation.

Internal Rate of Return (IRR): The discount rate that makes the net present value equal to zero. Multiple IRRs occur mathematically if the periodic cash flows change signs more than once.

INTERNAL RATE OF RETURN. The anticipated rate of return on a capital investment project undertaken by a business firm.

Internal rate of return (I.R.R.) on the incremental investment from choosing a large project instead of a smaller project.

Internal Rate Of Return. An Inside Look

A Look At Accounting Career s

Ancient Accounting Systems.

Internal rate of return (IRR)

The discount rate that gives a set of future cash flows a present value of zero. If the IRR is greater than the opportunity cost of capital, then the relevant project is potentially attractive.

Internal recruitment.

The internal rate of return (IRR) is the rate of return that would be required to exactly re-create the cash flows from an investment equal to the cost of the project. The IRR is the rate of return provided by the project if accepted.

Modified internal rate of return (MIRR) is a variant of IRR that assumes that cash generated is re-invested at the cost of capital (usually the WACC ). This is preferable because:

Any series of cashflow s has a single MIRR.

It takes account of the rate at which cash generated is re-invested.

Modified Internal Rate of Return — MIRR

Multiple rates of return

Offlake

PBO

Private Activity Bond — PAB.

Portfolio Internal Rate of Return Computation of rate of return by initially calculating cash flow for bonds, then computing the rate of interest that equates present value of cash flow to the portfolio’s market value. [Read more. ].

IRR — Internal Rate of Return (IRR) represents the profitability generated by a certain investment (a lot used with one of.

Internal rate of return

Rate of return

Return.

Portfolio internal rate of return

The rate of return computed by first determining the cash flows for all the bonds in the portfolio and then finding the interest rate that will make the present value of the cash flows equal to the market value of the portfolio.

Also called the internal rate of return. the interest rate that will make the present value of the cash flows from all the subperiods in the evaluation period plus the terminal market value of the portfolio equal to the initial market value of the portfolio.

SEARCH.

Internal Rate Of Return

A measure of the return on investment taking into account both the size and timing of cash flows; alternatively, the interest rate which, wh. (Read more)

See: Internal rate of return (IRR), Discounted cash flow (DCF), and Net present value (NPV) Pay-downIn a Treasury refunding. the amount by which the par value of the securities maturing exceeds that of those sold.

Cost of lease financing A lease’s internal rate of return .

Cost of limited partner capital The discount rate that equates the after-tax inflows with outflows for capital

raised from limited partners.

Cost-benefit ratio The net present value of an investment divided by the investment’s initial cost.

See: Internal rate of return I.S.D.A. See: International Swap Dealers Association I.S.M.A. See: International Security Market Association I.T.S. See: Intermarket trading system Idiosyncratic Risk Unsystematic risk or risk that is uncorrelated to the overall market risk.

The J Curve usually reflects performance as measured by internal rate of return (IRR). The J curve occurs because private equity involves large up-front injections of cash and usually takes a long time to return any of the benefits back to investors.

The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return. and net present value.

To determine problems with a business’s liquidity. Being profitable does not necessarily mean being liquid.

Required rate of return [r]: A stipulated minimum acceptable value of a project’s internal rate of return that is sometimes used as an alternative to the net present value criterion for investment appraisal or cost-benefit analysis. [e].

Internal Rate of Return (IRR)

Modified Internal Rate of Return (MIRR)

Average interest rate

Break-even point (BEP) in quantities

French Amortization System (Price)

Constant Amortization System

German Amortization System

Straight Line Depreciation Method.

Also called Internal Rate of Return (IRT). It is a method to rank the competing investment projects. IRT takes into consideration the investments performance, timing, and size of the investment.

It is computed using net present value (NPV) or internal rate of return (IRR) and is a consideration in analyses of capital and securities investments. The NPV method uses a discounted rate of interest based on the marginal cost of capital to future cash flows to bring them into to the present.

Accounting rate of return

Internal rate of return

Modified internal rate of return

Equivalent annuity

The primary goal of capital budgeting is to put capital where it will be most beneficial to the long-term value of the company and therefore the wealth of the owners.

A bond’s yield to maturity (YTM) is the internal rate of return an investor would achieve if she purchased that bond at its current dirty price and held it to maturity, assuming all coupon and principal payments are received as scheduled.

IRR — Is used two different ways. For the first, it refers to the Internal Rate of Return. For the second, it refers to Implied Repo Rate .

ISCC — Is the International Securities Clearing Corporation.

ISDA — Is the International Swaps Dealer Association.

Dollar-weighted rate of return

Also called the internal rate of return ; the interest rate that makes the present value of the cash flows from all the subperiods in an evaluation period plus the terminal market value of the portfolio equal to the initial market value of the portfolio.

Feasibility study — Evaluation of a contemplated project or course of action, according to pre-established criteria. (such net present value. internal rate of return. and payback period ) to determine if the proposal meets management requirements.

Horizon analysis is the analysis of a group of funds emphasizing on their expected results over a number of separate time frames. A forecast of the imputed discount rate, realistic expectation or internal rate of return is seen after it is calculated.

Annual Percentage Rate: The effective rate of interest on a loan assuming a one-year time period. This is the interest rate that is disclosed to borrowers for comparison with credit offered by other lenders. The calculation is the same as Internal Rate of Return (IRR).

The internal rate of return method determines the interest rate (the average rate of return ) at which the present value of future cash flows is equal to the cost of the investment now. You then make your decision on the basis of that yield.

Fisherian criterion: for optimal investment by a firm — that it should invest in real assets until their marginal internal rate of return equals the appropriately risk-adjusted rate of return on securities

Source: Miller and Rock, Journal of Finance Sept 1985, p. 1032

Contexts: models; finance.

and all cash inflows are calculated using a DISCOUNT RATE to give the worth (the PRESENT VALUE) of making the investment at a given point in time, such as today. Also, the value today of all future income from a project minus the amount of the investment. See PRESENT VALUE; INTERNAL RATE OF RETURN.

Internal Rate of Return

Liabilities

Market Value of Invested Capital

Minority Ownership Discount

Multiple of Discretionary Earnings Valuation Method