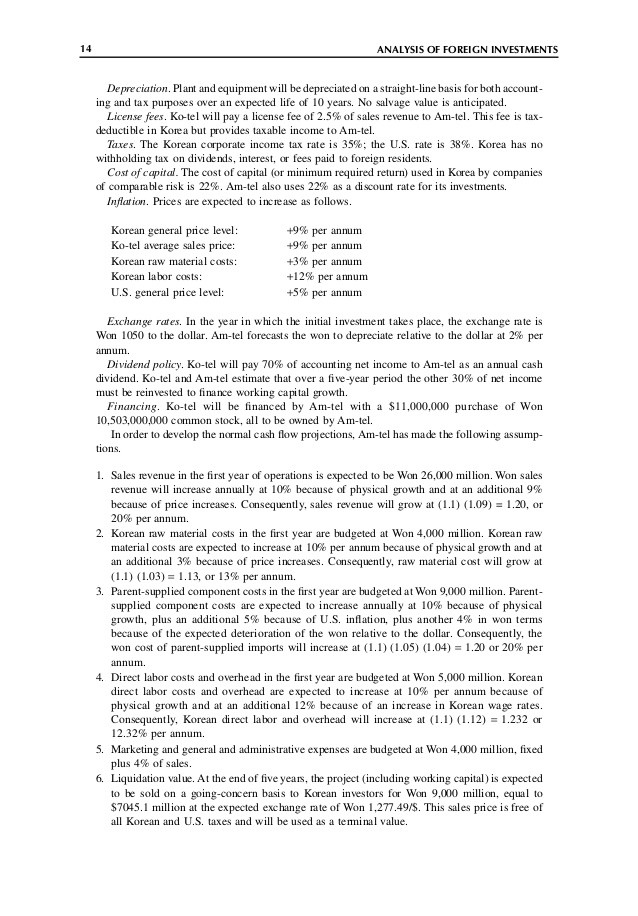

IMF to add A$ C$ to reservecurrency list

Post on: 3 Июнь, 2015 No Comment

EndaCurran

SYDNEY—The International Monetary Fund will begin reporting central bank holdings of Australian and Canadian dollars this year, underlining their growing importance to the world economy.

The IMF currently reports the global reserve holdings of the U.S. dollar, euro, sterling, yen and Swiss franc on a quarterly basis. It holds the figures in a database known as the Composition of Foreign Exchange Reserves, or COFER.

An IMF spokeswoman confirmed to The Wall Street Journal on Wednesday that the Canadian dollar and so-called Aussie would join the club and appear on its reserve-currency list within as little as three months.

The IMF is expanding the list of currencies separately identified in the COFER reporting template, the spokesperson said. The implementation of the revised COFER Report Form, with separate identification of the Australian dollar and Canadian dollar, is scheduled for the first half of 2013.

The IMF’s reporting system has some critical gaps. The world’s biggest holder of foreign-exchange reserves, China, doesn’t disclose its holdings. Some analysts also say the IMF’s data doesn’t capture all global reserves, especially those held by central banks in emerging markets.

Australia and Canada both have resources-focused economies that have benefited from booming demand for raw materials from Asia and elsewhere over the past decade. Global investor appetite for their currencies has risen since the countries emerged from the global financial crisis in much better shape than either the U.S. or Europe.

The IMF decision comes after sovereign wealth funds and central banks—including those in Switzerland and Russia—began diversifying their reserve-currency holdings into high-yielding Australian securities as an alternative to the low rates being offered in other developed countries.

Both Australia and Canada emerged from the 2008 financial crisis with their government’s triple-A credit ratings intact. They remain among just 14 nations that carry the stamp. Australia is also one of the few countries in the developed world that escaped recession during the crisis, and government figures Wednesday showed the country has enjoyed 21 calendar years of uninterrupted growth.

Although demand for Aussie dollars cooled from record levels in late 2012, more than 70% of Australian government bonds are still held offshore—double the level in foreign hands a decade earlier.

The Washington-based fund first indicated late last year that it was considering including the Australian dollar, the world’s fifth-most-traded currency, in its COFER reporting.

The perception of the Aussie as a volatile asset shunned by reserve managers has changed dramatically since the 2008 crisis and subsequent euro-zone woes. Once seen as a classic proxy for risk, the currency has defied slower global growth and financial market turbulence, powering to record highs against the U.S. dollar.

Yield demand is frequently cited as a reason why the Aussie continues to hover above parity against the greenback, even after the central bank cut interest rates six times since November 2011 to help lift a weakening domestic economy.

Commonwealth Bank of Australia, the nation’s largest lender by market value, estimates the Aussie is also the world’s fifth-largest reserve currency, drawing on IMF data. Based on the same data, Barclays has said foreign central banks are now the biggest buyers of Australian bonds—currently holding 27% of issued stock, up from 10% a decade ago.

The spiralling demand for Australian dollar bonds recently prompted U.S. investment bank Goldman Sachs to set up a global trading hub for Aussie-dollar products in Sydney.

Australia itself has a partial register of investors in its debt securities. The country’s center-right opposition, tipped to win an election scheduled for mid-September, has vowed to introduce a fuller register if elected.

Write to Enda Curran at enda.curran@wsj.com