How to Pick Good Mutual Funds

Post on: 1 Июнь, 2015 No Comment

How to Pick Good Mutual Funds

By WEALTH Magazine Staff | Print This Article

Mutual funds can provide a good way to diversify your portfolio and protect you from the risk of investing in a specific stock. But how do you sort through the thousands of funds that are out there to find the right ones for you?

Here are some principles to consider.

1. Mutual funds can be made up of stocks or bonds. In general, stock funds are riskier but have a higher potential for gain. 2009 saw investors leaving stock funds and buying up bond funds. As a result, many people lost out on steady gains in the stock market. But todays stock market remains volatile. So where does that leave the individual investor? Holding both stock and bond funds may be a good strategy, as doing so can reduce risks while leaving the potential for profit.

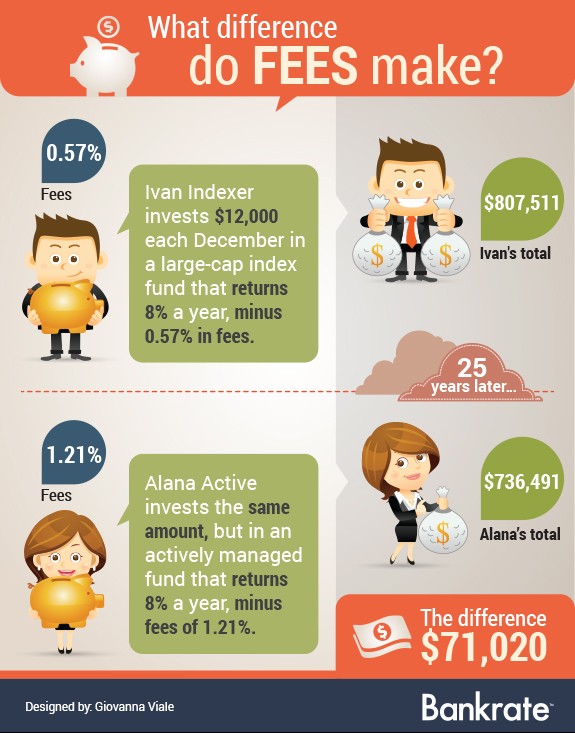

2. For your equity funds, decide if you want index funds or actively managed funds. Index funds are designed to track specific segments of the stock market, such as the S&P 500 Index; actively managed funds attempt to beat it. Again, theres more risk in actively traded funds, and more potential reward. Before taking on more risk, you should be sure you have the time to recoup any short-term losses. As a general rule, the sooner you need to use your principal, the more conservative your approach should be.

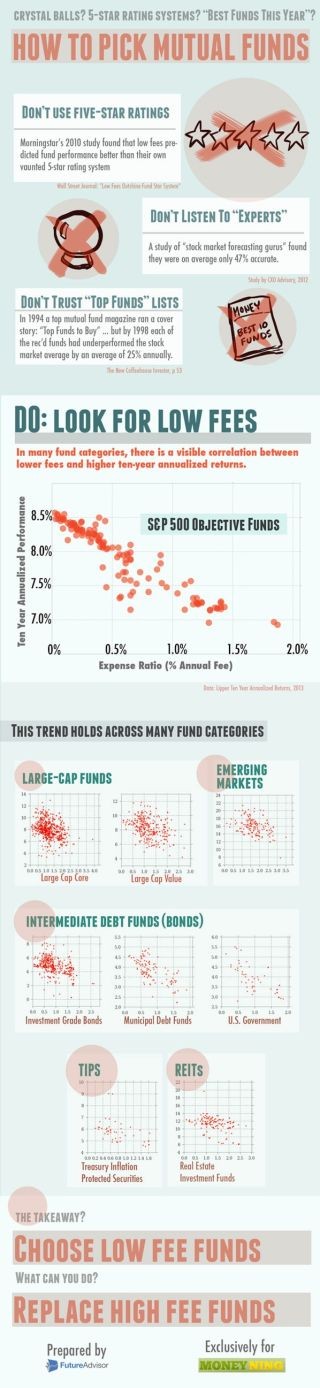

3. Whichever way you go, research a funds past results but dont obsess over them. Look for consistent results over the long term. A flash in the pan year set amid a bunch of mediocre years is not promising. Dont get too concerned with concentrating on one hot market sector, like technology. And dont fall into the trap of fighting the last war. Past earnings are only one factor for you to consider.

4. Know who is making the key decisions for the fund. Particularly for actively managed funds, the most important factor is the quality of its leadership. Get to know the fund manager, his or her track record and philosophy. See if it meshes with your own.

5. Do your research on mutual funds. Know the difference between small-cap and large-cap. Understand that some funds look for big, high-growth companies, while others are looking for under-performing or emerging companies. Compare funds with similar investing styles. For many people, a big part of your research should be talking to your financial adviser. So have a conversation and begin determining which funds are right for your resources and goals.

This entry was posted on Wednesday, October 5th, 2011 at 12:18 pm and is filed under INVESTING. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response. or trackback from your own site.