How to Invest in Bonds

Post on: 4 Апрель, 2015 No Comment

Your Guide to Understanding and Investing in Bonds

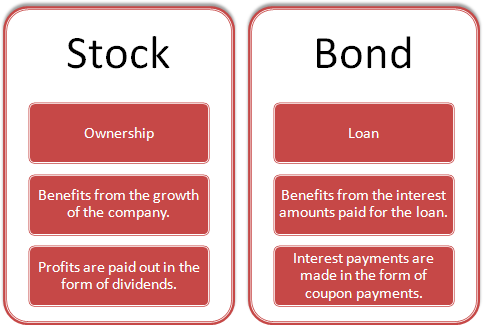

Bonds are a type of investment that results in an investor lending money to the bond issuer in exchange for interest payments. Bonds are one of the most important investments available for those who follow an income investing philosophy, hoping to live off the money generated by their portfolio. With the different options available to you (including municipal bonds, commercial bonds, savings bonds, and treasury bonds ), how can you know which is right for you or the dangers presented by owning different types of bonds?

That’s where this page — How to Invest in Bonds — can help. By working your way through it, you will find links to our most important bond investing articles. You can click on each link, read the article, and then come back here until you’ve finished. By the time you’re done, you should know enough about bond investing to ask questions of your broker or financial adviser. The biggest benefit is that you are less likely to feel emotional about your investing decisions when you understand the language and risks.

Getting Started with Bonds

The first place to start is Bonds 101 — What They Are and How They Work. This great piece will explain how you, as an investor, make money in bonds. what bonds are, why companies issue bonds, and much more. If you’re looking for a quicker answer and don’t want all the details, you can read What is a Bond? for a brief overview. If you like history, you may also want to briefly read Why is the Interest Income I receive on My Bond Called a ‘Coupon’? .

How Much of Your Portfolio Should Be Invested in Bonds?

A very common question is how much of your portfolio should be invested in bonds. There is a quick and easy rule that you won’t forget once you’ve read it!

The Ways to Invest in Bonds

There are several types of bonds in which you can invest and even more ways you can hold these bonds. Here are some resources and articles that you may want to consider.

Investing in Municipal Bonds. This complete beginner’s guide to investing in municipal bonds, which are immune from most state taxes. is a great place to begin if you are in a middle to high tax bracket. By investing in your local schools, hospitals, and municipalities, you can not only help your community, but make money. Once you’re ready to move beyond the very basics, you can read Tests of Safety for Municipal Bonds. This article will teach you some of the calculations you can do, the considerations you should make, when looking at a municipal bond investment. It is our hope that it lowers your risk and helps you avoid expensive mistakes.

US Savings Bonds. Get a broad education on savings bonds, their history, considerations before adding them to your portfolio, and tax notes.

Series EE Savings Bonds. These unique bonds offer tax advantages for education funding, the guarantee of the United States Treasury, a fixed rate of return for up to thirty years, and more.

Series I Savings Bonds. Series I savings bonds feature an interest rate based, in part, on changes in inflation, are guaranteed to never lose money, and are backed by the taxing power of the United States Government. This collection of articles will teach you how to invest in Series I savings bonds, tell you who is eligible to own them, and explain the annual purchase limits.

Bond Funds vs. Bonds. Many new investors don’t know whether they should own bonds outright or invest in bonds through a special type of mutual fund known as a bond fund. What are the differences, benefits, and advantages? Take a few moments to read the article to discover the answers.

Junk Bonds. One of the most alluring types of bonds new investors often spot is something known as a junk bond. Boasting high, double-digit yields, these dangerous bonds can lure you in with the promise of big checks in the mail, yet leave you high and dry when the companies that issue them miss payments or go bankrupt.

The Many Flavors of Preferred Stock. The preferred stock of many companies is actually very comparable to bond investments because both types of investments tend to behave the same way. To understand bond investing, you need to understand preferred stocks because the tax laws allow you to pay only 15% on dividend income received from preferred stocks, compared to full 35%+ depending upon your tax bracket on interest income on bonds.

Dangers of Investing in Bonds

Although bonds have a reputation that makes people believe they are safer than stocks, there are some real dangers that can hurt new investors who don’t know how to reduce risk. We cover these in the following articles:

How Bond Spreads Can Hurt Investors. Bond spreads are a hidden commission charged to you when you buy or sell bonds. They can sometimes cost you hundreds of dollars every time you buy a single bond! Learn how to identify them and ways they can be minimized.

Understanding Bond Duration. This seemingly simple term actually refers to the fact that if you buy a bond that matures in 30 years, it could fluctuate far more violently than a bond that matures in 2 years. In some cases, bonds with high durations can actually fluctuate as much as stocks! Learn what bond duration is and how you can calculate it in this important article.

The Danger of Investing in Foreign Bonds. When you buy bonds of other countries, or even companies located in other countries, there are very real dangers that you are not exposed to when you purchase in your home country. If you owned bonds in oil companies headquartered in Venezuela, for instance, you would have found your assets nationalized and seized by dictator Hugo Chavez without any way to recover what you lost. This article explains those dangers and some of the things you can do to reduce them.

Advanced Bond Investing Topics

Bond prices are often used as a valuation tool to help professional investors determine how expensive stocks and other assets are. This is done by comparing bond yields on certain types of government bonds to earnings yields on stock. If you want to learn how this works, you can read our explanation in Long Term Treasury Bond Yields vs. Earnings Yield: A Quick Valuation Tool for Markets.