Inflation Linked Bonds Better Hedge Against Inflation

Post on: 25 Июль, 2015 No Comment

Bank will charge Handling charge of 1%.

Inflation Linked Bonds What is the Need

Since last two years inflation for you stay at about 10%. It means that your cost is increasing 10% every year. while if you put you money in fixed deposit you will earn only below 10% return. That means that your money is not growing fast enough to beat inflation. Actually value of your money is decreasing. So Would you not like to have such fixed deposit which always gives more return than inflation. Will you not be happy that return of your fixed deposit should be more than 10% (or whatever the inflation rate is). Inflation Linked Bonds are to fulfill this need. By investing in these bonds you can be sure that the value of your money will never decrease. It will be always grow 1.5% more than the inflation. because RBI has set the rate of return inflation +1.5%.

Why should You Invest in Inflation Linked Bonds

- Because inflation will not eat up your saving. You have not to worry for rising inflation.

- It will give long-term protection against inflation.

- Government of India issue these bonds. This means that it is more secure than fixed deposit.

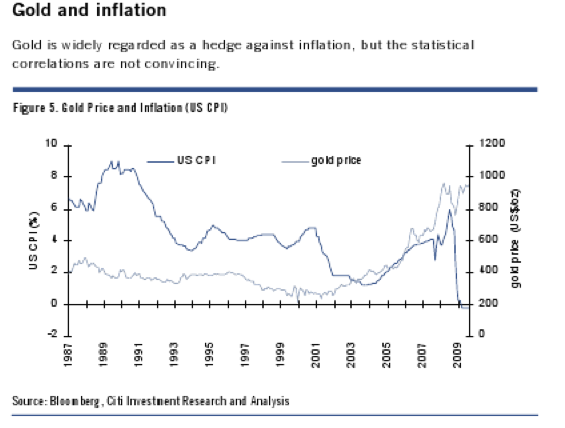

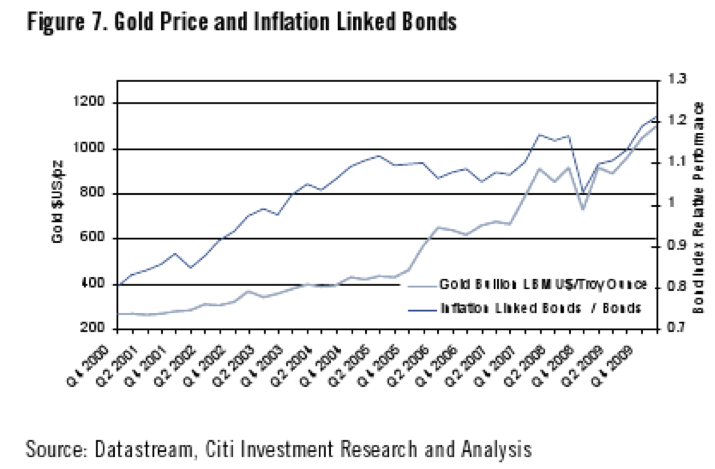

How Inflation Linked Bonds are Better than Gold

Many of us purchased gold because its value increases with time. Sometimes it gives more return than any other investment. During 2005-2012 price of the gold trebled. This type of performance attracts many. But historically gold did not performed in such way. Actually since 1925 gold gave the return of mere 9%. This is not bad but not very good either. During 1982 -2005 gold gave only 3% annual return. since last year it is giving negative return. What I want to prove that return of gold is not consistent. It may happen that after meteoric rise after 2005 gold cycle has reversed and you have to wait for another 5-10 year for the rise of gold. If you are comfortable with this up and down and glitter of gold attracts you then you can still invest in gold. But if you want constant and return over and above the inflation and no risk, then you should put your money in Inflation Linked Bonds. Also you will not lose your sleep about the theft of gold. Neither you have to spend for maintaining locker.

How Inflation Linked Bonds are Better than Property

With rapid urbanization and population increase value of the property is also increasing. In India it is also true that value of property normally increases in longer period. Unless there is slump or big bubble property pares with inflation. But there are some inherent risks and disadvantage with property in comparison of Inflation Linked Bonds.

