How to Price Convertible Bonds Finance Train

Post on: 18 Сентябрь, 2015 No Comment

Some common momentum indicators include:

- Convertible Security: Debt security that can be converted into a specified number of shares of the issuers common stock at the option of the security owner.

- Exchangeable Security: Debt security that can be converted into a specified number of common stock shares for a company other than the exchangeable security issuer.

Convertible Bond Analysis Process

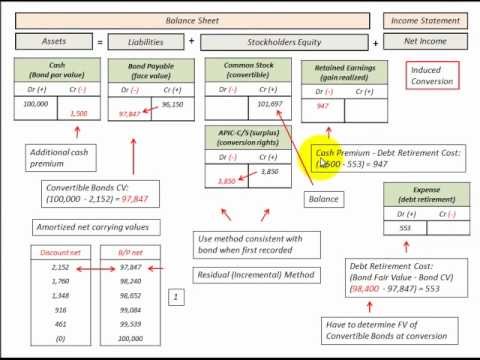

- Calculate Conversion Value: which is the current market value of the shares that the bond can be converted into.

- Conversion Value = Market Price per Common Share * Conversion Ratio

- Straight Value: price where the bond would trade if it were not convertible to stock.

- Minimum Value of a Convertible Bond: a convertible bond should, at the lowest, trade at the higher of either the conversion value or straight value.

- When thinking in a realistic manner about convertible bonds, the convertible bond for a company will trade more like a straight bond when the stock price is low because the convertible option has almost no value. Alternatively, the convertible bond will trade more like a stock when the companys share price is high because the conversion option has value.

Option Based Valuation for Convertible Bonds

As an alternative to the approach outlined in the prior segment, an analyst can take apply option prices to value a convertible bond.

Price convertible bond = Price straight bond + Price stock call option Price bond call option + Price bond put option

- The bond call is applicable if the issuers convertible bond is callable.

- The bond put is applicable if the issuers convertible bond is putable.

Note that this formula is an identity, so any one variable can be solved for if the other variables are known.

Risk/return Profile of a Convertible Bond

When thinking about the risk/return profile of a convertible bond, consider:

- The convertible bond will outperform the companys stock, when the stock does not change in value because the interest income from the bond is usually higher than the dividend of the stock.

- The convertible bond will outperform the companys stock, when the stock declines in value because the convertible has a price floor equal to the straight bond value.

- The convertible bond will underperform the companys stock, when the stock appreciates significantly because the investor paid a conversion premium on the convertible bond.