Hussman Funds Weekly Market Comment The Reality of the Situation May 28 2012

Post on: 17 Июль, 2015 No Comment

The Reality of the Situation

John P. Hussman, Ph.D.

All rights reserved and actively enforced.

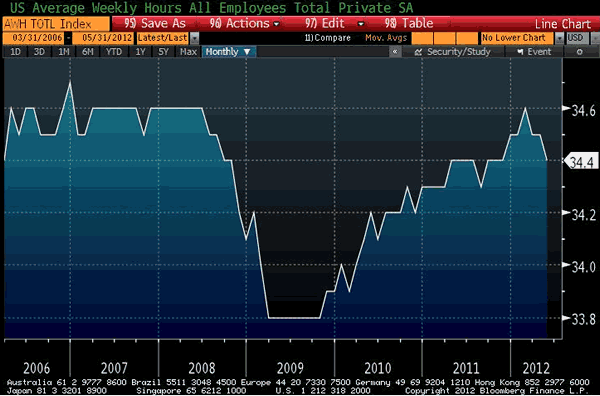

For nearly two years, the massive interventions of central banks have repeatedly pulled a fundamentally weak and debt-burdened global economy from the brink of resumed recession. The Federal Reserve’s balance sheet is now leveraged 52-to-1, with assets having an average duration of over 5 years, suggesting that if those assets were marked-to-market, an interest rate increase of less than 50 basis points would wipe out the Fed’s entire capital base. Of course, the Fed takes no marks on its assets when it reports its balance sheet, though it does occasionally take down the value of the securities in the Maiden Lane shell companies that it illegally set up to bail out Bear Stearns and other entities (in violation of Section 13(3) of the Federal Reserve Act, which Congress had to amend and spell out like a See-Spot-Run book as a result).

At a 10-year Treasury yield of 1.7%, interest on reserves of 0.25%, and a monetary base now at about 18 cents per dollar of nominal GDP (see Run, Don’t Walk ), further purchases of long-term Treasury securities by the Fed would produce net losses for the Fed in any scenario where yields rise more than about 20 basis points a year, or the Fed ever has to unwind any portion of its already massive positions. So further QE by the Fed would effectively amount to fiscal policy. Moreover, the benefits of central bank interventions are becoming progressively smaller and short-lived (nearly log-periodic in fact, to borrow a term from crash dynamics). None of this restricts the Fed from embarking on further interventions. It just emphasizes how far the Fed has already descended into the deep.

To the extent that our measures of market action improve on some possible future intervention, and until the point where the market reestablishes an overvalued, overbought, overbullish profile, we might have some latitude to take some speculative exposure in the event of another round of QE. But without substantially greater improvement in valuations here, there would be no investment basis for that exposure, so our latitude wouldn’t be very broad (we estimate the prospective 10-year total nominal return for the S&P 500 to be back down to about 5% on the basis of our standard methodology).

Remember that these bouts of QE, LTRO operations, and other interventions have essentially had their effect by squeezing interest rates to levels that are so low that investors feel forced to seek higher risk securities in a search for yield. What Bernanke views as a wealth effect is simply the richer valuation of existing cash flows that goes hand in hand with lower prospective returns in the future. This is not wealth creation, but simply a distortion of the time profile of returns that now leaves investors facing dismal future prospects for investment returns. The economic impact of QE has been restricted to short bursts of pent-up demand, but little more.

QE1 had a very strong effect, particularly on stocks, because they were priced at the time to achieve 10-year prospective returns of over 10% annually by our estimates, and also because the Fed focused its purchases on the mortgage-backed securities of Fannie Mae and Freddie Mac, which relieved much of the concern about mortgage debt. At the same time, the FASB tossed out the need for banks to mark the value of their assets to market prices, which bypassed the need for regulators to step in to restructure major financials. In my view, making the financial system more opaque is no way to respond to legitimate credit problems, but that’s what they did, and there’s no denying that the financial markets were relieved, in the same way that one would be relieved by looking away from a gruesome crime scene.

