How to Evaluate a Corporation Using Stock Ratios For Dummies

Post on: 2 Июнь, 2015 No Comment

Return on equity (ROE), quick ratio, debt covering ratio, debt-to-equity ratio and price-to-book ratio (PBR) are all ratios that can be calculated to provide clues about a companys finances.

Evaluate management with the return on equity

ROE measures the return on your investment in the company by showing how well the company invested its investors money and the companys accumulated profits. To calculate ROE, divide net annual profit by total equity:

ROE = Net Annual Profit / Average Annual Shareholder Equity

To determine net annual profit, total the companys net profits presented in each of its four most recent quarterly income statements. To determine equity, average the shareholder equity for those same four quarters; you can find that info on the balance sheets for the most recent quarters.

After you discover the companys ROE, compare it to others in the same sector. The company with the higher ROE is the more profitable one; try to find companies with an ROE of more than 10 percent. A terrible ROE (say, 0 percent) means the company is mismanaged.

When valuing a stock, ask yourself whether the ROE beat the rate of return the company could have earned just by putting the money into Treasury bonds. Look for companies that post an ROE greater than 10. After youve found that, go to the Yahoo! Finance Industry Browser to see whether the companys ROE exceeds others in its sector and if so, how many. You want to buy companies with high ROEs that have seen an upward trend over the past five years.

Sneaking a peek at the quick ratio

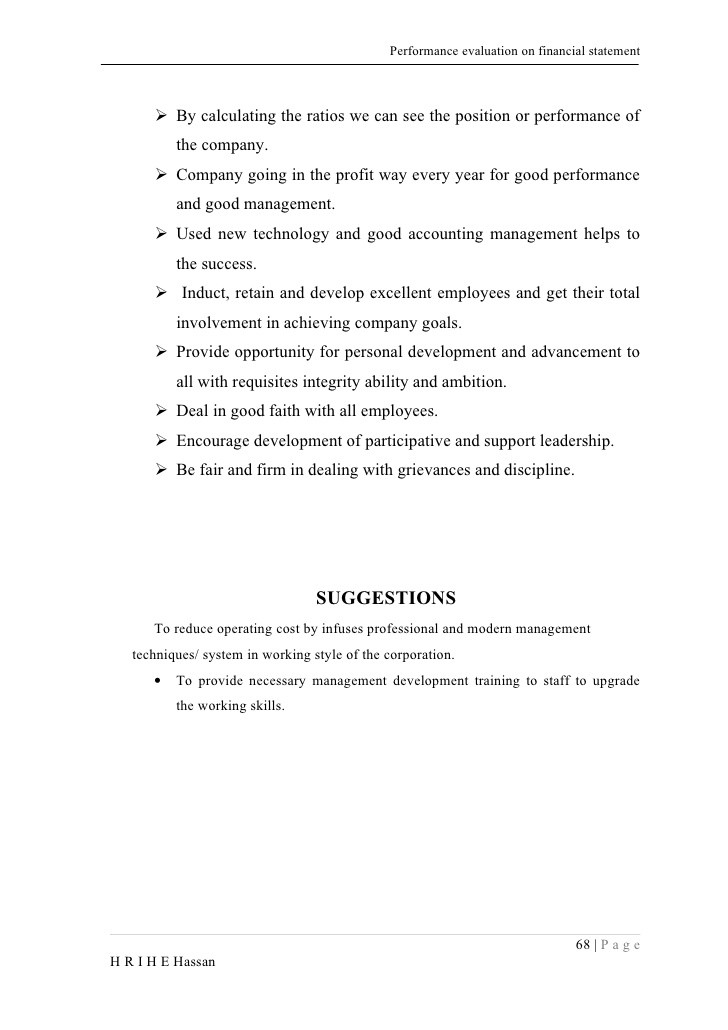

One of the best indicators of a companys ability to pay dividends moving forward is the quick ratio, which looks to see whether a company has enough liquid assets to cover dividends. Because inventories are the least liquid portion of current assets, the quick ratio removes them from the equation. To derive the quick ratio, subtract inventories from current assets; this removal leaves you with the firms most liquid assets. Then divide the result by current liabilities.

Quick Ratio = (Current Assets Inventories) / Current Liabilities

If you want to get extremely conservative, move beyond the quick ratio and just look at the cash on hand. Pure cash provides the best measure of whether a dividend can be paid because the current assets in the quick ratio may include a lot of accounts receivables from customers who cant pay or arent required to pay their bills in the time frame that dividends are scheduled to be paid.

Covering the debt covering ratio

Debt Covering Ratio = Operating Income / Current Liabilities

The debt covering ratio should equal at least 2. A debt covering ratio below that means the company may not be generating enough to pay both its interest payments and dividends.

Valuing the debt-to-equity ratio

An additional ratio to check for the stability of the company in general and the dividend in particular is the debt-to-equity ratio, which shows how much debt a company has compared to its equity. A high debt-to-equity ratio shows that the company relies on debt rather than equity to finance its operations and presents a clear warning sign. The equation for the debt-to-equity ratio is:

Debt-to-Equity Ratio = Total Liabilities / Shareholders Equity

You can find these numbers on a companys balance sheet.

Working with price-to-book ratio

Book value = Tangible Assets Liabilities

To calculate PBR, divide the companys market value or market capitalization (share price times number of shares outstanding) by its book value:

Price-to-Book Ratio (PBR) = Market Value / Book Value

Book value can be misleading because the assets category on the balance sheet reflects the companys cost to acquire an asset, not necessarily the assets current market value. The greater percentage of total assets made up by current assets, the more accurate book value becomes.