InflationFighting ETFs Back In Focus

Post on: 3 Май, 2015 No Comment

Its baaaaaaaack. After a brief hiatus that saw investors rushing to determine the best ways to battle deflation, inflationary concerns have begun to surface again. The cause of the latest bout of inflationary anxiety is of course the QE2 program recently announced by the Federal Reserve that calls for the purchase of hundreds of billions of dollars in bonds in an effort to push down borrowing costs and kick start the economy.

Economists and investors are divided on the plan, as many believe the Feds latest capital injection is a step in the right direction. But others both domestically and abroad have lashed out at QE2 as a further compounding of an already serious problem. They have already pumped endless amounts of money into the economy with extremely high budget deficits, and with a monetary policy which has already pumped in lots of money,” said German Finance minister Wolfgang Schauble. “The results have been hopeless.” Meanwhile, back at home, former Vice Presidential candidate Sarah Palin has been leading the charge against QE2, using international opposition as ammunition. “When Germany, a country that knows a thing or two about the dangers of inflation, warns us to think again, maybe it’s time for Chairman Ben Bernanke to cease and desist,” said Palin recently. “We don’t want temporary, artificial economic growth bought at the expense of permanently higher inflation which will erode the value of our incomes and our savings.” [see Three ETFs If Sarah Palin Is Right ]

Investors are once again scrambling to gauge the potential impact of QE2 to stoke the inflationary flames, and seeking out options to protect their portfolios. Below, we take a look at the most popular ETF options for combating inflationas well as some of the potential pitfalls for each strategy [for more ETF ideas, sign up for our free ETF newsletter ]:

TIPS

How They Fight Inflation: Most investors looking to protect portfolios from the ravages of inflation turn to Treasury Inflation-Protected Securities, or TIPS. Unlike most debt securities issued by the U.S. Treasury, the principal of these bonds increases with inflation and decreases with deflation, as measured by the Consumer Price Index. When TIPS reach maturity, investors are paid the greater of the adjusted principal or the original principal. And while the interest rate on TIPS is fixed, the change in principal translates into flexible coupons that will rise when inflation picks up.

ETF Options: There are currently seven ETFs in the Inflation Protected Bonds ETFdb Category. the largest of which is the iShares Barclays TIPS Bond Fund. Besides TIP, which has more than $20 billion in assets, this category includes international options (WIP ), a short-term TIPS fund (STPZ ), and a low-cost Schwab ETF (SCHP charges 0.14%).

Drawback: Despite the tremendous popularity of TIPS, there are some rather significant flaws to this asset class as an inflation hedge. First, it is important to consider that at the end of the day TIPS are in fact fixed income securities, and as such are impacted by factors that can influence all fixed income securities. Historically, central banks around the globe have reacted to jumps in inflation with interest rate hikesa development that generally has an adverse impact on bond prices.

Investors must also be careful when investing in TIPS through ETFs. While the actual principal amount adjusts with inflation, the price of TIPS depends on the level of demand in the market, and as such can be impacted by investor expectations. So investors who buy a new issue and hold it until maturity can lock in a real return above the rate of inflation, but those buying in when the market has already built in expectations for an uptick in inflation may not be protected [see TIPS: Silver Bullet Or Steel Trap? ].

Physical Precious Metals

How They Fight Inflation: Precious metals are another popular choice as an inflation hedge, based on a simple premise that as the value of money decreases the value of gold increases. Goldand to a lesser extent silver and other precious metalsare seen as substitutes to fiat currencies, especially the dollar. Upticks in inflation generally weaken the greenback, driving up demand for hard currency in the process.

ETF Options: Everyone knows about the SPDR Gold Trust (GLD ), which has more than $55 billion in assets, but there are a number of physically-backed products in the Precious Metals ETFdb Category. IAU offers cheap exposure to gold (expense ratio of only 0.25%, compared to 0.40% for GLD), while SLV holds silver bars. Another interesting option is GLTR from ETF Securities; the recently-launched fund holds gold, silver, platinum, and palladium [also read The Definitive Gold ETF Guide ].

Drawback: There is ongoing debate over the merits of precious metals as an inflation hedge, with some claiming that other asset classes have performed this task much better over the long term. Moreover, unlike stocks and bonds, precious metals derive do not derive any of their value from cash flows generated. Bars of gold and silver have never paid a dividend, and will never generate coupons payments for the investors who hold them. The lack of fundamental price drivers makes valuation of these assets is a tricky task, and exposes them to significant fluctuations based on market sentiment and investor psychology. It gets dug out of the ground in Africa or someplace, said legendary investor Warren Buffett on gold once. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it.

Broad-Based Commodities

How They Fight Inflation: Inflation is a rise in prices of goods and services, so it follows logically that owning goods experiencing an increase in price would effectively protect investors against inflation. As such, many have embraced exposure to commodities as a means of protecting against a surge in the CPI, reasoning that any inflationary pressures would boost the value of natural resources. Going beyond precious metals, agricultural commodities are often among the first to rise in inflationary environments, while energy assets also tend to appreciate significantly.

