How to Pass the Series 65 Exam

Post on: 7 Июнь, 2015 No Comment

E arlier this month I took the Series 65 exam. The test is designed for those who want to become investment advisors to manage others investments. In response to a number of email from my newsletter subscribers (I mentioned the exam in a newsletter), I thought Id share my experience studying for and taking the exam.

Series 65 Basics

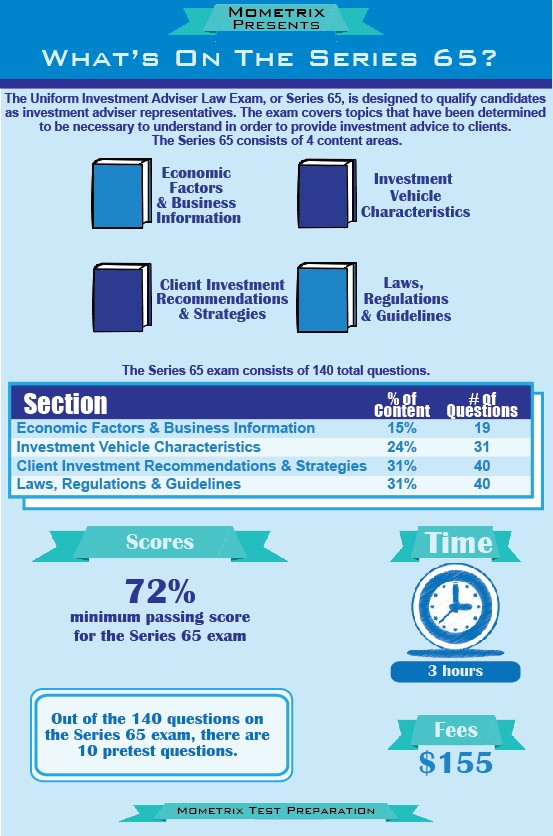

The Series 65 exam is 140 questions long. Theyre all multiple choice. Ten questions dont count, but of course you dont know which ten. Theyre sprinkled throughout the exam. They do that so they can test questions for use in future exams. Basically, test takers act like guinea pigs for those ten questions. So your score is based on 130 questions. You need to answer 72 percent of the questions correctly to pass. And beyond that, it’s just pass or fail. You don’t get any extra credit if you happen to nail all 130 questions, which, by the way, I did not do.

But that’s basically how to test works. You have three and a half hours to take it. I actually went through it pretty quickly. I was done in about an hour and twenty minutes and felt so confident I didn’t even go back and check any of my answers, which I had anticipated doing.

Part of the reason was because I had taken a number of practice exams through Kaplan. I used Kaplan’s study materials and I think those practice exams were much harder or noticeably harder than the actual exam. So, when I got done with the questions on the exam, I felt pretty confident.

So, what’s on the exam? Well, the study guide that you get from Kaplan is over 600 pages long. Thats intimidating, but some of that includes an index and a glossary so if we take all that out its only 575 pages long. Yeah, it’s pretty dense.

If you had absolutely no background in law or investing, it would be a tough exam. You’d have to spend some time because itd be a lot to memorize. And that’s really what it is. There are very few calculations that you actually have to perform. They give you a four function calculator that I used on one or two questions. They also give you a pen and something to write on. And, I think I also did a couple of calculations by hand. But it couldnt have been more than four or five questions and the calculations were very, very simple.

The exam is not about calculations so much. It’s really about memorizing a lot of stuff. What I found was there were some sections of this that I just knew cold. I wouldn’t have needed to study for them. An example of that would be questions on retirement accounts. I think I mentioned it in the previous podcast, questions cover the 5 year rule as it relates to Roth IRAs. Well, I have been looking at that intensely here recently as part of the podcast.

But there are other sections that were very new to me. There are questions on broker-dealers, for example. I’m never going to be an agent for a broker-dealer, at least as far as I can tell. It’s just not something that I’ve ever needed to know about and probably not something I’ll ever need to know about again. But it’s something I did need to know for the exam.

What does the Series 65 exam cover?

The Kaplan study guide breaks up the content into 10 units.

The first one is equity and debt securities. You need to understand the different types of equity. Youll need to know the difference between preferred and common stock, for example. Youll also need to know the difference between cumulative and non-cumulative preferred. For bonds, you need to be able to calculate the current yield, yield-to-call, and yield-to-maturity. Youll also need to know which yield is highest depending on whether the bond is selling at a premium or a discount to par. Other topics in this section included questions on REITs and ADRs (American Depository Receipts). As best as I can recall there were no more than about 10 questions on the exam that covered these topics.

The next section of the exam covers options. A basic understanding of puts and calls is necessary. I can actually thank a good friend of mine who invests extensively in puts and calls. He and I have coffee about once a month and he regales me with his stories of profit and loss in the options market. It’s from those monthly meetings at Starbucks that I know what I need to know about options. You have to be qualified to trade options. You can’t just open up a brokerage account and start selling or buying puts and calls. I am able to trade certain options in my SEP account at Vanguard. I just haven’t done it yet. We’ll see if I do it. If I do, I’m sure I’ll report it to you and I’m sure it’ll be ugly.

You need to understand insurance based products including annuities and different types of life insurance. Again, it doesn’t go into great detail. It would be nowhere near comparable to the exam you’d have to take to become a licensed insurance agent, but you do need to understand the ideas between a fixed annuity and a variable annuity, for example.

The third section of the exam is on trading securities. This section covers the different types of orders (e.g. market, stop, limit) and the differences between a bid and ask and the spread. The Series 65 exam also covered questions on dividends and understanding the declaration date and the ex dividend date.

The next section covered retirement plans. This was pretty straightforward for me because I kind of live and breathe the stuff. But you need to understand the workings of IRAs, 401(k)s, Roth versus traditional, as well as educational savings programs like the 529 Plan.

The next topic covered is portfolio management. Topics include tax and asset allocation. Here you need to understanding the risks and what would be a suitable investment for an individual given certain circumstances such as risk aversion and investing horizon. You did have to have at least a high level understanding of the different corporate forms and the pros and cons of each.

Economic factors were also covered. You need to understand GDP (Gross Domestic Product), GNP (Gross National Product), and CPI (Consumer Price Index). The test covered risk measures, including correlation, beta, alpha, and the sharp ratio. I expected monte carlo simulations to be on the exam, but dont believe they were covered.

And the last three sections were related to securities law. There was a section on federal securities regulations. This covered the 33 Act, the 34 Act, Reg. D. insider trading, and powers of the SEC. You need to understand the Investment Company Act of 1940. You also need a working understanding of the Uniform Securities Act. Finally, you need to understand the rules regulations that govern investment advisors and their representatives.

I studied for about 10 hours. During that time I read through the Kaplan study guide and then spent the rest of the time taking practice exams offered by Kaplan. One of the things that I found when I was taking these practice exams is that I was moving through them very, very quickly. I would take a practice exam of 130 questions and be done in 50 minutes. That actually gave me some comfort because I thought going in that I would have plenty of time to reread all the questions. As I said, I ended up not doing that. Probably not a smart move, but it worked out well for me.

By comparison, the Series 65 exam is not nearly as difficult as the bar exam. Of course the bar exam is two days. That’s a high level view of the Series 65 exam. If you have specific questions about it, feel free to shoot me an email. I’ll do my best to answer them.