Both QE2 and the Twist followed significant market declines, began from higher interest rates and lower stock market valuations, and attended global economic conditions that were tipping toward recession, but were less hostile than we observe at present. Each of these interventions was clearly welcomed by the financial markets, and any further intervention would predictably be welcomed for some period of time. But the headwinds are stronger, central bank balance sheets are more heavily burdened, stock valuations are richer, and interest rates are already so depressed that incrementally lower rates won’t matter much. If you put a balloon on the table and blow on it, that balloon will move forward. But that really only works provided that there is not a hurricane blowing in the opposite direction. With regard to the global economic situation, my impression continues to be that there is a hurricane coming.

Oncoming economic weakness was already evident in a broad range of leading indicators late last summer, but it was clearly forestalled by the coordinated intervention of central banks, coupled with the final resolution of the Greek debt situation. While we observed a burst of economic activity early this year as a result, that burst was transient. Meanwhile, the evidence from a broad ensemble of leading indicators (including what we inferred from unobserved components models) remained weak, as did year-over-year economic measures that were less sensitive to high-frequency fluctuations and seasonal adjustment.

The uniform deterioration in global GDP growth was already evident even as 2012 began. The chart below presents normalized growth rates (mean zero, unit variance), which shows the co-movement across economies more clearly. It’s notable that across the world, normalized year-over-year GDP growth rates — even at the start of 2012 — were already jointly at levels worse than at the start of the previous two global downturns.

The chart below illustrates how conditions have progressed in the past few months. Note that the latest reading on the Eurozone PMI has dropped to fresh lows, breaking below the levels that accompanied the 2011 market swoon.

The deterioration across Europe is not simply restricted to peripheral countries. The steep decline in France is notable, while the German PMI has now dropped below 50 as well, reflecting the sharpest drop in manufacturing output in three years. Meanwhile, Lloyds TSB noted last week that the majority of regions in the UK reported their weakest output performance in 2012 to date.

Of course, the argument from Wall Street is that despite clear evidence of recession across Europe, and significant slowdown or recession elsewhere in the world, the United States will somehow decouple and avoid recession. Reality hates to interfere, but the chart below presents the correlation between the GDP growth of several major nations (particularly in Europe) and U.S. GDP growth. The correlation with U.S. GDP — particularly in Euro-zone countries — is generally in the range of 70-90%.

For Europe, of course, the problem is not only recession risk but the high level of debt to GDP, and rising funding costs and default risk reflected in European government bonds (outside of Germany, which is seen as the safe haven). The developing global downturn is likely to have a disproportionate effect on debt-to-GDP ratios across Europe. To illustrate this, the scatter below presents the change of debt-to-GDP ratios against year-over-year changes in GDP. Notice in particular that contraction of GDP doesn’t simply raise the debt-to-GDP by virtue of a smaller denominator. Rather, weak GDP predictably results in revenue shortfalls and the need for counter-cyclical spending, all of which causes a disproportionate jump in debt levels relative to GDP. If you think European debt-to-GDP problems are bad, wait a few quarters.

While all of this seems fairly bleak, and promises to create numerous dislocations, I still think we can look forward with a great deal of hope. But as I noted early this year (see The Right Kind of Hope ), our hopes are not for more bailouts, or money printing, or any of the myriad policies that investors seem to hope will save bad investments and sustain elevated valuations. Instead, our hope is that in 2012, the market will finally ‘clear,’ in the sense that bad debt around the world will be recognized as bad and restructured; that overleveraged financials will be taken into receivership instead of forcing austerity on every corner of the global economy in order to make them flush again; that rates of return will rise enough to compensate and encourage saving — and high enough to encourage borrowers and other users of capital to allocate the funds productively. Of course, in order to restructure bad debt, someone has to accept a loss. In order for rates of return to rise, valuations must decline. In short, our hope is for events that will unchain the global economy from an irresponsible past and open the gates toward a prosperous future. Maybe that is too hopeful, but we are not entirely convinced that bailouts and ‘big bazookas’ will be as easily procured in the year ahead as a confused public has allowed in recent years.

