How To Invest Like The Ivy League Endowments With ETFs

Post on: 31 Май, 2015 No Comment

Summary

- The country’s largest endowments aim to preserve capital while producing income and appreciation with less correlation to the stock market regardless of market conditions.

- Performance among Ivy League endowments and retirement plans that invest like them varied widely last year but in the long run, they posted stellar risk-adjusted returns.

- You can invest like an Ivy League endowment yourself with a basket of ETFs offering exposure to all of the major asset classes in their portfolios.

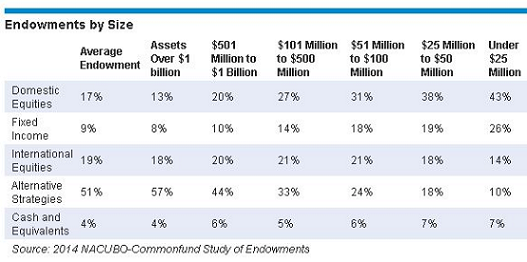

The investing strategy used by the country’s largest endowments aim to preserve capital while producing income and appreciation with less correlation to the stock market regardless of market conditions. The endowment style investing doesn’t call for market timing or making forecasts about which asset classes will outperform year to year. Hence they’re much more diversified than traditional stock and bond portfolios.

Endowments figure that it’s unlikely that anyone can correctly forecast which asset classes will outperform year after year, it’s best to invest in a wide variety of uncorrelated assets. The table below illustrates the randomness of how hedge funds, the U.S. and foreign stock markets, commodities, real estate, bonds and private equity perform year to year.

Annual Returns of Asset Classes in Endowment Portfolios

(Source: Endowment Wealth Management)

Latest Fiscal Year Endowment Performance

Performance among the country’s Ivy League university endowments and retirement plans that invest like them varied widely last year but in the long run, they posted stellar risk-adjusted returns. The

California Public Employees’ Retirement System’s (CalPERS) portfolio returned 18.4% for the fiscal year ending June 30, 2014 (up from 12.5% return generated in fiscal 2013). To put this in perspective, the S&P gained 24.6%, in the same period. Foreign developed markets gained 24%. Emerging markets rose 15%. A conservative globally balanced 60/40 portfolio with 60% allocated to stocks and 40% in bonds returned 7.9%.

CalPERS mammoth portfolio is diversified across stocks, private equity, fixed income, real estate, real assets like commodities, forestland and infrastructure. Investments in publicly-traded U.S. and foreign stocks gained nearly 24% while private-equity holdings earned 20%. The real assets component — income-generating office, industrial and retail properties — also scored double-digit returns of 13%. CalPERS has earned an average of 8.5% annualized the past 20 years and 8.9% annualized since 1988. The largest U.S. public pension fund covering 1.6 million members boasted its fourth double-digit return in the past five years. Assets under management have grown to more than $300 billion.

Harvard University’s $32.7 billion endowment returned 11.3% after expenses for the fiscal year ending June 30, 2014. Harvard Management Company’s policy is to invest only one-third of assets in publicly-traded stocks. HMC attributed the underperformance to its private-equity funds (16% of assets) and real assets (25% assets) such as timber, farmland, commodities and real estate.

Harvard’s private-equity holdings have returned 10% on average annually the past decade, lagging the public markets. Commodities gained 2% while real estate added 10%. Hedge funds, which account for 15% of assets, returned 7%. HMC’s fixed-income portfolio (9% of assets) includes a mix of domestic, foreign, and inflation-indexed bonds earned 1.9% to 2.7%.

Harvard’s endowment has returned an average annualized 11.6% over the past five years, 8.9% over the past 10 years, and 12.3% over the past 20 and 40 years.

Yale University’s endowment. the country’s second largest after Harvard, returned 20.2% for the year ending June 30, 2014 as assets swelled to $23.9 billion. Yale has allocated 31% of assets to private equity, 20% to hedge funds, 17% to real estate, 13% to foreign equity, 8% to natural resources, 6% to U.S. stocks and 5% to bonds and cash. The Yale endowment returned an average of 11% annually the past 10 years and 13.9% a year on average the past 20 years.

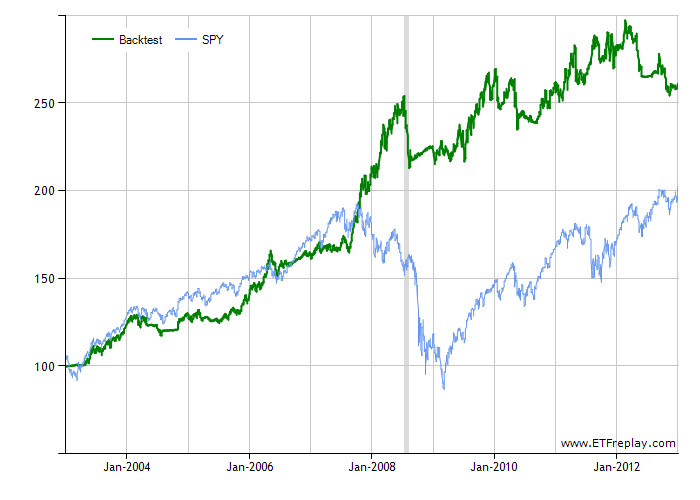

The Endowment Index , co-created and managed by ETF Model Solutions and Endowment Wealth Management of Appleton, Wis. returned 17% in the year ending June 30, 2014. But longer term, the Endowment Index — comprised of ETFs tracking U.S. and foreign stocks, liquid alternatives (commodities, private equity and hedge funds), fixed income and cash — outperformed the stock market benchmark with less volatility. The index returned 9.2% annually the past 10 years. It surpassed the benchmark S&P 500 by more than 1% annually.

The Endowment Index’s volatility, as measured by the portfolio’s standard deviation, was 12.4 vs. 15.4 for the S&P. The greater the standard deviation, the greater the portfolio’s volatility. What’s more the Endowment Index had better risk-adjusted returns as measured by its Sharpe Ratio of 0.51 vs.0.22 for the S&P. The greater the Sharpe Ratio, the better its risk-adjusted performance. A more conservative globally balanced 60/40 stock/bond portfolio returned 7.1% annualized the past 10 year with less volatility.

Individual investors cannot get an Ivy League allocation for their portfolios because Harvard and Yale don’t take outside clients. A few hedge funds and asset managers offer endowment portfolios but have monster investment minimums and fees. Makena Capital Management in Menlo Park, Calif. has an average account size of $1.2 billion. HighVista Strategies has a $5 million minimum and a two-year commitment. Morgan Creek Capital Management offers a mutual fund with a $2,000 minimum but charges an eye-popping 5.75% sales load and an oversized 4.23% annual operating expense.

Build Your Own Endowment Portfolio

You can mimic endowment portfolios yourself with a basket of ETFs offering exposure to all of the major asset classes in endowment portfolios with these ETFs. The exact allocations are proprietary. But an endowment allocation would have about 40% of assets in global equities, 20% in global income and 40% in liquid alternatives.