Inflation or Deflation What Quantity Theory of Money Can Tell Us

Post on: 16 Март, 2015 No Comment

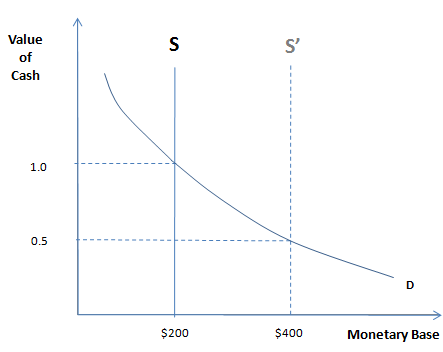

In order to combat the global credit freeze, the Federal Reserve has injected massive supplies of money into the system. The monetary base soared from USD $873.824billion in September 2008 to USD $2,011.15billion in November 2009. Many are worried that this unprecedented expansion of the money supply will cause hyperinflation.

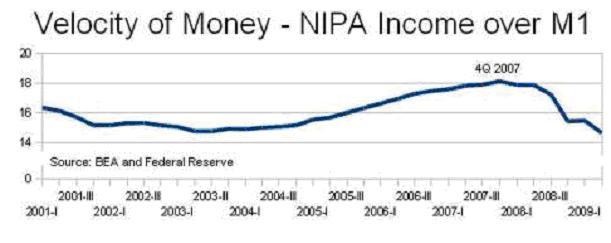

Conventional wisdom tells us that money supply is positively correlated with the price level, one of the stylized facts derived from quantity theory of money. Yet, for this positive correlation to hold, the two conditions must meet: Both velocity of money and the real output have to be relatively stable. As defined by Investopedia, velocity of money is a term used to describe the rate at which money is exchanged from one transaction to another.

The Quantity theory of money stipulates:

MV=PY

Where M is money supply, V is velocity of money, Price is the price level, and Y is the real GDP.

Or in the other form,

Inflation Rate=Money Growth Rate + Rate of Velocity change Real GDP Growth rate

That is, inflation is positive related to the growth of money supply only in the long run, where the effect of velocity change and real GDP growth can be reasonably ignored.

People, who argue for a higher inflation scenario, often ignore the fact that the velocity of money collapsed in the fall of 2008, approximately at the same time when the Fed started to pump the money into the system. Through aggressive monetary expansion, the Fed has successfully pulled the economy out of the pit of deep deflation. The collapse of velocity of money cancels out the surge of money growth from the Feds injections. Core inflation rose marginally 0.2% in October 2009. During its two-day meeting in November, Fed signaled that it would keep its Fed funds rate at all time low and stated:

With substantial resource slack likely to continue to dampen cost pressures and with longer-term inflation expectations stable, the Committee expects that inflation will remain subdued for some time.

On November 14, 2009, during the conference of TCFAs the Aftermath of the Global Financial Crisis , Mr. Joseph Lupton of JP Morgan resonated the same view on inflation as the Fed. He believes that the deflationary pressure has subsided, but will not completely go away. The downward pressure on prices and wages will continue plaguing the economy through 2011. The widening negative output gap, the difference between actual GDP and potential GDP, will continue underpinning the resource utilization in term of unemployment and capacity utilization. Even with a sizable economic rebound, the likelihood of a demand-pull inflation is minimal. In spite of sustained economic slack, he sees above trend growth over next six quarter.

After his presentation, Mr. Wendong Liu of the China Asset Management Co Ltd. went into further details on his view of the Chinese market. As a CIO of the biggest fund management company in China, he sees a heightened inflation expectation in China and notes that most of the fund managers in China resorted to commodity trading as a hedge against future inflation since no TIP-equivalent asset vehicles exist in China. Hence, various commodities, especially industrial metals and energy, are stockpiled by the Chinese counterparts, which in turn push up the global commodity price level.

In the US, this might lead to some degree of cost-push inflation. Recent strength in commodity prices reflects continuing chronic weakness in the dollar and the effect of inflation expectation spillover from the Emerging markets. For the countries, such as China, with a surging money supply, and less degree of decline of velocity of money, a higher inflation expectation is plausible. The surge in the US. National debt can be detrimental to value of the dollar. In the article, Wave of Debt Payments Facing U.S. Government in The New York Times. about $1.9 trillion of debt payments will be coming due within a year.

Nerveless, the current environment of low interest rates, low inflation and the early stage of an economic recovery provide a sweet spot for the equity market. In his NBER paper, Inflation, Resource Utilization, and Debt and Equity Returns, Prof. Hendershott found that during the last 10 business cycles since 1926 equities experienced 14-24% higher annualized return vs bonds during troughs compared to an average 20% return to bonds during the peaks.

Conclusion

In spite of the unprecedented liquidity injection in the United States, inflation appears to be elusive. Many claim that inflation is a monetary phenomenon and criticize the Fed for focusing on non-monetary indicators, such as resource utilization, to gauge inflation, which might jeopardize its dual mandates. Yet, quantity theory of money stipulates we should not only focus on the money supply only, but also on non-monetary measures, such the factors affecting the real output.

The inflation outlook in 2010 is likely to be relatively tame in the US. The lack of a money multiplier effect enables the Fed to continue pursuing an accommodative monetary policy without raising the threat of inflation. As the economy starts to recover, the concern about a liquidity trap gives away the growing concern on the Feds exit strategy. The Feds policy to reflate the economy during the current financial crisis might pose the potential long-term inflation risk if the Fed leaves the high level of liquidity in the system for too long.

******

Id thank Mr. Bo Liu and Ms. Annie Zhou for the opportunity to attend the 15 th Annual conference by the Chinese Finance Association (TCFA).