On the coming wave of bank restructurings

Spain has now committed 23.5 billion euros of public funds to rescue its third-largest bank, Bankia, amid last week’s revelation of fresh deterioration in real estate loans and other assets (which again makes us wonder what the losses would look like on the $100 billion-plus of European mortgage debt that JP Morgan has amassed, if JPM was actually required to mark these securities to market). Worse, Spain is providing these funds not as part of any restructuring, but by purchasing newly issued stock of the unrestructured, insolvent bank. While this will give Spain nearly 90% ownership of Bankia, the bailout effectively gives the people of Spain nearly worthless stock in an insolvent entity, putting them behind Bankia’s bondholders. In the likely event that Bankia fails, is nationalized, and is then restructured, the 23.5 billion euros of public funds will vanish as worthless stock, and in the process of restructuring, the bondholders of Bankia will recover 23.5 billion euros more than they otherwise would have. In short, by putting off the receivership and restructuring of Bankia, Spain is simply enriching the bank’s bondholders at the expense of its citizens, who are already being squeezed by budget austerity. This is particularly troubling given that it further expands Spain’s national debt at a time that Spanish yields are reflecting rising default premiums and regional governments are reporting significant strains.

On a lighter note, among the collateral put up by Bankia last year in return for ECB loans was the Portugese soccer player Cristiano Ronaldo. whose recruitment by Real Madrid was financed by Bankia. I wonder if Mario Draghi can play goalie.

The following chart presents the Google Trends report for frequency of searches including the phrase bank run (h/t ZeroHedge )

With respect to bank runs, it’s useful to remember that a bank really represents a pool of assets (loans, securities, investments, soccer forwards, scratch-off lottery tickets) funded by a pool of liabilities (deposits from individuals and corporations, senior debt, unsecured debt, convertible debt), and a little cushion of shareholder equity. To say that European banks are leveraged 25- or 30-to-1 means that the cushion of shareholder equity is very thin compared to the assets, so a 3-4% decline in the value of the assets would essentially leave assets worth less than the liabilities, making many banks insolvent. But even at the point of insolvency and bank failure, the shortfall between assets and liabilities can almost always be absorbed by taking receivership of the bank and cutting away the worthless stockholder equity and the unsecured and convertible debt. Senior debt rarely takes a loss in U.S. restructurings, though it’s quite possible in Europe. In the case of systemically important U.S. banks, the FDIC recently proposed that in the event of restructuring, senior bondholders would likely get equity and convertible debt in the newly restructured entity. In any event, insured depositors lose nothing.

That’s what’s so frustrating about the discussion surrounding bank failure — a $15 trillion stock market can lose 20% ($3 trillion) and it’s just a run-of-the-mill bear market. But let bank bondholders face a similar loss, and the banks cry that the whole financial system will go down. We’ll finally get some economic traction when global leaders have the sense to take bloated, mismanaged banks into receivership, mark down the assets to their actual value, restructure the repayment terms with homeowners and other borrowers, haircut the liabilities enough to make the resulting entities solvent, and then return them to the private market under a regulatory structure that splits traditional lending from securities trading. That prospect is getting closer.

Euro Hopium

Two main hopes have kept investors relatively complacent about the growing risks in Europe: the hope for Eurobonds, and the hope for large-scale ECB purchases of distressed sovereign debt (essentially money-printing).

With respect to Eurobonds, investors should understand that what is really being proposed is a system where all European countries share the collective credit risk of European member countries, allowing each country to issue debt on that collective credit standing, but leaving the more fiscally responsible ones — Germany and a handful of other European states — actually obligated to make good on the debt.

This is like 9 broke guys walking up to Warren Buffett and proposing that they all get together so each of them can issue Warrenbonds. About 90% of the group would agree on the wisdom of that idea, and Warren would be criticized as a holdout to the success of the plan. You’d have 9 guys issuing press releases on their general agreement about the concept, and in his weaker moments, Buffett might even offer to study the proposal. But Buffett would never agree unless he could impose spending austerity and nearly complete authority over the budgets of those 9 guys. None of them would be willing to give up that much sovereignty, so the idea would never get off the ground. Without major steps toward fiscal union involving a substantial loss of national sovereignty, the same is true for Eurobonds.

Over the weekend, Jean Claude Trichet, the former ECB head, proposed a system to save the Euro, whereby European politicians could declare a sovereign country bankrupt and take over its fiscal policy. He also proposed a system whereby the Eurozone could produce its own domestic energy by placing a giant hamster on a wheel the size of the Eiffel Tower.

