Important Information Regarding Leveraged and Inverse ETFs

Post on: 7 Июнь, 2015 No Comment

Important Information to Consider When Deciding To Invest in Leveraged and Inverse Exchange Traded Funds

Traditional Exchange Traded Funds — Background and Introduction

- Exchange Traded Funds (“ETFs”) are typically registered unit investment trusts (UITs) or open-end investment companies whose shares represent an interest in a portfolio of securities (stocks, bonds, etc.). ETFs are usually designed to track an underlying benchmark or index (for example the S&P 500). However, some ETFs invest in commodities, currencies, or commodity- or currency-based instruments, while others may focus on specific industry sectors (e.g. health care, consumer goods, energy, etc.).

What are Leveraged and Inverse ETFs?

- A specific type of exchange traded fund, leveraged ETFs seek to deliver multiples of the performance of the index or benchmark they track. Some leveraged ETFs are “inverse” or “short” funds, meaning that they seek to deliver the opposite

of the performance of the index or benchmark they track. Some investors seek to use inverse ETFs as a way to profit from, or to hedge their exposure to, downward moving markets.

IMPORTANT: Most leveraged and inverse ETFs “reset” daily, meaning they are designed to achieve their stated objectives on a daily basis. Due to the effect of compounding, their performance over longer periods of time can differ significantly from the performance (or inverse of the performance) of their underlying index or benchmark during the same period of time. The performance of these ETFs may therefore be different from what you might expect.

Example of How Leveraged and Inverse ETFs Might Perform

Leveraged ETF Example- Hypothetical Scenario

Consider a hypothetical leveraged ETF that seeks to provide twice the return of an index. An investor buys a share of the ETF for $100 while the underlying index is at 10,000. If the index goes up 10% to 11,000, the ETF will go up 20%, and the investor’s share will increase to $120. If the index goes from 11,000 back down to 10,000 the next day, that will equal a decline of 9.09%, which means that the ETF will go down twice

This occurs because the ETF rebalances its assets every day so that it will deliver the right multiple of the index’s returns on that day. This means that if the index goes up in value, the ETF will have to increase its exposure to the index for the next day in order to get the right multiple, and if the index goes down in value, the ETF will have to decrease its exposure.

If the index keeps moving in the same direction every single day, this will result in better than expected returns for the longer period. But any reversals in the index direction will leave a leveraged ETF worse off than would be expected based on its multiple. Because of this phenomenon, investors who plan to hold their investment for longer than a day should be cautious when considering the purchase of this type of ETF.

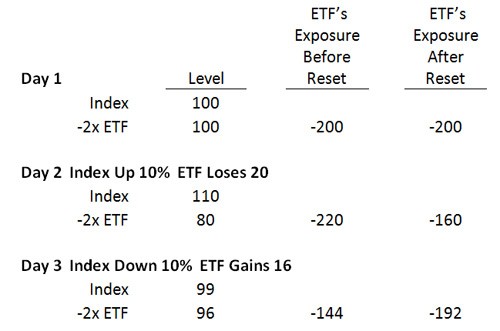

Inverse ETF Example – Hypothetical Scenario

As stated above, an inverse ETF seeks a return that is inverse to the performance of its underlying component. For example, an investor purchases a share of an inverse ETF for $100 while the underlying index is at 10,000. If the ETF’s respective index falls from 10,000 to 9,000 in one day, a decline of 10%, then the price of the ETF will rise to $110, an increase of 10%. If the index then climbs from 9,000 back to 10,000 on the next day, this is an increase of 11.11%. The ETF will fall by 11.11%, from $110 down to $97.78. Over the cumulative two day period, the ETF would be down 2.22%.

The ETF in this example performs worse than expected because of the daily rebalancing. As with long leveraged ETFs, these inverse ETFs will provide better-than expected returns if the index moves only in one direction, but reversals in direction will work to the detriment of the fund.

This effect can be magnified in volatile markets. Using another two-day example, if the index goes from 100 to close at 101 on the first day and back down to close at 100 on the next day, the two-day return of an inverse ETF will be different than if the index had moved up to close at 110 the first day but then back down to close at 100 on the next day. In the first case with low volatility, the inverse ETF loses 0.02 percent; but in the more volatile scenario the inverse ETF loses 1.82 percent.

The effects of mathematical compounding can grow significantly over time, leading to scenarios such as those noted above. ETFs that are both inverse and leveraged are complicated instruments that should only be used by sophisticated investors who fully understand their risks.