How to Invest in DoubleTaxFree Municipal Bond Funds

Post on: 30 Март, 2015 No Comment

Comstock / Stockbyte Collection / Getty Images

If you live in a U.S. state where you need to pay state tax on your investment income, you may be missing the boat if you aren’t earning double tax-free income from your investments. The term “double tax-free” refers to the fact that municipal bonds issued within a state are typically free from income tax on both the federal and state levels.

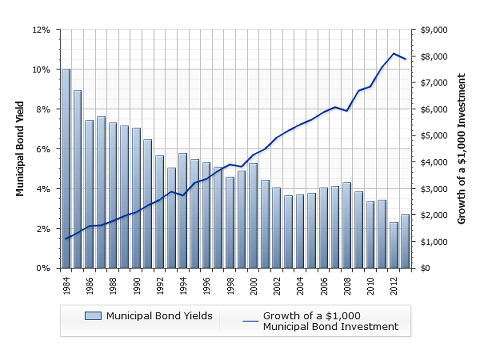

Given that state taxes are much lower than those on the federal level, this may not seem to be that meaningful of a benefit at first glance. Over time, however, it can add up substantially due to the impact of compounding.

How Double Tax-free Funds Work

Consider an investor with a $100,000 portfolio who lives in Massachusetts, where the income tax is 5.25%. If he or she invests in the Vanguard Massachusetts Tax-Exempt Fund (VMATX), which had an SEC yield of 2.38% as of June, 2014, the portfolio would generate $2,380 of tax-free income. Alternatively, the investor could own a national municipal bond fund with the same yield, but that $2,380 would only be $2,255 on an after-tax basis. Again, $135 may not sound like much, but when that amount is compounded year after year the longer-term impact is substantial.

Keep in mind, national tax-exempt bond funds may hold bonds issued by entities in your state. In that case, the amount of income that corresponds with the weighting in bonds issued in your state enjoys double tax-free status. Usually, however, this is only a small benefit.

It’s also important to consider that municipal bonds of all stripes typically offer lower yields than their taxable counterparts, so it’s necessary to do your research to determine whether munis are right for you. You can learn more on this topic here .

Triple Tax-free Income

Triple tax-free bonds are those that are tax-exempt at the municipal level as well as the state and federal levels. This is an option for investors who must also pay a city tax, such as those who live in New York City.

A bond doesn’t necessarily have to be issued by the municipality to be tax-free on the city level; it also can be issued by entity within the state. Bonds issued by Puerto Rico and other U.S. territories such as Guam and the U.S. Virgin Islands is also triple tax-exempt, which means that such securities may find their way into single-state muni bond funds. As a result, it’s always wise to take a closer look at a fund’s portfolio to make sure you know exactly what you’re getting.

Laws are always changing, however, so it’s important not to make assumptions about the tax-free nature of a bond. Be sure to contact an investment advisor if you have questions on a specific fund or bond issue. Alternatively, owning a mutual fund designed to provide triple tax-free income – such as T. Rowe Price New York Tax-Free Bond Fund (PRNYX) – alleviates the need for investors to do their own research on individual securities.

A Word of Caution

As with all things investing-related, there are considerations beyond simply the amount of money you can earn in a given year. While an investor who took all of their money and plunged into funds that are double or triple tax-free could certainly earn higher after-tax yields, they would also find themselves with a highly undiversified portfolio. If someone owns a municipal bond fund (or funds) concentrated in a single state, they are fully exposed to the economic trends in that particular region. If a city defaults, as Detroit did in 2013, or if a particular state has a weak property market, single-state funds could suffer a loss of principal. As a result, it’s important to complement double tax-free municipal bond funds with other types of investments to ensure appropriate diversification .

It’s also important to keep in mind that municipal bond funds are exposed to interest-rate risk. or the possibility that rising bond yields will cause prices to fall. This consideration may not be as much of an issue for someone who holds individual bonds. which will repay their principal at maturity except in the very rare case of default.

Finally, investors need to be aware that municipal bonds are not appropriate for retirement accounts .

The Bottom Line

Municipal bond funds that offer double or triple tax-exempt income allow you to keep more of your money, and they may be a better option than national bond funds for those whose portfolio is focused on munis. If you live in a state with a state income tax, consider this as one of your options – but make sure you maintain the appropriate level of diversification.

The full list of single-state municipal bond funds can be found at this page on Morningstar, while the list of single-state municipal bond ETFs is available here .

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Always consult an investment advisor and tax professional before you invest.