- You need a big amount to invest in property.

- You can become victims of frauds and cheating. Builders, developers and land sharks can anytime cheat you. Remember film Khosla ka Ghosla.

- You have to spend extra for stamp duty, brokerage, legal fees and maintenance in case of property. Therefore your final return may come down.

- Selling property is not such an easy task. You have to wait for months in search of suitable buyer.

- Neither you will get the prevailing rate of the locality. Because those rates are for new property while your property is now second-hand.

Will I be Able to Save Tax

Inflation Linked Bonds underscore in this front. It does not have in tax saving element. Rather You have to give tax every year on accrued interest. While this interest is payable after the tenure of the bonds. For this reason only tax-free bonds become more attractive for those people who are in higher tax slab.

Suppose you earn 12.75% interest (cpi- 11.24%+1.50%) for this year. Lets see what will be after tax return.

30% slab 8.54%

20% slab 9.94%

10% slab 11.34%

Not taxable 12.75%

Therefore for those people who comes in 30% tax bracket, tax saving bonds will be more beneficial. While Those in 20% bracket can also opt for tax saving bonds because it gives fixed return for whole tenure. Also inflation above 10% is not the norm. It will come down and then return of Inflation Linked Bonds will also be lesser. People in 10% bracket should prefer Inflation Linked Bonds because tax-free bonds will be more rewarding only when inflation comes down below 7%. Which is distant probability for growing India.

When Will You Get Interest

- Unlike other bonds all the accrued interest on Inflation Linked Bonds will paid after the maturity.

- Interest will be compounded half-yearly.

Tenure of the Inflation Linked Bonds

Inflation Linked Bonds are for 10 years. there is no other tenure offered. This is also negative of these bonds. It should have the option of 5, 15, 20 years tenure as well. hopefully RBI will think about this after the success of the first issue.

Amount Limit of Inflation Linked Bonds

Amount limitation also discourages high income people. One can invest up to 5 lakhs rupees annually. Minimum investment should be 5 thousands. By this limitation RBI want to make it clear that these bonds are for low and middle income groups. High income group will not be able to use it as hedge against inflation.

Emergency Redemption of Inflation Linked Bonds

These bonds are for ten years but one can redeem it earlier also. But there is the condition of minimum duration.

- Senior Citizen (above 65 years) 1 years

- Others 3 years

Also There is penalty for early redemption. It will be half of the last interest paid. Suppose your investment of 1,00,000 becomes 1,43,334 at the rate of 12.75% in three years. After three and half-year you redeems the bonds then 4431 (50% of the last 6 months interest) will be deducted. Finally you will get total 1,47,766 rupees.

Difference Between Inflation Linked Bonds and Inflation Indexed Bonds

There are two main points where they differ

Inflation Index

- Inflation Linked Bonds take account of Consumer Price Index(CPI). This rate of inflation is based on the price of items which we consumers pay.

- Inflation Index ed bonds take account of Wholesale Price Index(WPI). As its name denotes it is the price rise in wholesale market.

Also let me clarify that CPI for the Inflation Linked Bonds will not be the same as it is today. There is new formula coming to monitor the consumer price inflation. It may be less than current CPI. But certainly it will be more than WPI .

Calculation of Interest

- Calculation of interest Inflation Linked Bonds is simple. The interest rate of the year will be the average CPI inflation plus 1.5%. It will be compounded every 6 months.

- Calculation of Inflation Indexed bonds is somewhat complex. In this case first principal amount is adjusted according to inflation and then interest is calculated. This type of calculation gives better return.

From Where You can Subscribe Inflation Linked Bonds

- SBI and associates

- All nationalized banks

- ICICI bank, HDFC Bank and Axis Bank.

- Stock Holding Corporation

For subscription fill this form and go to the above banks and SHC. You do not need to have bank account for the bond subscription in particular banks. Banks will do the KYC and fill you information in RBI platform. Finally it will issue a certificate.

For further clarification you can go to this FAQ link of RBI .

Last Updated: 31st December, 2013