How to survive a bear bonds market Investment Basics from Citywire Money

Post on: 24 Июль, 2015 No Comment

Favourites

Investors are being urged to review their holdings in bonds after one of the most violent sell-offs in the asset class in years.

All types of fixed interest stocks fell last month after the US central bank said it might start to reduce the amount of bonds it buys each month as part of its efforts to stimulate the economy after the financial crisis.

High risk local currency emerging market bonds fared the worst, plunging an average of 7.5% in May, while dollar-based debt from emerging economies slid 4%.

But mainstream bond markets did badly too with UK government bonds (or gilts) falling between 0.5% and 3%. It was a similar story with corporate bonds.

May was a bad month overall for investors with share prices suffering as well. For example, the FTSE 100 has tumbled 6% in the two weeks since Ben Bernanke, chairman of the US Federal Reserve, said he might ‘taper’ the amount of free money he’s been pumping into the global economy.

However, investors are accustomed to turbulent share prices. They are not so used to sharp falls in bonds, which are generally regarded as a more defensive investment and which are used in many people’s pension savings to smooth out the ups and downs of the stock market.

What’s going on?

Shaun Port, chief investment officer at Nutmeg, an online wealth manager, said the falls in bond markets were significant as they showed ‘people are reassessing their fixed interest exposure’.

In particular he urged cautious investors with large amounts in gilts to take care. Warnings of a bubble in gilts have come thick and fast in the past two years as the Bank of England has pumped £375 billion of new money into government bonds to drive down long-term interest rates.

Last month’s falls in government bonds were the third worst in 25 years, a sign, says Port, of the sort of big losses that could follow as the Fed and, further down the line, the Bank of England scale back their ‘quantitative easing’ policies and start to raise interest rates.

The challenge for investors is that it is not just gilts and treasuries (US government bonds) that are expensive. All other forms of bonds have soared as investors have sought out higher returns.

However, investors face a conundrum, according to Mark Dampier, head of research at Hargreaves Lansdown, the funds and shares broker. Bonds do best when the economy slows down and interest rates and inflation are low. At some point, these must rise and bonds will suffer as their fixed rate of income starts to look unattractive. But will this happen any time soon? ‘I don’t think that UK base rates will rise until after the general election,’ said Dampier. He played down fears of a 1994 scenario when bonds – and shares – crashed in response to rising US interest rates. ‘History seldom repeats itself exactly,’ he added.

Investors got an idea of the stretched state of bonds markets this week when Richard Woolnough, a leading bond fund manager, revealed he had 12.5% of his M&G Optimal Income fund invested in shares. which he said were better value than bonds. Given his fund has £15.5 billion of investors’ money that’s £1.9 billion in shares – much more than many full-time equity fund managers look after!

Woolnough said: ‘If I was the Fed, I would’ve stopped quantitative easing already.’ He believes the US economy is in better shape than the Fed thinks. This is why investors were anxiously awaiting to see the latest employment figures from the US. A fall in unemployment should be good news but investors are worried what happens when the Fed stops artificially boosting stock markets.

Is anywhere safe? ‘Duration’ and ‘spreads’

To answer this question you need to understand a bit about how bonds work.

Bond prices are affected by two things: interest rates. which, if falling, can make their fixed rate or coupon look attractive, or, when rates are rising, make their rates look unattractive; and credit risk. which is the danger of the issuer not paying interest on the bond or giving investors their money back when it matures.

The impact of rising interest rates is particularly severe on longer-dated bonds. They have got more years to go with their rate of interest looking unattractive so they drop more in value when rates are expected to rise.

A bond’s exposure to interest rate risk is measured by ‘duration’. Managers of bond funds, like Woolnough, have cut duration on their funds to make them less vulnerable to interest rates rising.

For example, a 1% rise in interest rates could see a long-dated bond fall by 20% or more over a period of time. This is why short-dated – or lower duration – bonds fell less in May than longer-dated – or higher duration – bonds.

Credit risk is measured by another term known as the ‘spread’. This is the extra yield or interest rate investors get from buying riskier bonds. Spreads are measured in relation to gilts and treasuries. For example, a short-term gilt with less than five years to run currently yields slightly more than 0.5%, the base rate of interest set by the Bank of England. By contrast, a high quality corporate bond of the same maturity would yield about 1.3%. In other words it trades at a ‘spread’ of around 80 ‘basis points’ (or 0.8%). Lower quality bonds would have a higher spread over gilts, meaning they would pay more in interest.

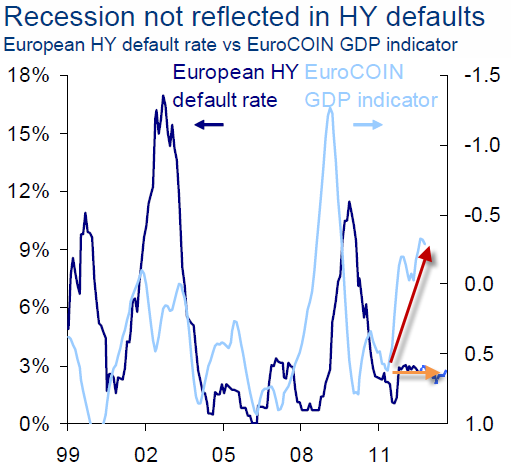

During the bull market in bonds, spreads have narrowed as bond prices have risen. However, Port has noticed credit spreads starting to widen. This is significant because it adds to the pressure on bond prices.

Is anywhere safe?

Not really: here’s a quick review of the main types of bonds and where they stand.

Gilts and treasuries:

Like many professional investors Shaun Port of Nutmeg sold his last positions in UK and US government bonds last year. With yields well below inflation they represent very poor value. Pictet Asset Management, the Swiss investment group, forecasts annual losses of up to 3% in the next five years which it says is ‘almost unprecedented’.

Index-linked government bonds: