IMF Survey Emerging Markets Can Manage Evolving Mix of Global Investors

Post on: 16 Май, 2015 No Comment

IMF Survey Magazine: Policy

An investor walks by the screen of a stock exchange in China: volatile bond flows have risen as more opportunities opened up to invest in emerging markets (photo: Bei Feng/Corbis)

Related Links

GLOBAL FINANCIAL STABILITY REPORT

Emerging Markets Can Manage Evolving Mix of Global Investors

IMF Survey

March 31, 2014

- Composition of global investors in emerging market stocks, bonds has been changing over the past 15 years

- This new mix has made capital flows more sensitive to global financial shocks

- Policies to deepen emerging market financial systems can help manage risks

T he mix of investors in emerging markets stocks and bonds has evolved considerably over the past 15 years, which has made capital flows and asset prices in these countries more sensitive to events outside their own borders, according to new research from the International Monetary Fund.

In its latest Global Financial Stability Report. the IMF investigates the effects of changes in the mix of these global investors.

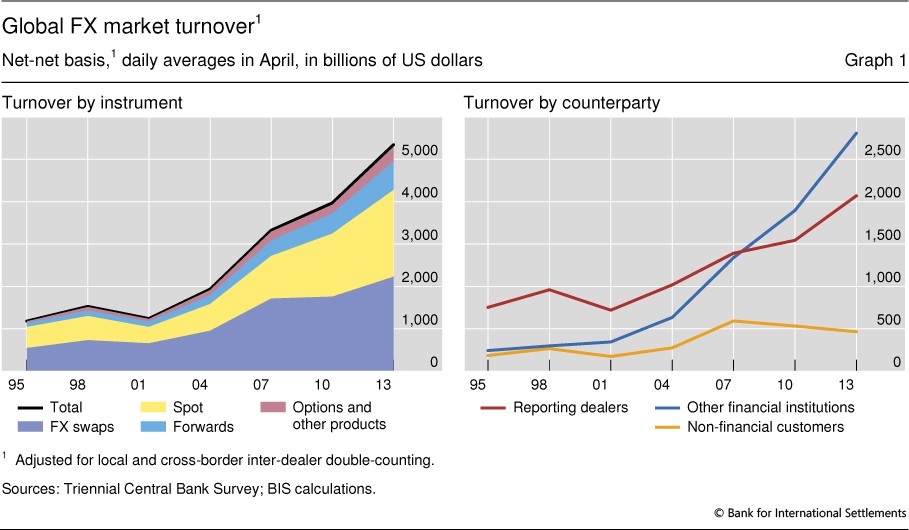

The role of bond fundsespecially local-currency bond fundshas been on the rise since the early 2000s. Savers in advanced economies now increasingly channel their money through global mutual funds that invest both in advanced and emerging market economies. The participation of sovereign wealth funds and central banks in these financial markets is growing as well.

Back in the 1990s, by contrast, investing in emerging market economies mostly meant purchasing equity though funds specialized in these countries.

The IMF said that different investors behaved distinctively. During the sell-off of emerging market stocks and bonds in 2013 and early 2014, institutional investors such as pension funds and insurance companies with long-term strategies broadly maintained their emerging market investments. Retail-oriented mutual funds withdrew. Different types of mutual fundssuch as those focused on bonds and equityalso have shown varying degrees of sensitivity to global financial turbulences.

Knowing who the investors are is critical for understanding the evolving stability of capital flows into emerging markets, especially when the uncertainty over advanced economies monetary policy remains high, said Gaston Gelos, Chief of Global Stability Analysis Division in the IMFs Monetary and Capital Markets Department and the head of the team that produced the analysis.

No emerging market is an island

Changes in the mix of global investors in emerging market stocks and bonds are likely to make overall capital flows more sensitive to global financial conditions, according to the IMF.

The analysis found the share of more volatile bond flows had risen as more opportunities opened up to invest in emerging markets, and that larger direct foreign participation in local financial markets could transmit global volatility to local asset prices.

Investment from mutual funds is more sensitive to the ups and downs of global financial conditions than that of institutional investors. Many of the small investors putting money into mutual funds are less informed savers, who may panic-sell at signs of volatility. Mutual funds also invest in stocks and bonds that performed well in the short run, while selling those that did badly a strategy called momentum trading. This may contribute to induce boom-bust cycles in asset prices, the IMF said.

Receiving more investment from institutional investors is generally good for capital flow stability during normal and moderately volatile times, because they tend to invest for the long term. However, the report cautions that these investors can pull more money out of a country and take longer to return after more extreme shockssuch as during the global financial crisis, or if a countrys government bonds are downgraded below investment grade.

Fundamentals matter

After two decades of investing, have global investors learnt more about emerging markets and become less prone to panics? There is little evidence for that, according to the IMF.

Economic conditions in a country affect investment and local asset prices, the IMF observed. For instance, in the months following the initial sell-offs in May and June 2013, global investors started to treat economies with better fundamentals differently from those with weaker ones.

But overall, there is no evidence that investor choices in times of stress in recent years were driven any more by countries economic fundamentals than they were in crises in the late 1990s and the early 2000s, according to the IMF.

The IMF also said investors tendency to mimic each others choices, known as herding behavior, has not declined either.

Options for policymakers

This does not mean that emerging markets efforts to strengthen their economies are ineffective and that these economies are at the mercy of global investors and policies in advanced economies, according to the IMF.

Together with stronger economic fundamentals, emerging markets have strengthened and deepened their financial systems over the past 15 years. The size of the domestic investor baselocal mutual funds, pension funds, insurance companies, and bankshas grown, sometimes helped by direct participation of foreign investors in local markets.

In addition, more emerging markets can now sell local currencydenominated bonds to foreigners, overcoming the so-called original sin problem. The institutional quality of local markets has also improved substantially.

The reports analysis highlights that local financial systems with more domestic services, products, and liquid markets help reduce the sensitivity of emerging economies stock returns and bond yields to the changes in global financial conditions. And the reductions are quantitatively large as well, the IMF said.

Therefore, policies to promote a more developed financial system, will better equip emerging markets to reap the benefits of financial globalization, while reducing its potential costs, the report adds.

The IMF also notes that initiatives to support the development of local-currency bond markets are generally beneficial. Countries should monitor the size of direct participation of foreign investors in local markets, as a very large foreign presence may transmit new volatility. This also underscores the importance of developing a local investor base.

The IMF will publish more analysis from the Global Financial Stability Report on April 9.