Moving to the European Central Bank, large scale ECB purchases of sovereign debt would simply be the money-printing version of Eurobond issuance. When the ECB purchases the bonds of a given country, and creates Euros for them, it has essentially printed money until the point in time that the bond is paid off. If that day never comes, as is the concern with distressed European debt, then the ECB has essentially printed permanent Euros in order to finance the spending of the country whose bonds it purchased. In order to guard against this sort of backdoor fiscal policy, the ECB only buys bonds after ensuring that it has a senior position to other bondholders. So if the ECB was to purchase distressed European debt on a grand scale, the result would be that the remaining bonds would be subordinated, making the prospective losses on those bonds even higher than they were previously.

Ultimately, what investors really want is for the debt of various countries to be wiped away by the ECB simply printing money to retire that debt, or by having Germany and stronger Euro-area members to make endless transfers to peripheral European countries. The whole system rides on this willingness to transfer fiscal resources, or to allow money printing (with no revenue to stronger members from that money printing) in order to finance heavily indebted members. The reason the recent elections in Greece and France matter is that they send a signal from the public to European governments: the people are unwilling to make any more austerity bargains that put the public behind bank and government bondholders. So Germany is now being asked to continue its transfers without any end in sight.

We can’t rule out the chance that Europe will cobble together enough temporary liquidity for Greece and troubled banks to kick the can down the road another time or two, but these kicks will become increasingly weak and short-lived in the context of a new recession. Even in the event of various liquidity injections, there is virtually no chance of addressing the solvency of Europe — the ability of each government (much less the banking system) to sustainably pay their debts — within the constraints of the Euro. As long as the Euro exists as a single currency, individual countries can’t inflate away the real value of their debt, or restore their trade competitiveness through exchange rate depreciation against other countries.

Under these strains, I expect that the Euro will fracture well beyond a Greek exit. Ultimately, the result might be a strong Euro that reflects the union of Europe’s most fiscally responsible countries, or we might instead see a weak Euro that follows the departure of Germany from the currency union and leaves peripheral members free to inflate. So it’s not clear which direction the value of any surviving Euro may take until it is clear which member countries will remain. In any event, however, what we are unlikely to see is a single Euro that combines fiscally responsible and fiscally irresponsible countries, and requires endless one-way transfers of sovereign public resources in order to hold the system together.

We will undoubtedly have moments of promising news that will relieve economic and Euro-area concerns for brief periods of time. Part of the reason that the markets have been fairly complacent despite deterioration on these fronts is exactly the hope and expectation of investors for these transitory but unpredictable moments of relief. If one steps back from the trees to observe the forest, the reality of the situation is that Europe is already largely in recession, the global economy is slipping quickly toward the same outcome, and in my view, the U.S. is also entering a recession that will ultimately be dated as beginning in May or June of 2012 (i.e. now). The economic headwinds already in place are likely to make any meaningful budget progress virtually impossible in the Eurozone, and without meaningful budget progress, the likelihood of continued bailouts to peripheral European states is slim. So while short-lived bouts of hopeful enthusiasm are likely, the reality of the situation is much more challenging.

Market Climate

As of last week, the Market Climate for stocks remained in the most negative 0.5% of all historical observations, and was characterized by rich valuations, unfavorable market action, and a variety of hostile Aunt Minnies that are associated with poor subsequent returns. Stocks are no longer overbought on intermediate-term metrics, but market internals have broken down decidedly. The latitude for a constructive position at present valuations would lie between the point where our measures of market action improve and the point where an overvalued, overbought, overbullish syndrome reasserts itself. There would not be a great deal of latitude between those points at present valuations, but a significant decline would create a broader range of potential opportunity. We’ll see.

Again, our real hope is that the global economy will finally get on with the process of restructuring bad debt, allowing losses to be taken where losses should be taken, and allowing economic growth to move forward without the anchor of misguided bailouts, reckless central bank bubbles, or government guarantees for the worst abusers of capital. Ideally the sooner this happens, the better, but we know where our periodic investment latitude will be in the event this resolution drags on for a while.

For now, Strategic Growth and Strategic International remain fully hedged. Strategic Dividend Value is nearly 50% hedged, and Strategic Total Return continues to carry a duration of about 2.8 years, just under 14% of assets in precious metals shares, and a few percent of assets in utility shares and foreign currencies.

Prospectuses for the Hussman Strategic Growth Fund, the Hussman Strategic Total Return Fund, the Hussman Strategic International Fund, and the Hussman Strategic Dividend Value Fund, as well as Fund reports and other information, are available by clicking The Funds menu button from any page of this website.