ETF Options: There are a number of ETFs offering exposure to a diversified basket of commodities [see a complete list ], the largest of which is the PowerShares DB Commodity Index Fund (DBC ). That ETF spreads exposure across more than a dozen individual commodities, including crude oil, gold, corn, sugar, and zinc. There are also a number of commodity-specific ETPs, offering pure play exposure on everything from cotton to copper [read What Every Investor Should Know About Commodity ETF Investing ].

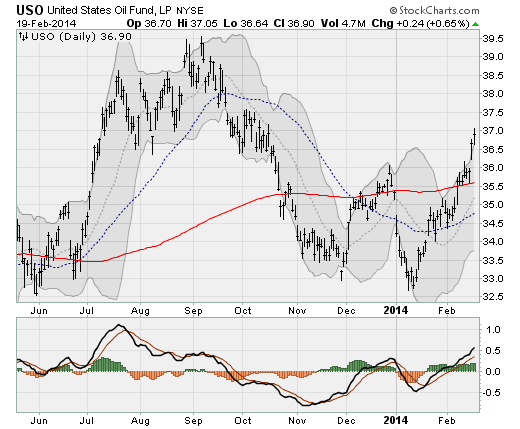

Drawback: While the high value-to-weight ratios of gold and silver (as well as platinum and palladium) allow for the creation of a physically-backed investment product, the physical properties of most natural resources make such a structure impractical. As such, all of the broad-based commodity ETPsincluding both ETFs and ETNsoffer exposure through futures-based strategies. Returns to these products depend not only on the change in spot prices, but also on the slope of the futures curve. When markets are contangoedas many commodity futures are currentlythese products can run into some stiff headwinds, meaning that a rise in spot prices isnt enough to guarantee a positive return to investors.

One interesting option for investors looking to minimize the adverse impacts of contango is the United States Commodity Index Fund (USCI ). This ETF seeks to replicate the SummerHaven Dynamic Commodity Index Total Return, a benchmark that is comprised of 14 futures contracts selected from a pool of 27 potential commodities. In order to select index constituents, quantitative methodologies are utilized to select those commodities exhibiting the steepest backwardation or most mild contango, as well as momentum factors [see Case For The Third Generation Commodity ETF ].

Commodity-Intensive Equities

How They Fight Inflation: As discussed above, some investors have a hard time establishing direct exposure to an asset that is incapable of generating cash flows. Moreover, many are concerned about the potential impact of contango on commodity investments, noting the considerable gap between a hypothetical return on oil and gas prices and the performance of ETFs linked to those commodities [read Playing Precious Metals Through Equity ETFs ].

Some investors have embraced stocks of commodity intensive companies as a means of establishing indirect exposure to commodity prices, while avoiding the potential pitfalls of a direct investment. Because the profitability of these companies is linked to the prevailing market prices for the resources they extract or produce, they often trade as a leveraged play on spot prices. Just as rising crude prices are good for the oil industrys bottom line, soaring gold prices translates into increased profitability for gold miners and higher timber prices boost the outlook for timber companies.

ETF Options: The Commodity Producers Equities ETFdb Category includes both broad-based funds, such as HAP. and resource-specific ETF options:

Drawback: It is important to keep in mind that the underlying holdings of most funds in the Commodity Producers Equities ETFdb Categories are stocks. While there will generally be a strong correlation between share price and prices of the related commodities, these stocks arent immune to weakness in equity marketsa development that often accompanies jumps in inflation.

The IndexIQ Global Resources ETF (GRES ) is one fund that sidesteps this issue. GRES invests in developed market stocks of commodity intensive companies, but also includes short exposure to global equities as a partial equity market hedge. That short exposure to broader equity markets serves to isolate the component of returns to commodity-intensive stocks that is attributable to movements in resource prices [see Ideas On Inflation-Proofing ].

Other Inflation-Fighting ETF Ideas

Besides the general asset classes highlighted above, there are a number of other interesting ETF options for investors looking to establish some protection against inflation:

- IQ Real Return ETF (CPI ): This ETF of ETFs seeks to provide a hedge against inflation by providing a real return over the Consumer Price Index. To accomplish this objective, CPI focuses on a core holding of short-term bonds, surrounding this exposure with different asset classes depending on certain macroeconomic factors. These satellite holdings can include commodities, real estate, currencies, and equities in an attempt to generate the a real return over inflation.

- WisdomTree Dreyfus Commodity Currency Fund (CCX ): This ETF offers exposure to currencies linked to economies in which commodities account for a significant portion of exports. In constructing the currency basketwhich at launch consisted of the Australian Dollar, Brazilian Real, Canadian Dollar, Chilean Peso, Norwegian Krone, New Zealand Dollar, Russian Ruble and South African Randeach major export group (energy, industrial metals, precious metals, livestock, and agriculture) is represented [see Under The Hood Of CCX ].

[For more in-depth ETF analysis consider trying out a free seven day trial to ETFdb Pro .]

Disclosure: No positions at time of writing.