How to Pick Good Mutual Funds for Your 401k or Retirement Plan

Post on: 25 Июнь, 2015 No Comment

Let me see if I can describe how your employer 401k (or 403b, etc) retirement plan orientation went:

• You all walked into a meeting.

• An HR administrator handed you a folder chucked full of loose documents.

• You were released with little direction and told to bring the papers back all filled in.

Am I close?

It’s pretty sad that something so important to our livelihoods later on in life is treated as another routine task. There are many things that should be explained to you when you sign up for your 401k (click here for my complete guide on this topic ).

But if there’s one thing where people REALLY need help, it’s deciding which mutual funds to pick for their plan. Past returns? Large cap / small cap? Expense ratios? What does all this stuff mean?

In the MyMoneyDesign household, we have both a 401k and 403b. So let me use what I’ve learned to help steer you towards making the best choices you can make.

First Things First – You’re Not a Fortune Teller:

One of the biggest mistakes people make when they’re picking their mutual funds is to look at the past returns and expect that the fund will do the same thing going forward. Unfortunately, that’s just not how it works.

People, say it with me:

• Past returns do not guarantee future returns.

It’s impossible to know if you’re picking a true winner because NO ONE knows what will happen in the future! If we did, then we’d be a whole lot richer than we are now! The fact that an investment could go up or down is the chance you take with an investment.

With that said, when picking your mutual funds, there’s really only two things we can do:

• Avoid funds that have already proven to be losers

• Maximize returns by keeping our costs down as much as possible

Keeping these two points in mind, here are five questions you need to ask yourself to pick the best funds:

1) Does this fund do better than the S&P 500 return over the long run?

The S&P 500 has returned an average annual rate of 8% for over half a century. Is the fund you’re looking at making that much?

How do you find this out? Look at the Past Returns data in the 10 year return or Since Inception columns (if the fund is more than 10 years old). The older the data, the better. This is because 10 years or more is enough time to capture the ups and downs of a significant period in economic history, and demonstrate how the fund performed or defended against the trend.

What about 1, 3, or 5 year return data? You can pretty much ignore this. Short-term data basically trails the ups and downs of the market. Unfortunately, this is just not enough time to determine if the fund is stable enough to beat the trend.

Remember – this doesn’t mean the fund you pick is automatically going to do 8% or better. It can indicate the integrity or stability of the fund against the rollercoaster of the market.

Advanced Tip – If you’re already aware that other benchmarks exist (like ones for bonds, mid / small cap funds, foreign funds, etc), then you can use a more targeted benchmark to compare against the performance of your choices. To do so would be more of an apples-to-apples comparison.

2) How much am I paying for this mutual fund?

Every mutual fund option you choose will have a fee called an “expense ratio”. Your goal is try to pick the ones with the lowest fees possible.

Overlooking the expense ratio fee is another big mistake when picking your 401k funds. A fund with too high of fees can have significant implications on your returns. Here’s an example:

Ouch! Not only is that $1,890 in fees if you have a $100,000 portfolio, but let’s say the fund only returned 3.06% (as in the example up top). That means you’re really only making 3.06 – 1.89 = 1.17% per year, or -1.83% if you count a 3.00% inflation rate. Terrible!

What’s a “normal” expense ratio? Well, consider that the “The Vanguard 500 Index Fund Investor Shares (VFINX)” has an expense ratio of 0.17%. For that same $100,000 portfolio, that’s only $170 per year in fees. How’s your choice comparing?

As a rule of thumb, anything over a 1.00% expense ratio is probably more expensive than it needs to be.

3) What does Morningstar think of this fund?

Have you ever heard of “Morningstar”? Morningstar is a service that ranks mutual funds on a five-star system (i.e. the more stars the better). Although a Morningstar rank is not a perfect sign of an all-star pick or great returns to come, it does hold some weight. They use far more criteria to judge mutual funds than you and I would ever consider. Heres an example:

If nothing more than a second opinion, use the Morningstar ranking as an aide to picking your winning funds. If the ranking wasn’t given in the information you received, you can go to Morningstar’s website and easily search the fund yourself.

4) How diversified do I want to be?

Not all funds invest in the same thing or the same place. And to some degree, you can use this to your advantage.

Without getting too technical, you can pick some funds that are more aggressive at returns (and riskier) than others. For example:

• Risk increases as you go from large to medium to small funds.

• Rick increases as you go from value to growth funds.

• Foreign funds are perceived as riskier than US stocks, and US stocks are usually more risky than bonds.

A big part of which ones to pick depends on how you feel about risk. If you’re willing to gamble, then put some (not ALL) of your money on the riskier choices. But if the thought of losing your money haunts you at night, then stick to the safer choices.

In the absence of all else, use the old rule of thumb:

• 110 – Your Age = The percentage of your portfolio that should consist of stocks. The rest should go into safer investments like bonds.

On the breakdown of stocks, try to spread at least a small amount of your money into the small/mid cap or foreign funds. I wouldn’t recommend exceeding a 20% allocation in any one of these categories.

5) How does this fund compare to other choices?

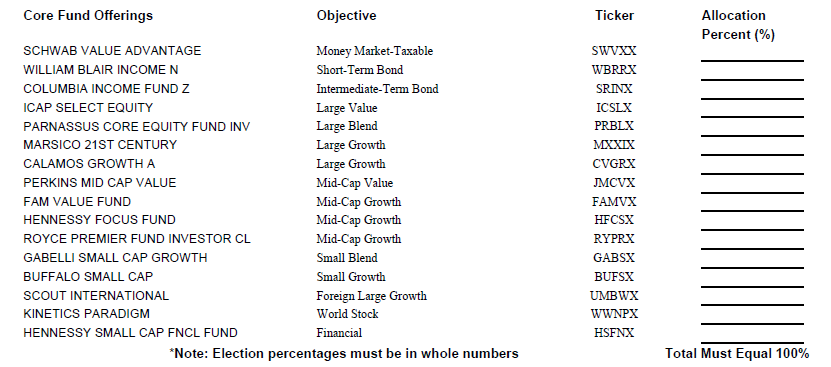

Everything is relative. Some employer plans offer anywhere from 10 to 100 mutual fund choices. Although your options may not rival the 8% benchmark or come close to the 0.17% expense ratio, you may just have to simply play the hand you’ve been dealt – Especially if you are trying to qualify for your employers 401k match.

Perhaps your 401k fund options aren’t perfect, but there will be some that are better choices than others. Remember – Use these tips to help make the best of the choices you have.

Readers: How do you choose funds for your 401k or employer retirement plan? What special criteria do you use? Beginners – Are there any other questions you have you have when you’re first making your choices?