Inter Economic Market Allocation How the Average Investor can Beat the Market July 2013

Post on: 8 Июнь, 2015 No Comment

Seeking Alpha — Market Historian

I believe it is important to look at the investment markets from a top down (i.e. global macro) viewpoint in tandem with a bottom up (i.e. individual stock selection) perspective. Additionally, I believe that all of the noise (i.e. news, press releases, earnings reports, quantitative easing updates, economic statistics, etc.) that we are exposed to on a daily basis clouds both the short and long-term perspectives of even the best investors, making it hard to decipher both cyclical and secular bull and bear markets. With that background and with the viewpoint of a market historian, let’s examine the stock, bond, and commodity markets over different timeframes for clues as to what will be the strongest performers on an absolute and relative basis in the months and years ahead.

On a year-to-date basis, the clear winners for 2013 thus far are U.S. stocks. The iShares Russell 2000 Index Fund (IWN ) is leading the charge, up 24.4%. The S&P 500 Index, as measured by the SPDR S&P 500 ETF (SPY ), is in second place with a return approaching 20%. After that, there is a sizeable drop-off in returns. In fact, the iShares MSCI EAFE ETF (EFA ) is the only remaining positive performer, up a little over 9%. This is surprising considering the strong performance of Japanese stocks (EWJ ), with the Nikkei up 35.9% through July 26th, 2013. For reference, Japan comprised approximately 22.5% of the MSCI EAFE index at the end of June. The rest of the market barometers that I’ve selected have posted negative returns YTD. Gold stocks (GDX ) and physical gold (GLD ) led decliners with losses of 40.6% and 20.5%, respectively. A noticeable change in character occurred in the bond market. The iShares Barclays 20+ Year Treasury Bond (TLT ), which had been a strong performer over the last several years, faltered, falling 9.6%.

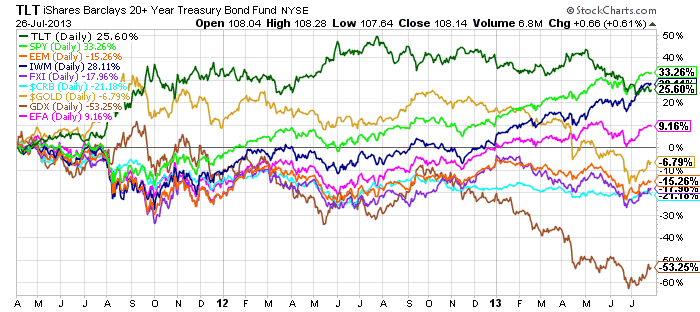

Over the two year and almost 4 month timeframe depicted above, U.S. stocks continued as leading performers, with SPY gaining 33.3% and IWM up 28.1%. Bonds look much better over this period, with TLT up 25.6%. The reason I selected the April 1st, 2011 starting point is that it roughly marks the point in time where bonds and stocks started outperforming commodities, as I articulated in my recent authored article on Seeking Alpha. While that outperformance has continued in calendar 2013, it may be getting long in the tooth. Nonetheless, it is clear that stocks and bonds are in a cyclical bull market over this timeframe. Gold stocks, as measured by the GDX, were by far the worst performers over this interval, declining 53.3%. Gold also posted a loss over this timeframe, but the yellow metal was only down 6.8%. The sheer magnitude of the underperformance of gold stocks relative to gold foreshadows a significant opportunity. This will be reinforced as we look back over longer time periods. Relative to commodities over this timeframe, gold’s loss was actually more benign. On a comparative basis, the broader CRB index posted a 21.2% decline. Meanwhile, emerging markets, which are highly correlated with commodities, also struggled. The iShares MSCI Emerging Markets ETF (EEM ) posted a loss of 15.3%. The iShares China Large-Cap ETF (FXI ) was down 18%. Thus, for scorecard purposes, emerging markets, commodities, and commodity stocks were in a cyclical bear market over this interlude.

