HYDRAULIC FRACTURING

Post on: 16 Март, 2015 No Comment

By: Lee R. Hansen, Legislative Analyst II

You asked for information on hydraulic fracturing, including (1) how it lowers natural gas prices, (2) how it affects the nation ‘ s energy independence, (3) which states have benefitted from the practice, and (4) the environmental concerns.

SUMMARY

Over the past several years, hydraulic fracturing (fracking) and horizontal drilling have greatly increased domestic natural gas and oil production by allowing wells to reach previously inaccessible natural resources. Domestic natural gas production has increased 19% since 2007, leading to a roughly 50% decline in gas prices. This increased gas and oil production has also led some to predict that the nation could achieve energy independence sometime in the next decade, although others argue that such predictions are overly optimistic.

How individual states have benefited from fracking depends largely on the amount of shale gas or oil in the state, the proliferation of the new techniques, and the state ‘ s tax and regulatory system. According to a study funded by the American Petroleum Institute, Texas, which contains the oil producing Barnett shale formation, collected over $10 billion in state and local tax revenue from unconventional (fracking related) oil and gas activity in 2012. Pennsylvania, which contains portions of the gas producing Marcellus shale basin, collected over $1.2 billion in similar state and local tax revenue last year.

Alongside its apparent benefits, fracking has raised several environmental concerns, particularly related to water contamination and usage. The U.S. Environmental Protection Agency (EPA) and several states are currently studying the practice ‘ s implications.

HYDRAULIC FRACTURING

According to the U.S. Energy Information Administration (EIA), hydraulic fracturing is a well completion technique designed to improve oil and gas production. The process involves injecting large volumes of fluids and proppants (small spheroids of solid material) at high pressure into a well to create fractures in the source rock and carry the proppants into the fractures to hold them open when production commences. The hydraulic fracturing fluid is typically water-based and contains various chemicals, including bactericides, buffers, stabilizers, fluid-loss additives, and surfactants. These chemicals promote the effectiveness of the fracturing operation and prevent damage to the formation. When used in conjunction with horizontal drilling, hydraulic fracturing enables oil and gas producers to extract the resources economically. Without these techniques, the oil and gas do not flow to the well rapidly, and commercial quantities cannot be produced from shale.

IMPACT ON NATURAL GAS PRICES

Natural gas prices are mainly a function of market supply and demand. Factors on the supply side include natural gas production, net imports, and underground storage levels. Increases in supply tend to pull prices down, while decreases tend to push prices up. Price increases tend to encourage production as well as imports and sales from storage inventories. Declining prices tend to have the opposite effect.

Factors on the demand side include economic conditions, winter and summer weather, and petroleum prices. (Petroleum fuels may be an economical natural gas substitute for manufacturers, power generators, and large building owners.) Higher demand tends to lead to higher prices, while lower demand can lead to lower prices. Because the global market for natural gas is significantly limited, as compared to the global market for oil, the demand side forces influencing gas prices are much more domestically oriented.

According to the state Department of Energy and Environmental Protection ‘ s Comprehensive Energy Strat egy (CES), domestic natural gas production has increased by 19% since 2007, largely from unconventional sources such as shale gas. Over the same time, prices have dropped from over $7 per million British Thermal Units (BTU) in 2007 to below $3 per million BTU in 2012. Prices are now in the $3 to $4 range and expected to rise slowly in the coming years.

EIA ‘ s Annual Energy Outlook 2013 Early Release projects U.S. natural gas production to increase from 23.0 trillion cubic feet in 2011 to 33.1 trillion cubic feet in 2040, a 44% increase. Almost all of this increase is due to projected growth in shale gas production, which grows from 7.8 trillion cubic feet in 2011 to 16.7 trillion cubic feet in 2040.

ENERGY INDEPENDENCE

According to EIA, in 2010 proved reserves of U.S. oil and natural gas rose by the highest amounts ever recorded by the agency. An important factor for each fuel was the expanding application of horizontal drilling and fracking in shale and other tight (very low permeability) formations. Higher prices, particularly for oil, helped to improve economic viability, and increase proved reserves.

Of the natural gas consumed in the U.S. in 2011, about 95% was produced domestically. Thus, the supply of natural gas is not as dependent on foreign producers as the supply of crude oil, and the delivery system is less subject to interruption. According to EIA, the availability of large quantities of shale gas should enable the U. S. to consume a predominantly domestic gas supply for many years and produce more natural gas than it consumes.

EIA also notes however, that although the prospects for shale gas production are promising, considerable uncertainty remains. Many shale formations, particularly the Marcellus Shale, are so large that only a limited portion of the entire formation has been extensively production-tested. Most shale gas wells have been drilled only in the last few years, leaving considerable uncertainty about their long-term productivity. In addition, future technological developments could substantially increase productivity and reduce production costs even further, or create a more profitable foreign market for domestically produced gas.

The greatly increased production of oil in the U.S. recently led the International Energy Agency (IEA) to predict that the nation would become the world ‘ s largest oil producer around 2020. IEA believes that the increased production, combined with increasing fuel efficiency standards, will make the U.S. a net oil exporter around 2030. Critics of the IEA ‘ s predictions point out that peak U.S. oil production would only last for five to ten years . that estimates of how much oil could be cost-effectively extracted are overly optimistic . and that the price impact of increased domestic production is greatly limited because oil is subject to a global commodity market.

OTHER STATES

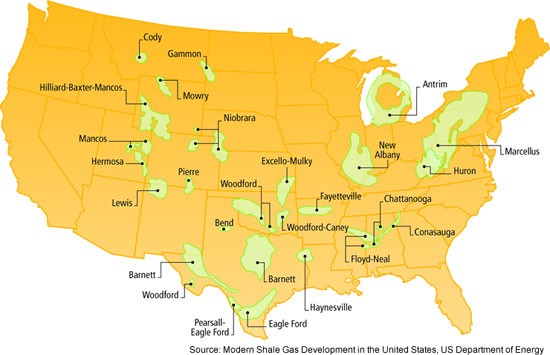

Shale gas is found in plays, which are shale formations (1) containing significant accumulations of natural gas and (2) sharing similar geologic and geographic properties. Illustration 1 shows shale plays in the lower 48 states.

Illustration 1. Shale Plays in the Lower 48 States

According to a study sponsored by the American Petroleum Industry, 16 states are currently producing oil and natural gas from the 20 largest unconventional (i.e. requiring fracking) oil and natural gas producing plays in the lower 48 states. Some states contain plays but are not producing oil or natural gas from them (e.g. New York currently has a moratorium on fracking). Table 1 shows the 2012 state and local tax revenue from unconventional oil and gas activity in these 16 producing states.

Table 1. 2012 State and Local Tax Revenue from Unconventional Oil and Gas Activity