How to correctly calculate Enterprise Value

Post on: 30 Май, 2015 No Comment

Menu

How to correctly calculate Enterprise Value

After all that heavy macro stuff, back to the nitty-gritty world of fundamental analysis.

Lets have a look at Enterprise Value. which as concept is gaining more and more attention, among others famous Screening guru O’Shaughnessy has identified Enterprise value as the most dominant single factor in his new book. Also a lot of the best Bloggers like Geoff Gannon and Greenbackd prefer EV/EBITDA

Interestingly many people seem to just use and accept the standard Enterprise value calculation.

Investopedia has the normal definition of Enterprise Value:

Definition of Enterprise Value EV

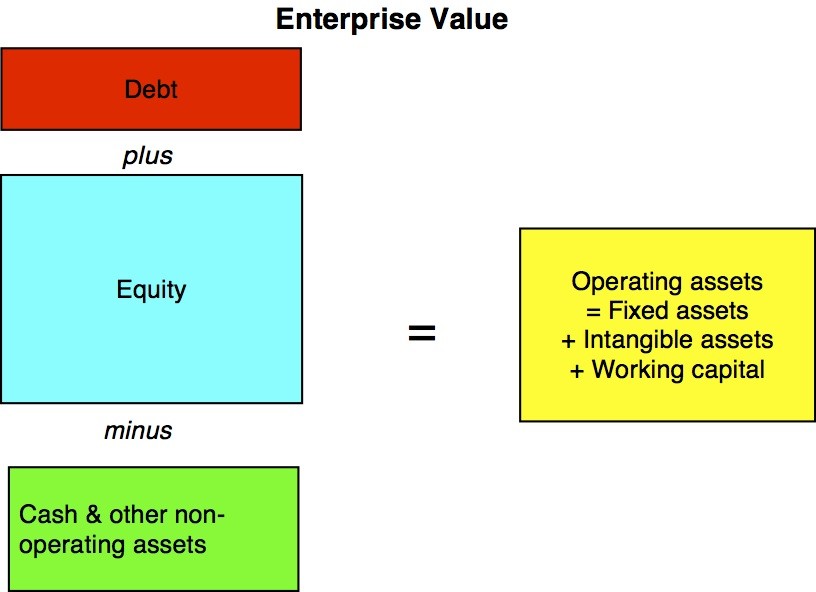

A measure of a companys value, often used as an alternative to straightforward market capitalization. Enterprise value is calculated as market cap plus debt, minority interest and preferred shares, minus total cash and cash equivalents.

Investopedia also offers an interpretation

Investopedia explains Enterprise Value EV

Think of enterprise value as the theoretical takeover price. In the event of a buyout, an acquirer would have to take on the companys debt, but would pocket its cash. EV differs significantly from simple market capitalization in several ways, and many consider it to be a more accurate representation of a firms value. The value of a firms debt, for example, would need to be paid by the buyer when taking over a company, thus EV provides a much more accurate takeover valuation because it includes debt in its value calculation.

So this is a good hint how to understand Enterprise Value: It originates from take-over valuation, most prominently from Private Equity investors or old style corporate raiders.

How to UNDERSTAND Enterprise Value

The private equity / Raider business in principle is relatively easy: You buy a company (or achieve full control) and then in a first step you extract all existing cash and/or assets which are not necessary to run the business from the company. In a second step, the corporate raider will then put as much debt onto the target companys balance sheet and let it pay out as a dividend or capital reduction.

The more the Raider can get out quickly either as excess cash or as a dividend recap (short form for a debt financed dividend) the higher the return on investment.

The first important aspect: Excess cash OR excess assets

As I have written above, a raider of course likes best plain cash lying around. On the other hand, the raider will happily sell anything which is not really required to run a business and pocket this cash as well. However mechanical screeners will only capture cash on the balance sheet, not any extra assets.

A good example is my portfolio company SIAS. Their EV/EBITDA decreased strongly because the exchanged their extra asset in the form of a South American minority stake into cash. Another extra Asset company would be EVN with its Verbund stake .

Including the Verbund stake, EVN looks quite expensive at EV/EBITDA 8.3 (EV

4 bn, EBITDA

500 mn) against 5-6 EV/EBITDA at RWE and EON. However if we deduct the extra asset of 25% Verbund (

1.6 bn EUR) from the 4 bn EV, we suddenly end up with an EV/EBITDA of <5, a lot cheaper for this very conservatively run utility company.

In my experience, it is much more interesting to find companies with extra assets which don't show up as cash on the balance sheet. This was mentioned before as favorite technique of value legend Peter Cundill .

Next step: What to add to Enterprise Value

So its pretty clear that the less debt a company has the more a PE/raider will be willing to pay.

But it is also important to understand, how the capacity to put debt into a company is determined. Especially in the US, the debt will be put into the target in the form of corporate bonds. In order to sell them, you need to have a rating .

The lower the rating the more expensive the debt. In practice, raiders will try to achieve a BB rating as this is usually the sweet spot before bond spreads go up dramatically.

Rating agencies have relatively simple ratios to determine maximum debt loads within a certain rating category, however the most important point is this one:

Rating companies add additional items to determine debt capacity which are:

pension deficits or unfunded pension liabilities

financial and operating leases (capitalised)

any other known fixed payment obligations (cartel fines, guarantees etc.).

Economically, those items are very similar to financial debt which is usually included in the EV calculations, as they represent fixed payment obligations which sometimes (like pensions) even rank more senior than debt.

It is therefore no wonder that with a standard EV/EBITDA screener, often UK retail companies with huge (underwater) operating lease and pension commitments show up as cheap and then people are surprised that they go bankrupt soon (Game Group anyone ?).

Special case: prepayments

Prepayments are an interesting feature of some business models, among other for instance at Dart Group .

Normally, a company produces its goods first and then sells them again receivables until cash is then finally collected. In the case of prepayments, cash comes first in against a payable and the good gets produced at a later stage and then delivered with no further cash inflow to the customer. If the prepayments do not carry any formal restrictions, the company in theory can use the cash for whatever it wants. So for instance if a company can finance inventory out of payables, the prepayment cash could be used to finance even machinery or to reduce financial debt. So to make a long story short: cash from prepayments without formal restrictions should be considered free cash and deducted from enterprise value.

How to calculate Enterprise Value correctly:

So now we have all ingredients to correctly calculate Enterprise Value:

a. Equity Market cap

b. Financial debt (long + short term)