How to Calculate Convexity Calculating the Convexity Calculate the Convexity

Post on: 16 Март, 2015 No Comment

Most Searched

How to Calculate Convexity

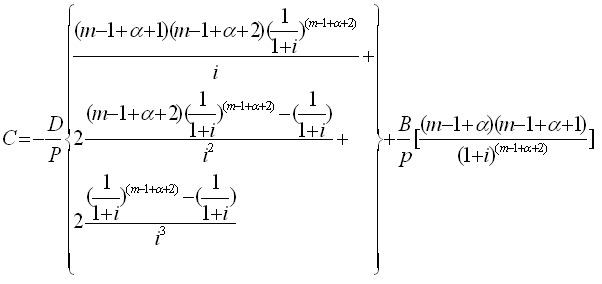

Convexity or convexity of a bond is the measure of the sensitivity of the duration of the bond to the changes in the interest rate. This is usually measured as the relationship between the bond prices and the bond yield. Convexity is used as a tool for risk management and helps to measure the amount of market risk. This article on how to calculate convexity will help you in calculating convexity of a bond.

Convexities of various bonds are usually compared and analyze the market risk. This is usually done by plotting graphs of the convexity of the bonds. As the convexity of the bond increases it shows that the systemic risk to which the bond is exposed increases and vice versa. It is also noted that the coupon rate of the bond is inversely proportional to the convexity of the bond.

It is of great importance for the investors to know how to calculate convexity.

Steps for calculating convexity of a bond

You will need a calculator and a paper and pencil to perform the calculations. As the calculations are very big, using a calculator will save you time as well as make your work easy and obtain error free results.

- Step 1: Note down the values of coupon rate and the face value of the bond from the bond certificate.

- Step 2: Multiply the coupon rate of the bond by the face value of the bond and divide it by two to get the semi-annual coupon payment.

- Step 3: Now, list the coupon payment as the function of periodic cash flow against each time period.

- Step 4: Add the face value of bond to the last coupon payment. This is the cash flow for the last period.

- Step 5: Divide the cash flows by (1+r) n. Here, “n” is the period for which the cash flow is being discounted and “r” is the rate of discount sometimes referred as prevailing interest rate. This is the present value of the future cash flows.

- Step 6: Calculate the value of n× (n+1) for each period.

- Step 7: Multiply the values obtained in step 5 and step 6. This is the present value of the cash flows adjusted for the duration.

- Step 8: Add the values obtained in step 7 with the estimated period to obtain total value.

- Step 9: finally divide the value obtained in step 8 by (1 + YTM) 2 × price. This will give you the convexity of the bond.

In the final step YTM is the yield to maturity. To know the value of YTM, refer to the financial calculators.

Calculating convexity of a bond online

You can also calculate the convexity of the bond using online tools. To use these tools you need the information regarding the bonds. This information includes bond’s par value, coupon rate of the bond expressed in percentage, the number of elapsed coupons, yield of the bond expressed as percentage and frequency and the number of coupons elapsed.

When you get all the information regarding the bond, place the values in the online calculators and click on the calculate button to get the value of the convexity of the bond.