How To Hedge Your Investments In High Yielding mREITs

Post on: 20 Май, 2015 No Comment

Mortgage REITs are said to have been benefiting from the actions of the Federal Reserve Bank for some time now. These mortgage REITs continue to provide investors with elevated returns. However, these elevated returns are not without risks. This report aims to look into how these mortgage REITs work and how they are affected by changes in the yield curve and the general interest rate levels. We also look into possible hedging strategies to hedge mortgage REIT investments.

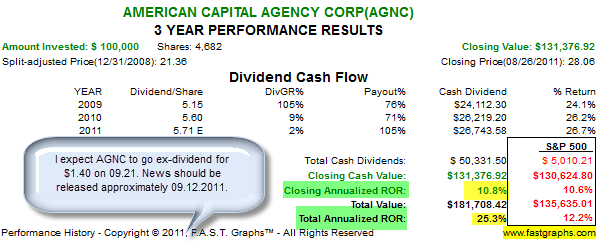

The federal fund rate has been kept low by the Federal Reserve Bank ever since the 2008 U.S. financial meltdown. The policy rate hit a record low of 0.25% since the beginning of 2009 a nd has stayed unchanged since then in a bid to stimulate the sluggish U.S. economy. One sector that had particularly benefited from this prolonged record low interest rate environment is U.S. mREITs. Most mREITs are trading in proximity to their 52-week highs [for instance American Capital Agency (NASDAQ:AGNC ), Annaly Capital (NYSE:NLY ), Capstead Mortgage (NYSE:CMO ), Armour Residential (NYSE:ARR ) etc .]. Besides indulging in generous dividend distributions (high dividend yields ranging from 10% — 16%) to their shareholders, most mREITs have offered handsome capital gains as well.

mREIT Business Model

Mortgage REITs borrow short term to invest in long term mortgage-backed securities. The prevailing non-existent interest rates enable these mortgage REITs to borrow funds at cheaper rates, reducing their cost of funds. Mortgage REITs generate income from the spread they earn between their interest income and the interest they pay on their borrowings. Lower short term interest rates mean cheaper cost of funds, resulting in enhanced interest rate spreads for mREITs. So what matters is the slope of the yield curve. As long as the rates are kept low by the Federal Reserve Bank, and the yield curve doesn’t flatten any further, these mortgage REITs are expected to outperform. A hike in short term rates by the Fed, or further flattening of the yield curve, will result in a depression of the interest rate spreads that these mortgage REITs earn.

Yield Curve Twists

The graph below depicts the results of various operations conducted by the Fed, including Operation Twist, the extension of Operation Twist, and the Maturity Extension Program. The long term interest rates (30-year t reasury yields) decreased 30bps, while the short term rates (1-month t reasury) remained relatively flat since the beginning of the year. Further flattening of the curve, as a result of another round of quantitative easing, will crush income for mortgage REITs.

(Click to enlarge)

Interest Rate Forecasts

The U.S. economy has shown no respite, despite the continuous efforts undertaken by the Fed. The country is suffering from stubbornly high unemployment of around 8%, while the GDP growth forecasts continue to hover around 2%. These forecasts have been lowered since the beginning of the current year, owing to the release of disappointing U.S. economic data. The chairman of the Fed has shown his unease with the prevailing situation, and talks of another round of quantitative easing (QE3) are widespread. Another round of easing or not, expectations are that the Fed will keep the short term interest rate at the current record low level up until 2014, which means mREIT investors can expect elevated returns until at least 2014.

Risk Mitigation Strategies

Elevated returns offered by investments in mREITs are not without risks. Among the risks associated, interest rate risk is a major concern for both mREITs themselves and investors. In our reports on various mREITs, we noted how changes in interest rates can cause the net interest income and the book value of the mREITs to be adversely affected, ultimately forcing dividend cuts.

Investors, in order to reduce the risk, first switch their investments from high-levered mREITs to low-levered mREITs. Two Harbors Investment Corp (NYSE:TWO ) and MFA Financial Inc (NYSE:MFA ) are two such mREITs, which employ less debt in their capital structure.

Secondly, investors can hedge the risk of a hike in rates by taking counter positions in relevant ETFs. One option is to long iShares 20+ year Treasury bond ETF (NYSEARCA:TLT ), which largely holds U.S. treasury bonds. Investors can also use Treasury ETFs to hedge against a yield curve risk by buying ProShares Short 20+ Year Treasury (NYSEARCA:TBF ) and ProShares Short 7-10 Year Treasury (NYSEARCA:TBX ). Selling short iShares FTSE NAREIT Mort Plus Cp Idx (NYSEARCA:REM ) and Market Vectors Mortgage REIT Income ETF (NYSEARCA:MORT ) are the two options to hedge the risk of mortgage REITs falling apart. Both REM and MORT seek to invest exclusively in U.S. mortgage REITs. Mitigating risk using ETFs is cost effective.

Thirdly, investors can also use buy put options on the particular mortgage REITs that they have in their portfolios, to mitigate risk.

Finally, the optimal hedging strategy for investors looking to hedge their investments in mortgage REITs would be to invest in the least-levered mortgage REITs, and short REM and MORT worth 20% of their portfolio, while long TLT worth 20% of their investments in the least-levered mREITs.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Business relationship disclosure: The article has been written by Qineqt’s Financials Analyst. Qineqt is not receiving compensation for it (other than from Seeking Alpha). Qineqt has no business relationship with any company whose stock is mentioned in this article.