How to Invest in Vanguard Funds Using ETFs and Save Money While You re at It

Post on: 16 Март, 2015 No Comment

How to Invest in Vanguard Funds Using ETFs and Save Money While Youre at It

Is it possible to save money by investing in exchange traded funds (ETFs) instead of mutual funds. For many of Vanguard s mutual funds, this is possible. Even more importantly, Vanguard ETFs offer Canadians and people living internationally the ability to invest in Vanguard mutual funds via ETFs.

First, Ill compare the difference between investing in a Vanguard mutual fund, and investing in a Vanguard ETF. Vanguard has an online calculator that allows you to compare the differences in costs between ETFs and mutual funds for a given investment type.

Example one: Investing in the Vanguard Total Bond Market Index Fund (VBMFX) versus the corresponding ETF (BND)

Want to invest in a broad market of bonds, but not sure if mutual funds or ETFs are better for you? Using the online calculator, I compared the following two investments:

- Vanguard Total Bond Market Index Fund (Investor Shares) (VBMFX)

- Management expense ratio (MER): 0.22%

Note: The Admiral Shares series has a lower MER of 0.12%, but requires a minimum $100,000 investment.

Using the online calculator, I entered the following data:

- Initial investment of $10,000.

- Monthly investment of $200.

- Commission of $4.99.

- Time span of 15 years.

- 5% rate of return.

Using this data, it turns out that I would have saved $339.12 by going with the mutual fund. The downside of ETF investing is that its usually done through a broker, and the broker charges commission for each transaction. With a commission of $5 per transaction, Im effectively reducing my return by 2.5% for each monthly investment, which somewhat hurts my overall returns.

When it comes to a longer time span, however, the lower MER can swing the balance in favor of the ETF. I changed the parameters as following:

- Increased monthly investment to $250.

- Increased time span to 25 years.

With the longer time span and slightly larger monthly investment, the balance has now swung in favor of the ETF. I can now save $397.68 by going with the ETF.

You can adjust different parameters within the online calculator and see which scenario looks more attractive for you.

Example two: Investing in a Vanguard ETF versus a typical Canadian bank mutual fund

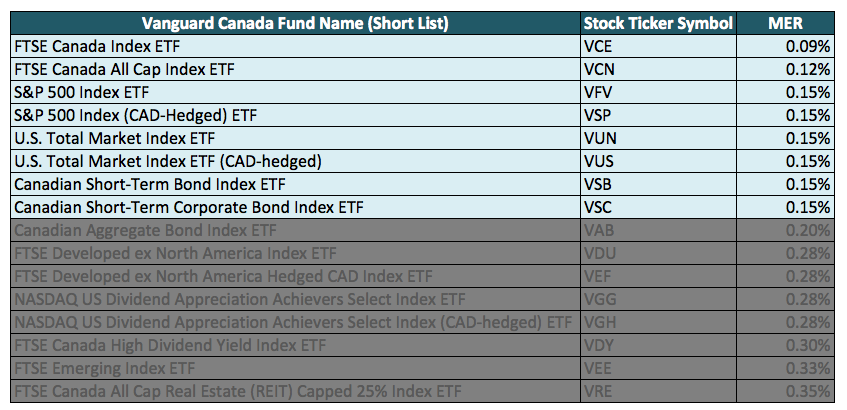

For those of us living in Canada, we dont really have a choice between Vanguard mutual funds and Vanguard ETFs. For us, the choice is more between a typical selection of mutual funds at one of the large banks and Vanguard ETFs through a broker.

For my second example, Im going to compare investing in the BMO International Index Fund versus the Vanguard Europe Pacific ETF. Both investments track the MSCI EAFE index ; the ETF returns are using market price total returns data.

Heres some performance data for both funds: