How to Use High and Low Beta Stocks and ETFs

Post on: 15 Апрель, 2015 No Comment

Beta is a useful measure to determine how wildly one stock, fund, or other security will move with movements in a stock market index. To calculate beta, the price action of a single stock or fund is compared to the price action in the S&P 500 index.

Beta can range from negative to positive infinity. Here’s what beta means at various intervals:

- Negative – A negative beta score implies that a stock or fund will move opposite of the market. If you see negative beta, know that the security will move down when the market is up, and up when the market is down. A short position on the S&P 500 index would have a negative beta score of 1.

- Zero – Zero beta implies no correlation, positive or negative, between a stock and the S&P 500 index. The movements are not at all correlated. (Hedge funds traditionally try to create profitable funds with zero beta, or zero correlation to the market at large.)

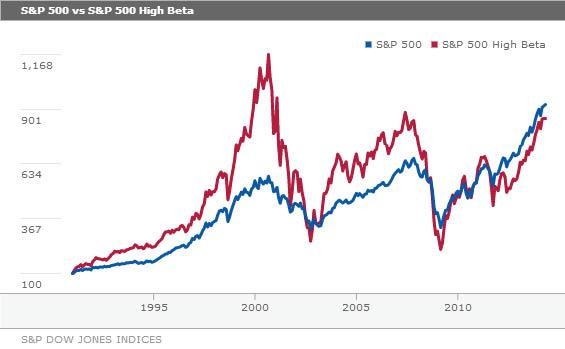

- Positive – A positive beta score means that the stock or fund will move with the S&P 500 index. If the S&P index is up, expect for anything with a positive beta to be up. A beta of 1 matches the S&P 500 index movements – the SPY ETF (an ETF that tracks the S&P 500 index) is one of the rare funds that manages a perfect score of 1.

How to Use Beta in Your Portfolio

Beta can be used to create a balanced portfolio. When investment professionals talk about risk, they are usually talking about beta, or how much a portfolio will rise or fall with the broad market. A fund with a beta of 0.5 would be less “risky” than a fund with a beta of 2. You can expect much more volatility in a fund with a higher beta than a fund with a lower beta.

Here’s how you might use beta in your own portfolio:

- Reduce Volatility – You can reduce volatility with low-beta securities like bonds. Bonds typically do not trade with any relationship to the stock market. For example, Google Finance lists the beta of the Vanguard Total Bond Index ETF (BND) at 0.02. At nearly zero, this bond fund moves with no real relationship to the S&P 500 index. Adding it to a portfolio with the S&P 500 index would give you positive yields from bond payments while reducing your exposure to the movements of the stock market.

- Increase Leverage – You can use high beta stocks and funds to increase the relationship between your portfolio and the stock market. For example, the small cap Russell 2000 Index ETF (IWM) by iShares has a beta of 1.2. This means that the fund will trade up or down with bigger movements than the S&P 500 index. When the broad stock market is up, you can expect this fund to beat the S&P 500 index as far as total returns go. However, when the S&P 500 index is down, you can expect this fund to lose more value than an S&P 500 index fund.

Have you looked at your portfolios beta?