Now this tour through market history is starting to get interesting. As many of you might recall, the global markets bottomed in March of 2009, with the S&P 500 Index touching the 666 level intraday on March 9th of 2009, and closing at 676.53 on the same day. This marked the low level in the 2008/2009 cyclical bear market, and the low level, thus far, in the secular bear market that began in 2000. For perspective, the S&P 500 Index closed at 701.46 on October 4 th , 1996! Since the closing low on March 9th, 2009, an epic rally has taken place in global stock markets, led by U.S. stocks, with IWM posting a gain of 222.4%, SPY delivering a gain of 173%, and EFA rising 121%. Emerging markets and commodities both look better over this period with EEM gaining 109%, FXI up 62.3% and the CRB index gaining 36.5%. Two surprises stand out, at least from my vantage point. First, gold stocks declined by 10.6% over this timeframe, even though gold delivered a healthy gain of 45.1%. The second surprise from my point of view is that bonds, as measured by the TLT, were the second worst performer, posting a gain of 21%. This is remarkable, considering the last four and a half years have seen a surge of assets into bond funds and out of stock funds.Usually investors chase performance, but the psychology of the downturn in 2008/2009 was so severe, that ever since then, investors have preferred the stability of bonds despite their poor relative returns .

Reviewing the past ten years of price action is very introspective and this analysis yields a far different conclusion than the March, 2009 through July, 2013 appraisal. Gold goes from being a bottom tier performer to the strongest returning asset. Gold stocks, as measured by HUI Gold Index (the data goes back farther than the GDX) are in positive territory this time, but they still trail the performance of gold by a wide margin, again foreshadowing a contrarian opportunity in my opinion. Emerging markets continue their climb up the rankings, with EEM moving from the fourth best performer to second position. Bonds also gained ground, with the TLT’s 100.8% return rivaling the SPY’s 109.7% increase. On the opposite end of the spectrum, SPY and IWM lose some of their luster, with both their absolute performance and relative rankings declining. The relative movements over this time period compared to the prior interval will be a harbinger of future relative rankings among these nine asset categories as we go back further in time. Studying the ten-year period yields two conclusions from my perspective. First, it isn’t so clear anymore what assets are in secular bull and bear markets. Second, and building on this, it appears that the strength in the U.S. stock market since March of 2009 through July of 2013 is part of a cyclical bull market within a secular bear market.

An assessment of this 13 year and roughly 4 month timeframe reveals that performance of gold, emerging markets, and gold stocks continue to climb on both an absolute and relative basis. Going further, it is easy to say from this chart that gold, emerging markets, and gold stocks have been in secular bull markets, though they have been in cyclical bear markets since various points in 2011. In similar fashion, the longer timeframe makes it easier to comprehend that the S&P 500 Index has been in a secular bear market that began in March of 2000. Incidentally, I chose the March 23rd, 2000, starting point, as it marked the closing high point in the S&P 500 Index at 1527.35. This closing high wasn’t exceeded until May 30th, 2007. The S&P 500 Index ultimately peaked on October 9th, 2007, at 1565.15. This closing high wasn’t exceeded until April of 2013. We have continued to make new highs since that point in time, but a decisive, sustained multi-year breakout over the 2007 highs will be needed in order to provide sufficient evidence that the secular bear market in U.S. stocks has run its course. One final observation is that the gains in the CRB Index over this timeframe have been rather muted compared to the gains of physical gold and precious metal stocks. Additionally, oil and copper have appreciated strongly over the same period. I believe that these aforementioned commodities are foreshadowing a move higher in the broader commodity complex as I think that substantial growth in the global monetary base, due in part to quantitative easing around the world, will provide an inflationary tailwind. Compared to the commodities themselves, I believe that commodity stocks, such as Alcoa (AA ), Peabody (BTU ), Cliffs Natural Resources (CLF ), Barrick Gold (ABX ), and Chesapeake Energy (CHK ) offer a better way to play the expected resurgence in commodities, as they are extremely depressed relative to historical valuations.