Implications Of An Elevated Equity Risk Premium For Asset Allocation

Post on: 4 Август, 2015 No Comment

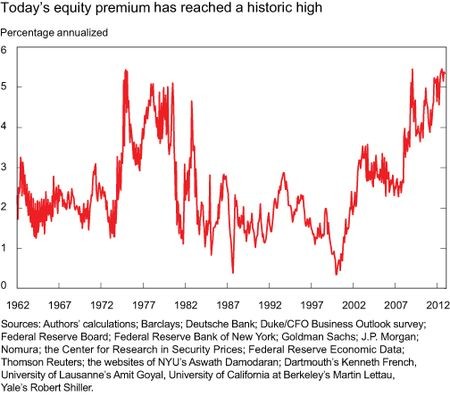

Assessing the equity risk premium (ERP) is an important factor for investment professionals and corporate finance officers. I will forgo discussing the importance to a CFO in assessing the ERP and focus on investment professionals. Given the importance of the ERP one will find a surprising amount of disagreement around how to determine the appropriate ERP level. One can perform a Google search on equity risk premium and find an inordinate amount of research on the topic.

From The Blog of HORAN Capital Advisors

As I noted, the ERP calculation used in the above chart is based on the market’s earnings yield. Essentially, this is an ex post calculation and what is most important for an investor is the prospective expected market returns or ERP. For readers that are interested in a more detailed discussion of the ERP, Aswath Damodaran. a professor at Stern School of Business at New York University, published a paper (which is frequently updated) on the various methods utilized in calculating the ERP.

Based on the current ERP level, the high excess return expected for the market, an investor should consider allocating a larger percentage of their assets to equities versus the risk free treasury bond asset. However, I have discussed several times the fact that investors continue to seek out bond investments versus equity investments based on fund flow data. The recent fund flow release from ICI continues to note the flow of funds out of equities and into bonds. Given the relatively high ERP, why are investors not allocating more investment dollars to stocks versus bonds?

Although investors may not allocate larger dollars to equities, this doesn’t mean stocks won’t generate returns in excess of bonds. From a behavioral perspective investors tend to fear losses more than missing out on gains. With the number of negative market shocks investors have experienced since the year 2000, tech bubble, financial market crisis and the real estate bubble, this fear of loss is not surprising. Additionally, the markets hate uncertainty and events in Washington, D.C. have done anything but create more certainty.

The below chart of the U.S. Economic Uncertainty Index is at its highest level other than the level reported at the height of the debt ceiling debate in August last year. The on again off again fiscal cliff discussions in Washington also include approval to raise the U.S.’s debt ceiling. The debt ceiling debate in 2011 was not a positive for the equity markets.