How to Calculate Cost Basis

Post on: 16 Март, 2015 No Comment

How to Calculate Cost Basis

Look up your financial records for the asset whose cost basis you want to calculate.

Cost basis can also be measured per share. If you bought 100 shares of Stock XYZ for $1000, then the cost basis per share is $10.

Resources

More Like This

How to Calculate Cost Basis After Selling Stock

How to Avoid Capital Gains on the Sale of a House

You May Also Like

Cost basis is a measure of the amount of the original investment in a stock or other security. It is often used.

Every investment you make has a cost basis. Whether it is a house or shares of a company's stock, the money you.

Calculating Cost Basis ESPP. When purchasing stocks periodically throughout your career through an employer stock purchase plan. (or calculator and paper)

Cost basis is the total amount of money you spend to make an investment of some kind. investors have to figure cost.

The Internal Revenue Service (IRS) requires taxpayers to calculate the cost basis for purchased and constructed assets. Cost basis is used to.

Cost basis is needed for tax purposes to determine the amount of capital gain (or loss) an investor has on investments. There.

Cost basis is how much you paid for shares of a security The average cost basis method is an IRS-approved way to.

Cost basis is defined as the amount of money originally. You will hardly see a display ad for municipal bonds without.

Calculating tax basis correctly for newly acquired assets affects the annual depreciation expense that you can use to reduce income for tax.

Shareholder basis in an S corporation has several important tax effects. Profit or loss of an S corporation is applied to personal.

When an investment is sold, the taxable profit or loss is determined by calculating the difference between the sale price and the.

A partnership is a good way to pool money and resources among several individuals to run an entity. Partnerships do not pay.

Cost basis is a tax term describing your total cost for a capital asset, such as a stock or a home. Your.

An integral part of starting or running a business is knowing the cost of your sales. This information is needed for a.

The cost basis of a stock is the original amount that you pay to acquire the stock. Capital gains or losses are.

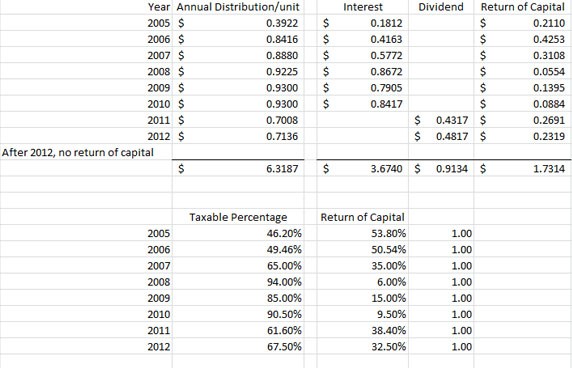

A dividend reinvestment plan allows an investor to accumulate shares in a company with regular investments and the reinvestment of any dividends.

When you invest in stocks, you need to be able to track the costs of your investment to evaluate performance. In addition.