Hussman Funds Weekly Market Comment September 1 2003 Unusual Valuation

Post on: 12 Май, 2015 No Comment

September 1, 2003

John P. Hussman, Ph.D.

All rights reserved and actively enforced.

Unusual Valuation

The Market Climate for stocks is characterized by unusual overvaluation and moderately favorable market action. In the Strategic Growth Fund we continue to target exposure to market fluctuations in the range of 40-70% of portfolio value. So we continue to be positioned to gain primarily from market advances.

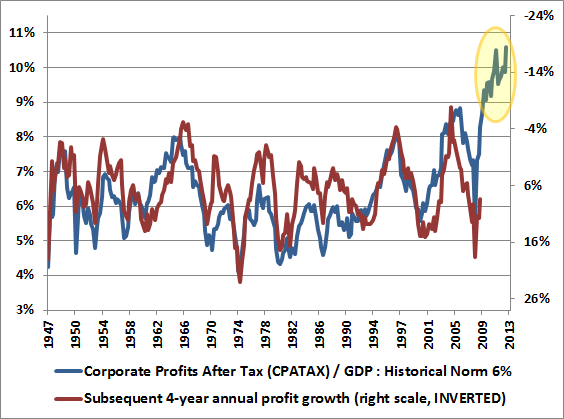

This week, I’ve described the market’s overvaluation as unusual. By any reliable measure, the valuation of the market now exceeds all other historical valuations except for 1929, 1965, 1972, 1987, and of course 2000. For a great while, the stock market has traded at price/book, price/dividend, price/revenue and other ratios that have far surpassed any historical precedent. Owing to the economic strength of the late 1990’s, the least extreme valuation measures were based on earnings. This is another way of saying that earnings were elevated, compared to other fundamentals, during the late 1990’s. We observed this as high profit margins (high earnings/sales), high return on equity (high earnings/book value), and low dividend payout ratios (dividends/high earnings).

I developed the price/peak-earnings ratio because it filters out the uninformative volatility of earnings during recessions, and provides a more useful framework to talk about stock values. To quote valuations on any other measure in recent years would have led many readers to extremely bearish conclusions. Unfortunately, the market is now strenuously valued even on the basis of price/peak-earnings. The current multiple of 18.75 has historically been surpassed only a few times in history, with singularly terrible results. This isn’t to say that stocks can’t deliver adequate returns between now and some narrow set of future dates, but to expect that stocks purchased at these levels will deliver attractive long-term returns in general requires the assumption that current valuations will remain elevated into the indefinite future.

For example, since the 1987 market peak, the S&P 500 has actually delivered an annualized total return of 9.66%. But this reasonably good outcome results precisely from the fact that the extreme valuations at the 1987 peak are roughly matched by the extreme valuations of today. In other words, if a very long-term investor is willing to rely on the notion that valuations when they sell will match or exceed the unusually high valuations of the present, that investor can reasonably expect stocks purchased at current levels to deliver long-term returns somewhere the range of 8-10%. To us, that’s a strenuous assumption, and it ignores the fact that stocks may be priced to deliver much stronger returns at various points in the intervening years. For long-term, buy-and-hold investors, it is highly probable that there will be numerous opportunities to purchase stocks at better long-term returns than they are currently priced to deliver.

In our view, defensive positions taken during periods of extreme valuation may cause investors to miss occasional short-term returns, but they do not compromise long-term returns. Moreover, the bulk of our defensive positions occur during periods where both valuations and market action are hostile. We believe that these positions enhance, rather than compromise, our ability to generate long-term returns. While past returns do not ensure future results, our objective is to substantially outperform a buy-and-hold approach over the full market cycle, with smaller periodic losses, on average. Stated another way, our objective is to achieve a high long-term total return per unit of risk. The comments in recent updates regarding Sharpe ratios may be helpful in evaluating how we have performed at this objective to-date.

Market Climate versus market forecasting

As usual, the investment positions we take from time-to-time should not be confused with forecasts. This may seem counterintuitive, but think of it this way. Even in the most favorable Market Climate we identify, the average weekly gain has historically been about 0.40%. In the most unfavorable Market Climate we identify, the average weekly loss has been about -0.20%. In either case, the standard deviation or typical range of error is about +/- 2%. As it turns out, these population differences between Market Climates are highly significant on a statistical basis. But looking from week to week, the small sample differences are completely insignificant. A brief example may make this clearer.

