How to Measure Mutual fund Risk Alpha Beta Standard DeviationAmerican Financial Advisor

Post on: 1 Апрель, 2015 No Comment

How to Measure Mutual Fund Risk

Consistency in Performance

The toughest part in making an investment decision is selecting the right product be it mutual fund schemes, stocks or commodities. There is danger in choosing a product purely based on its past performance without giving much thought to other factors such as charges, downside risk, consistency of performance etc. Mutual fund investors often make the mistake of buying into a mutual fund scheme that has given very high returns in very short time. It is very difficult to identify the right fund amongst hundreds on offer in the market. If you make the wrong choice you could lose money in a big way.

style=display:inline-block;width:300px;height:250px

data-ad-client=ca-pub-8763624540817409

data-ad-slot=4318930882>

Will you invest in an equity fund that gave over 100% returns at a time when the equity markets were witnessing a secular bull run but showed a sharp drop in net asset value (NAV) when the markets were volatile? You dont want a fair-weather friend, do you? A good mutual fund scheme is one that consistently manages to outperform its benchmark over 3-5 years.

Risk Return Trade-Off

Investments in most securities come with a degree of risk. Therefore if the returns are not in proportion to the risks taken there is no point in investing in such financial instruments. A good mutual fund is one which gives better returns than others for the same kind of risk taken. It means that if two mutual funds have same type and proportion of holding, both are exposed to same market risks. Under such same circumstances the fund which gives higher return is a better fund.

Risk-adjusted returns are evaluated against return given by a risk free instrument like government backed debt papers (bonds etc). Following paragraphs explain how to measure mutual fund risk.

Indicators of Mutual Fund Risk

There are five main indicators to measure mutual fund risk. -

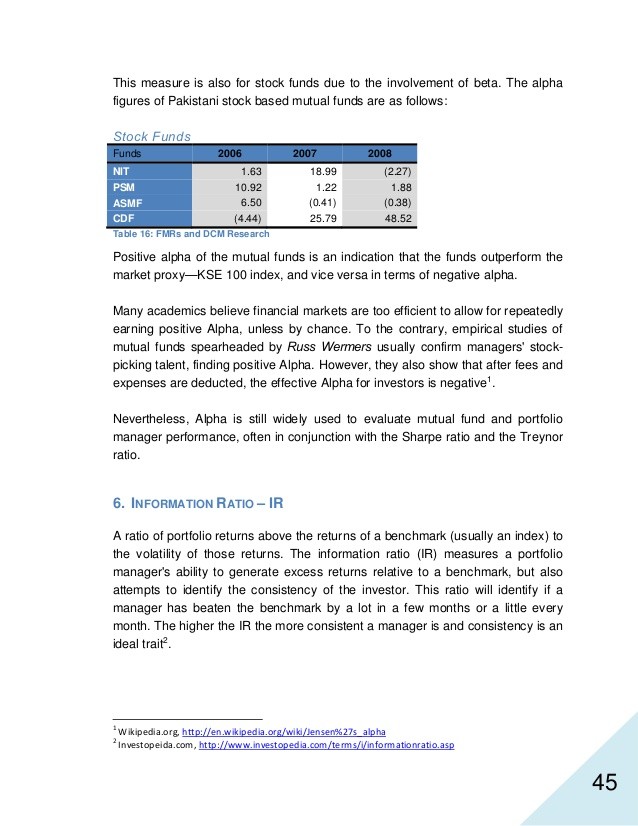

- Alpha The simplest definition of an Alpha would be the excess return of a fund compared to its benchmark index. For example if a fund has an Alpha of 10%, it means that it has outperformed its benchmark by 10% during a specified period. Therefore Alpha is a measure of an investments performance on a risk-adjusted basis. Alpha takes the volatility (in other words price risk) of a fund and compares its risk-adjusted performance to a benchmark index. The excess return of the investment relative to the return of the benchmark index is its Alpha. The more positive an Alpha is, better is the fund performance. Negative Alpha means that the fund has given lower return than the performance to a benchmark index.

- Beta It measures a funds volatility (swings in NAV, both up and down) compared to that of a benchmark. It tells you how much a funds performance would swing compared to a benchmark. A fund with a Beta of 1 means that its NAV will fluctuate same as the benchmark. If a fund has a Beta of 1.5, it means that for every 10% upside or downside of the benchmark, this funds NAV would go up or down by 15%. So Beta (or Beta Coefficient) is a measure of volatility. It is a “Systematic Risk” (or Market Risk) inherent to the entire market or to a specific market segment related to the stock. Economic conditions, political situations, recession, war etc are causes of systematic risk. You can consider Beta as a tendency of an investment’s return to respond to swings in the market. It is calculated by using regression analysis. “Regression” here means the strength of relationship between the dependent variable (the NAV) and a series of changing variables (economic conditions, political situations, recession, war etc).

If your investment’s Beta is 1.0 it shows that your investments price will move in lock-step with the market. A Beta of less than 1.0 indicates that the investment will be less volatile than the market. A Beta of more than 1.0 indicates that the investments price will be more volatile than the market. For example, if a fund portfolios beta is 1.2, its theoretically 20% more volatile than the market. For a conservative investor who does not like higher risk should invest if funds which have lower Beta. But an investor, who wants high returns, even if the risk is higher, will go for higher Beta funds.

- Standard Deviation This also measures the volatility risk of the “Rate of Return” of mutual fund or stocks. Rate of return is gain or loss of an investment over a specified period (quarterly, 1 year, 3 years, 5 years etc). It is expressed as percentage increase over the initial investment cost. Standard Deviation measures the dispersion of data from its mean. The more this data is spread apart, the higher the difference is from the norm. Obviously a volatile stock will have a high standard deviation because its price will fluctuate more around the mean. The standard deviation tells you how much the return on a fund is deviating from the expected returns based on its historical performance.

- Sharpe Ratio This measures the risk adjusted performance of the fund. Sharpe Ratio indicates to the investor whether his investment’s returns are due to good investment decisions or due to excess risk taking. Sharpe Ratio is calculated by subtracting the risk free rate of return (typically from US Treasury Bonds) from the rate of return of your investment and dividing the result by the investments standard deviation of its return. The higher your investment’s Sharp Ratio the better it’s Risk Adjusted Performance .

- R Squared This one is a bit heavy to understand. R Squared is a statistical tool that represents the percentage of a fund portfolios or securitys movements that is linked and can be explained by movements in a benchmark index. For example for a fixed income mutual fund the benchmark is US Treasury Bills. For equity funds the benchmark is S&P 500 Index. R Squared values fall between 0 and 100. Suppose your mutual fund has R Squared value of 85. It means that your mutual funds performance is closely related to its benchmark index (US Treasury Bill or S&P 500 Index). A fund rated 70 or less will not perform like its benchmark index. So if an actively managed fund has a high R Squared ratio, do not invest in it. This is because an actively managed fund is supposed to give you higher return than its benchmark index.

This article has attempted to explain how to measure mutual fund risk. I am sure that if you read this article twice you will have clear understanding of indicators like Alpha, Beta, Standard Deviation, Sharpe Ratio and R Squared.

For more information on Mutual Fund click the following links. -