How to Buy Zero Coupon Bonds

Post on: 7 Апрель, 2015 No Comment

Before you learn how to buy zero coupon bonds, you must understand what they are and how they fit into your investment portfolio. Zero coupon bonds provide no interest until their maturity. When you purchase one of these bonds, you pay a much lower price than face value. The face value is the amount the bond will pay out upon maturity. You get your initial investment plus the interest on the bond. These bonds are long term investments, you will want to hold onto them for a minimum of ten years.

Buying zero coupon bonds is a good strategy if you want a low-risk investment for a long term goal, such as paying for higher education or saving for retirement. They allow you to make a small initial investment that gains value over time. When it comes to where and how to buy zero coupon bonds, you can go to various corporations, the U.S. Treasury and government facilities both local and state. Note that even though you are not making payments on your bonds you may still be required to pay taxes on the imputed interest.

There are some basic tips and pieces of advice to keep in mind if you decide to buy zero coupon bonds. First, remember these are long term investments. They are not completely free from risk, but they are far more conservative than other types of investments. such as buying stocks. You should be prepared to hold onto them until full maturity if you want to profit from this particular type of investment. Also, there are a couple of ways you can avoid paying federal taxes on earnings from zero coupon bonds.

For example, to defer tax payments, buy your bonds through your retirement account which should be tax-deferred. The interest is taxable for the fiscal year, however it is reinvested. By purchasing the bond via your retirement account, you do not pay taxes on your profit until your retirement. You can also avoid making tax payments by purchasing tax-free zero coupon bonds that are municipal. These are available via your state, county and certain local institutions. Most of the time, this interest is not federally taxable.

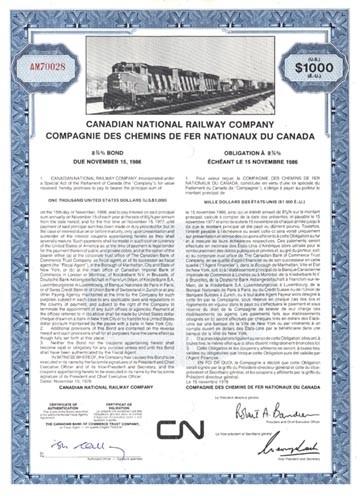

Another thing you should know when learning how to buy zero coupon bonds is that the more the bond costs, the less your profit. As an example, let’s use a bond that will be worth $1000 when it matures. If you pay $800 for the bond, you will only make $200 when it matures. If you pay $600, your profit will be $400. So, shop around for the best prices on these bonds. For comparison shopping, visit a broker and see what they have to offer. You may want to compare different brokers to see who has the most reasonable commission.