How to protect against rising interest rates

Post on: 2 Июнь, 2015 No Comment

By Drazen Jorgic 01 Feb, 2011 at 00:01

With inflation expected to remain well above the 2% target for the foreseeable future, wealth managers are turning to structured products for ways to hedge against the inevitable interest rate rises.

The December inflation figures – showing the consumer price index rose to 3.7% from 3.3% in November – have brought the issue of rising interest rates to the fore, with the market now expecting a rise in interest rates before the year end.

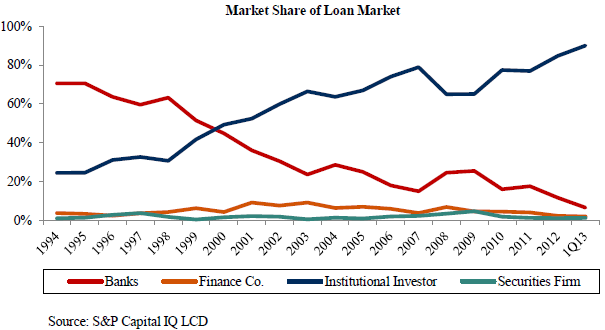

At the time of going to press, December 2011 short sterling futures, which are linked to three month Libor, were trading at 98.39, which suggests hedge funds, institutional investors and banks expect the interest rate to be 1.61% as we head into 2012.

Commentators also point out that the expectation for a rise in interest rates – or three month Libor – has spiked over the past few weeks.

John Craven, Société Générale’s head of professional client relationships, says many wealth managers have made significant profits from fixed income — particularly corporate bonds — over the past 24 months and are now looking at ways to reduce exposure or protect their portfolio from a rise in interest rates.

He says: ‘Growth and inflation have returned, yet Interest rates remain at a record low level. It’s simply a question of how quickly interest rates will return to more normal levels, and the extent to which bond prices will be impacted.’

‘Many wealth managers are telling us they are reducing their over-weight in fixed income, yet they are still concerned about the impact that changes in interest rate expectations could have on the remainder of their bond portfolio.’

With this in mind, Société Générale has released two products which track 3 Month £ Libor expectations, and are designed to allow wealth managers to directly hedge interest rate exposure.

The pay out on the product is the level of the 3 Month £ Libor at the time of the expiry of the products – one in December 2011 and the other in December 2012 – multiplied by £100. Therefore interest rates at 2% would result in £2 being returned, while at 4% it would be £4, but if they stayed low and 3 month LIBOR was 0.5%, it would result in a loss with only £0.50 being repaid.

Craven says: ‘The product launch was based on feedback from discretionary asset managers saying they would like to hedge the possibility of rates rising more quickly than expected. By effectively securitising the 3 month LIBOR future, and listing it on the LSE, we aim to provide wealth managers with a simple powerful tool’

A hedge against a rate rise

The problem of hedging a rise in interest rates has been compounded by the lack of floating rate notes on the market, which traditionally have been issued by financial institutions. Non-financial corporates have been far lower issuers traditionally.

Inflation concerns have prompted wealth management firm Cazenove to create a new structure linked to the retail price index (RPI), according to head of structured products Davydd Wynne (pictured)

Working with structured products specialist Catley Lakeman Securities, Cazenove launched a five-year note that pays out income linked to the level of the RPI.

The note, which is RPI plus 2.12%, has a 50% European protection barrier on the FTSE 100 index and was struck at 5,820.

Wynne notes the index would have to finish at around 2,900 in five years’ time for the capital to be at risk.

He adds: ‘The coupon is 2.1% regardless. Precisely because we were thinking that inflation may stay stubbornly high, and given that we have got 2.12% of RPI embedded with the product, it looks like an appropriate time to follow that strategy.’

Wynne says Cazenove’s approach was to look at the payout terms and ask whether they are fitting in the firm’s view of what is going to happen.

‘The product terms must deliver the return you think is optimal for your client,’ he says. ‘There are times where you will look at the payout of the product and whether it looks worthwhile or not, but given that interest rates are still low, the market is starting to consider what will happen if they have to raise rates.’

Upward pressure

Rasik Ahuja, head of structured products at EFG Private Bank, says the prospect for interest rate hikes and the best way to deal with this has been a constant topic of conversation with clients.

He says: ‘It’s difficult because in the short term, central bankers will keep rates low but on the longer end it’s the market forecasts that will drive it.’

Ahuja says EFG expects the upward pressure on rates to continue and last year the private bank decided to play this theme through a four-year fully capital protected note offering leveraged exposure to 10-year sterling constant maturity swaps (CMSs).

As a variation of the regular interest rate swap, CMSs are exposed to changes in the long-term interest rate so they can adjust with each reset period, so investors can benefit from a rise in interest rates.

Ahuja explains: ‘We took a strike at 4.25% and got gearing of 18 times with a cap on return at 40%. So if the 10-year CMS rises 2% to 6.25%, at the end of the four years we are looking at a 36% profit.’

He says EFG believes the likelihood of such a scenario is high.

‘The long-term average over the last 10 years is over 5%, with a high of 6.77% in 2000. But we are happy even if we make 10% to 15% as our opportunity cost is low and we are not sacrificing any capital,’ he says. ‘If we are right we will make substantially more.’

Ahuja adds that EFG is actively looking at ways to play a similar trade.

‘We think that a gilts trade makes sense [today] and we’ve had conversations with clients. The main concern is around interest rates so we are looking at that sort of trade.’