Insurers Flight to Quality Investment Strategy Carries Risks of Its Own

Post on: 8 Июнь, 2015 No Comment

Share This Story

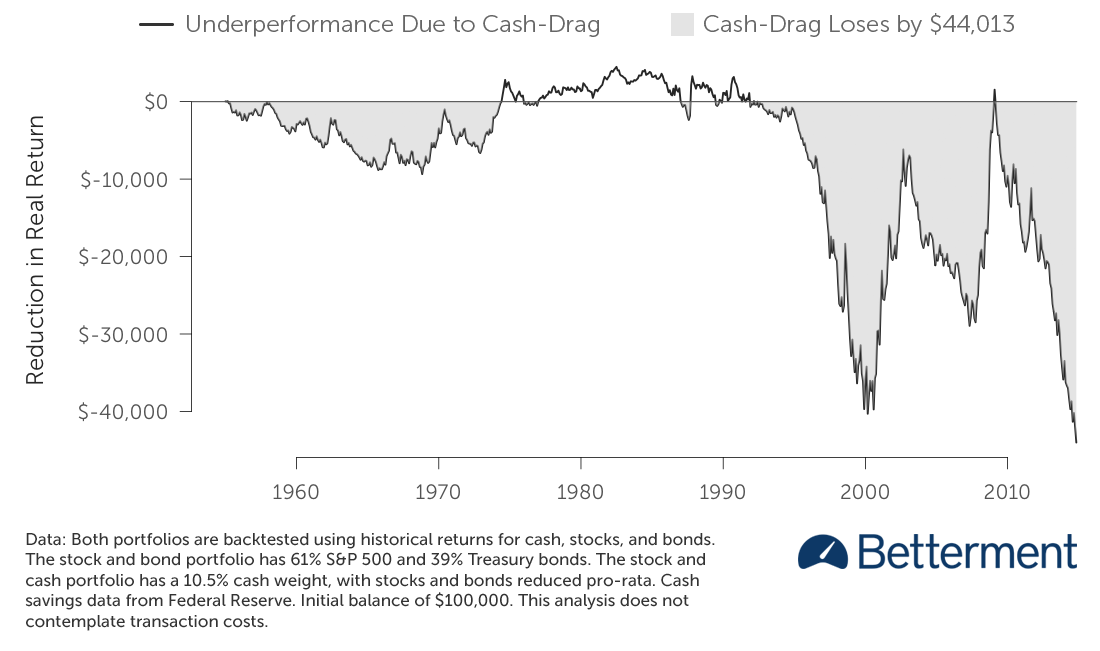

Insurers and reinsurers are turning to high-grade government bonds as a response to economic turmoil in Europe, but as carriers look to reduce their exposure to sovereign default, they may be opening themselves up to interest and inflation rate risk down the road, a recent report says.

Insurance industry portfolio yields have fallen steadily from 2007 to 2012, hitting their highest mark at five percent in Q2 2007, but falling to less than half of that in Q2 2012. Yet, despite these low yields, Guy Carpenter says in a mid-year review that insurers are more conservatively invested now than at any time in recent memory, as heightened risk and uncertainty in some Eurozone countries has led to a flight to quality among insurer and reinsurers.

Eurozone fears are now focused on Spain and italy since they are structurally important to the stability of the single currency, GC says in its report. Carriers have reacted to this threat with a flight to safety in investment portfolios and a movement into high-grade government and corporate bonds. These higher-grade investments include Swiss, U.S. German, Japanese and British government bonds

But the report notes that while the insurers strategy has reduced exposure to sovereign default in the short term, it has also made balance sheets more susceptible to interest and inflation risks. Although (re)insurers investments in higher-grade fixed income securities have calmed nerves for now, it is only logical to expect an increase in interest-rate sensitivity for portfolios with lower yields to maturity, GC says. This creates the potential for negative balance-sheet impacts should interest rates rise suddenly.

GC also notes that insurers flight to lower-yielding securities has also reduced investment returns, placing additional pressure on underwriting results.

Of course, no one can predict the future, and interest and inflation risk may not materialize. Whether this risk will come to pass and whether today’s quantitative easing will lead to unexpected inflation remains less than certain, GC says. It is nevertheless noteworthy that carriers with conservative investment allocations and low equity gearing a relatively unhedged against inflation and interest-rate risk.