How to Buy Muni Bonds Total Return

Post on: 24 Июнь, 2015 No Comment

Municipal bonds

Last weekends Intelligent Investor column, on the often prohibitive costs of buying municipal bonds, set off a thundershower of comments and emails. We can reduce them to a few key questions:

1. Can I avoid the potentially high cost of trading individual munis by buying a mutual fund?

2. Why buy individual munis at all if you can buy a fund instead?

3. Is it more expensive to sell than to buy an individual muni?

4. Why not buy closed-end muni funds (which often trade at discounted prices) instead of individual munis?

Lets answer each of these in turn.

1. Yes, to a point. A large, well-run mutual fund will generally incur lower trading costs than an individual buying some of the same bonds. The fund can buy wholesale while individuals have to buy retail, which typically is more expensive.

Recent research by Securities Litigation & Consulting Group. a financial-research firm in Fairfax, Va. shows that small lots of munis (batches of $250,000 or less) can be 18 times more expensive to trade than large lots of $1 million. But even the biggest funds with the most astute managers still have to pay trading costs.

While you can minimize your trading costs by buying a no-load mutual fund or commission-free exchange-traded fund, you cant eliminate them. They will come out of the funds return in small increments whenever it buys or sells a bond.

2. The question of whether you should buy a fund or individual munis is complex. You can make a plausible argument either way.

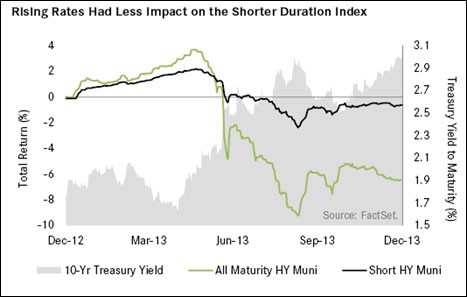

Bonds better than funds: If you hold an individual muni to maturity, you neednt have any fears of losing any principal if interest rates rise. (Were assuming the issuer doesnt default, and were leaving inflation aside.) In a fund, however, rising rates will take an immediate bite out of your net asset value. While it can be expensive to buy or sell municipal bonds one by one, they dont charge annual management fees; mutual funds do. The average muni-bond mutual fund, according to Morningstar, charges 0.96% in annual expenses. Even if you pay a fat 3% markup or trading cost to buy an individual muni, youll break even relative to a mutual fund if you hold the bond for at least three years. Hold the bond for 10 years or more, and it will be much cheaper than the average bond fund. Buy a new-issue bond in its initial offering and you shouldnt pay any trading costs at all, say market participants.

Funds better than bonds: If you assume that you need a minimum of 10 bonds for basic diversification and at least $100,000 per bond to get trading costs down, it can take $1 million to build a feasible portfolio of individual munis although many investors, including Phil Potter, whom I profiled in the column, have done it for less. For people who arent comfortable plunking several hundred thousand dollars at once into a few bonds, a fund might be preferable even if it ends up costing more. A fund also offers wider diversification than you will likely get in a roll-your-own portfolio. Another factor: Even though rising rates will take a chunk out of your principal at a mutual fund, the fund can reinvest the incoming interest payments at higher yields as rates go up reducing what bond managers call reinvestment risk. Small investors cant always reinvest their interest coupons at the latest, best rate.

3. Overall, trading costs tend to be somewhat lower for sellers than for buyers of munis, according to the SLCG report and other analysis. For small trades, however, is much more expensive than buying. Thats why you shouldnt buy individual munis at all if you dont plan to hold until maturity (or an early redemption or call).

Richard Green, a finance professor at Carnegie Mellon University, recommends asking your broker to tell you the “interdealer price,” or the latest level at which the bond traded in the wholesale market among brokerage firms. Then ask what markup you will have to pay above that. As your broker tells you, check what he says against the latest price reported on Emma, the pricing website maintained by the Municipal Securities Rulemaking Board. If the price is more than 1% to 1.5% above the latest Emma price, dont buy.

“It’s like walking into the car dealership with the invoice price in your hand,” says Green.

4. The many people who suggested buying closed-end funds instead of individual munis were, in my opinion, too blasé about the risks of closed-ends. (One reader commented, The ONLY way to buy Munis is thru Muni Open or Closed End Funds)

Closed-ends are the Pushmi-Pullyus of the fund world. Their shares trade throughout the day like a stock, while the funds generally publish the value of their portfolios only once a week. Because their share price is set by supply and demand, closed-ends can often trade for more than the net asset value, or NAV, of their portfolios (a premium price); the shares can also trade for less than the NAV (a discount).

Many investors are attracted to closed-end funds by the discount after all, it isnt every day you can get something for provably less than it is worth. According to Morningstar, the 203 municipal closed-ends that it tracks trade at an average discount of 4% meaning you have to pay only $96 for every $100 worth of munis that you buy.

But closed-ends have liabilities, too literally.

All but 15 of the muni closed-ends on the market are leveraged, meaning they engage in the risky strategy of borrowing money to juice returns. That has paid off over the past decades of declining interest rates but could make that will backfire once rates rise. And the average muni closed-end charges a bloated 1.16% in annual expenses, with fully two dozen of them charging an extravagant 1.5% or more. Finally, more than 20 of these funds trade at premiums, not discounts meaning that you pay more than $100 to buy $100 worth of bonds.

Bear in mind, then, that if you buy a closed-end muni-bond fund and interest rates spike upward, you are likely to be hit by a double whammy: The value of the underlying portfolio will fall, and the share price is likely to plunge (meaning that the discount will get deeper, and you might have to sell for much less than the assets are worth).

Until discounts get a lot wider, closed-end funds arent exactly a cheap back door into the muni market.