Consider the most favorable Market Climate we identify. In any particular week, we could make a so-called forecast that the market might advance by about 0.40%. But this forecast would be so swamped by the +/- 2% range of error as to make that forecast meaningless. One might think that lengthening the forecast interval would quickly increase the reliability of the forecast, but it does not. As you increase the number of weeks in the forecast by a factor of n, you multiply the range of error by roughly the square root of n. So for example, a 4-week forecast in the most favorable Market Climate would be a gain of about 4 x 0.4% = 1.6%, but the range of error would grow to the square root of 4 x 2% = +/- 4%. The problem with going to increasingly longer forecast periods is that these forecasts would rely on the Market Climate remaining unchanged. But since we can’t actually predict changes in the Market Climate in advance, that is not a reliable assumption.

So there we have it — strong statistical differences in the average market behavior across Market Climates, but virtually no ability at all to predict where the market is going. The appropriate strategy is simple — we align ourselves with the prevailing Market Climate, rather than trying to forecast specific market outcomes. By taking greater risk in conditions that we associate with a high return/risk ratio on average. and taking less risk otherwise, we believe that we can accrue a high average return/risk ratio over time.

In contrast, I don’t believe that we have the ability to call market bottoms, market tops, rallies, declines, bull markets or bear markets. Shifts in the Market Climate may overlap with important changes in market direction to some extent. But as a practical matter, I don’t really think in terms of bottoms, tops, bull markets or bear markets.

In short, we know that the future will be made up of a series of present moments. By taking good care of the present moment, constantly observing and responding to reality as it is rather than how we wish or hope it to be, we naturally expect to take good care of the future.

In bonds, the Market Climate remains characterized by mildly favorable valuations and mildly favorable market action. These conditions are sufficient to warrant a moderate exposure to fluctuations in long-term interest rates. Currently, the overall duration in the Strategic Total Return Fund is just over 6 years. Other things being equal, a 100 basis point change in long-term interest rates would be expected to induce a roughly 6% change in the value of the Fund. More commentary regarding the bond markets can be found in the Fund’s latest Annual Report.

Other comments

The number of American lives lost in the occupation of Iraq now exceeds the number of lives lost in military combat. The press hardly reports Iraqi deaths anymore. This outcome is outrageous and needless. The element that creates risk for our troops is the perception that they do not have neutrality. As I’ve noted before, the greatest act of respect for American troops would be for the Bush Administration to extract the U.S. from the role of occupier and to legitimize its role as peacekeeper; to abandon the objective of unilaterally shaping Iraq, shift enforcement to a wider force of NATO troops, and expand the role of the United Nations in civil matters. The security of our troops does not demand a broader use of force, but a broader coalition.

The greatness of America is rooted in the virtue of our principles; that all men are created equal; that they are endowed by their Creator with inalienable rights; that government must be by the consent of those who are governed; that it is precisely the defense of rights and due process for the utterly indefensible that secures the rights of all others. These principles do not require that we overthrow other governments that do not respect them. Rather, they demand that we respect these truths wherever our nation exerts its influence.

The founders of our nation, such as Thomas Paine, recognized the distinction between principles and men — between the virtues of a nation and the individuals who lead it at any particular time. In contrast to the neoconservative view that the U.S. should seek to attain absolute dominance in military power and political influence, our founders sought equality and mutual respect among men and between nations. They rejected, as Paine wrote, the savage idea of man considering his species as his enemy, because the accident of birth gave the individuals existence in countries distinguished by different names. They distinguished security and defense from dominance, and viewed aspirations of one people to determine the fate of another as repugnant.

The atrocity of war is always multiplied by the willingness of each side to overlook their common humanity with the other side. Thousands of years ago, the Buddha taught that no individual enjoys a separate existence; that no action exists apart from its reaction. He recognized that attending to the suffering of others is a step that can alleviate one’s own suffering. Christ asked simply that we do unto others what we would have them do unto us — You have heard it said that you should love your friends and hate your enemies, but I say to you, love your enemies; bless them who curse you; for He makes his sun rise on both the evil and on the good, and sends his rain on the just and the unjust.

These teachings are not hopelessly impractical. Rather, the challenge is to find ways, consistent with our defense and security, to make them practical in our world. To love one’s enemy always begins with the insight that one’s enemy also suffers, whether from ignorance, hatred, poverty, injustice or wrong perception. This does not excuse wrong actions, nor defend them from justice. But there are always opportunities to address broad human suffering, even as we pursue enforcement against specific individuals. Even simple actions can have great impact. If we can deliver tanks by helicopter, it is not impossible to also deliver power generators, water, and medicine. The Buddha taught, He who understands the roots of great suffering comes to enjoy great peace.

Nothing can be done to advance American principles around the world unless we insist on taking actions that are faithful to those principles. We can do better.